🏘 Market Pulse - Home Building Grows & Inflation Hits Hard

Home Building Grows & May home-price growth saw its largest monthly slowdown in 16 years

“When we strive to be better than we are, everything around us becomes better too.”—Paulo Coelho, Brazilian lyricist and novelist

Spending on residential construction rose 0.2% in May and is now 19.0% ahead of a year ago. Builders are working hard to add inventory to meet buyer demand despite ongoing labor and supply chain issues.

Black Knight reports May home-price growth saw its largest monthly slowdown in 16 years, falling by more than a full percentage point. That was the second straight month of slowing price growth, but prices still rose 1.5% from April.

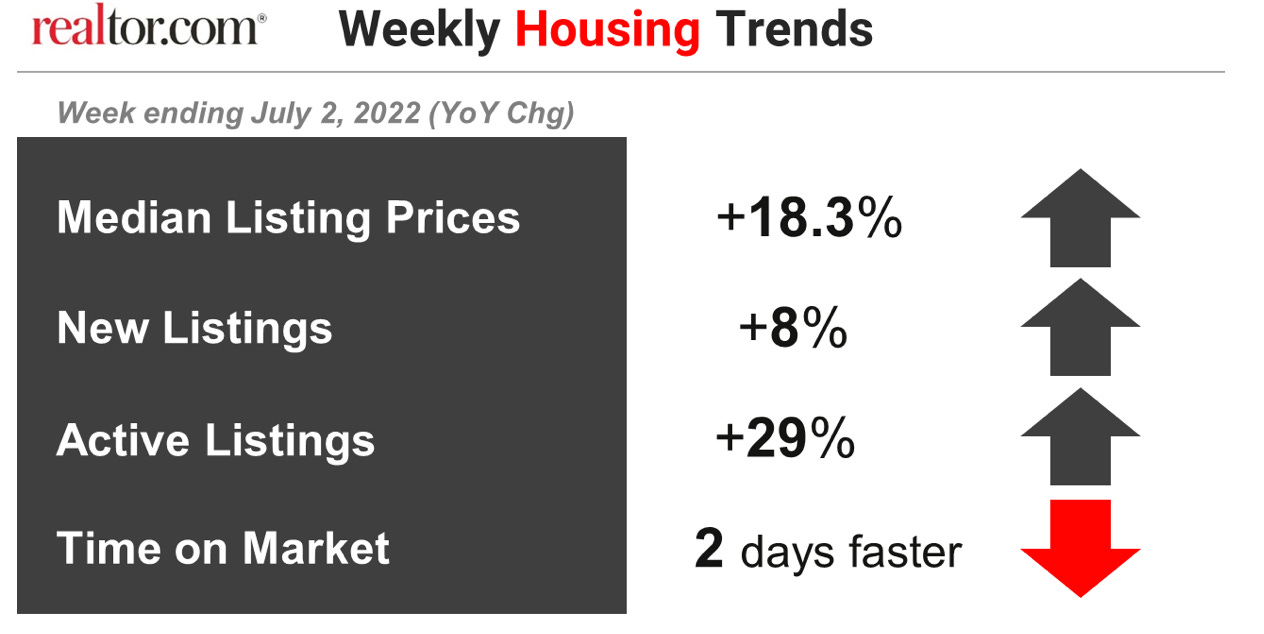

Realtor.com reports that in the week ending July 2, for-sale inventory continued to gain. New listings were up 8% versus a year ago, pushing total active inventory 29% higher than a year ago

.

After multiple ownership changes, Jerry Lewis’ Las Vegas home is set to hit the market again for $2.7 million after it got touch-up renovations to modernize the property.

The past 17 weeks have seen consistent growth of properties coming on the resale market.

As of July 11, 2022, there are currently active (%’s compared to 1 weeks ago):

6,722 Single Family Homes +8.07%

931 Condos +8.25%

596 Townhouses +3.30%

254 Manufactured Homes +3.25%

418 High Rise Units -0.95%

93 Multiple Dwellings -4.12%

2,278 Parcels of Land +0.98%

2,597 Rentals On Market +7.76%

Past Seven Days Market Watch (%’s compared to 1 week ago):

1,466 New Listings +9.65%

273 Back On Market +7.91%

96 Price Increases +9.10%

1,743 Price Decreases +35.54%

858 Accepted an Offer +20.51%

724 Sold -14.92%

55 Expired -65.48%

448 Taken Off Market +27.64%

152* properties are coming soon +22.587%

As of July 11, 2022 there are 595 more active residential resale properties on the market compared to one week ago, an increase of 7.07%.

*Properties coming soon do not indicate all of the upcoming properties. These are listing that are entered into the MLS prior to list date.

Housing costs eyed as major culprit in latest 9.1% inflation hike

Real Estate Mogul Nick Candy to list modernist Los Angeles Mansion for $85 Million

Vegas real estate still hot but takes first step back to normal

Yun: Bolder FED inflation policy might catapult mortgage rates

JOBS TAME RECESSION FEARS... The three major stock indexes, led by the tech-heavy Nasdaq, gained for the week, as investors’ recession fears were quelled by a stronger-than-expected June jobs report.

Those fears came from Fed meeting minutes acknowledging that tighter policy could cause a recession, but noting that inflation could become entrenched if people start questioning the Fed's resolve to fight it with big rate hikes.

Yet June saw 372,000 new payrolls, 3.6% unemployment, and hourly earnings up 5.1% from a year ago, though trailing 8.7% annual inflation. Plus, the ISM Non-Manufacturing index showed the services sector still growing. (Perhaps people have to work two jobs now to afford increased prices in life’s essentials!)

The week ended with the Dow UP 0.8%, to 31,339; the S&P 500 UP 1.9%, to 3,889; and the Nasdaq UP 4.6%, to 11,635.

As money flowed to equities, bond prices fell, the 30-year UMBS 4.5% down 0.94, to $99.31. In Freddie Mac's Primary Mortgage Market Survey, the national average 30-year fixed mortgage rate dropped 40 basis points (0.4%). Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up-to-the-minute information.

DID YOU KNOW… Data firm CoreLogic predicts by next May annual home price appreciation will drop to 5%, hitting the normal 3%-5% yearly growth rate.

INFLATION UP, RETAIL SALES UP, CONSUMER SENTIMENT DOWN... It's a good news-bad news week. Consumer Price Index (CPI) inflation is forecast to keep rising for June, but Retail Sales are expected up, indicating consumers are still powering the economy. But consumers should also give us some bad news: University of Michigan Consumer Sentiment is predicted to hit a new all-time low.

Forecasting Federal Reserve policy changes in coming months. Wall Street now expects the Fed will raise rates at the next two meetings, then take a break, hoping to engineer a “soft landing” and not send the economy into recession (NOTE: NOTE GOING TO HAPPEN - OPINION). Note: In the lower chart a 100.0% probability of change is a 100.0% probability the rate will rise.

AFTER FOMC MEETING ON: CONSENSUS

Jul 27 2.25%-2.50%

Sep 21 2.75%-3.00%

Nov 2 2.75%-3.00%

Probability of change from current policy:

AFTER FOMC MEETING ON: CONSENSUS

Jul 27 100.0%

Sep 21 100.0%

Nov 2 90.2%