For the week of August 8, 2022

HOME PRICES MODERATING

“Happiness often sneaks in through a door you didn’t know you left open.”—John Barrymore, American stage, screen, and radio actor

Data firm Black Knight reports home price growth in June dropped nearly two percentage points, the largest monthly slowdown since the early 1970s. June also saw the largest single-month inventory increase in 12 years.

CoreLogic, another major data outfit, found price growth slowed for the second month in a row. They now forecast annual home price appreciation will drop to 4.3% by June 2023, in line with average price growth from 2010 to 2020.

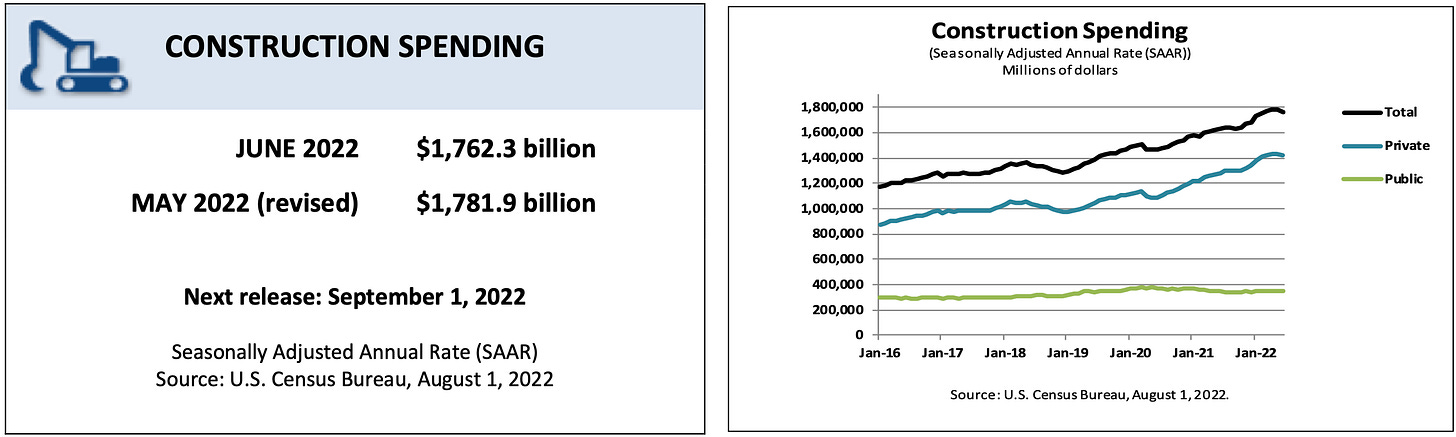

Residential Construction Spending in June fell 1.6% below the revised May estimate. At a seasonally adjusted annual rate of $923.7 billion, home building is still a solid 15.6% higher than a year ago.

National Economic Notes

Weekly jobless claims rise to 260,000 ahead of confirm payrolls report

Payrolls increased 528,000 in July. Many of these payrolls are low-paying, entry-level jobs. Many Americans are taking on second jobs to supplement income with the rising costs of goods and services.

Senate Democrats passed the “Inflation Reduction Act” on Sunday. No Senate Republic s supported the Bill so VP Kamala Harris delivered the tie-breaking 51st vote. The bill includes $370B for energy and climate change reforms; Lowers the cost of prescription drugs; A 15% minimum tax for corporations making $1 billion or more in income; A 1% excise tax on stock buybacks which takes effect in 2023; $70 billion for the IRS which will hire 67,000 new IRS agents and increases the budget of the IRS by 600%.

Second Quarter 2022 GDP numbers had a negative growth rate of -0.9% signaling two consecutive quarters of negative growth. This is the definition of a recession.

INVERTED YIELD CURVE WATCH:

30 Year Treasury Bond Yield 3.004%

10 Year Treasury Bond Yield 2.766%

5 Year Treasury Bond Yield: 2.911%

2 Year Treasury Bond Yield: 3.214%

The current absorption rate for the Southern Nevada market the past four weeks is 24.75% - down 2.8% from last weeks absorption rate. For context, 6 months ago, the absorption rate was over 100%.

A market with an absorption rate at or above 20% is typically called a seller’s market, whereas an absorption rate below 15% signal a buyer’s market.

The past 21 weeks have seen an increase of residential properties coming on the resale market in Southern Nevada.

As of August 8, 2022, there are currently active (%’s compared to 1 weeks ago):

8,085 Single Family Homes +3.57%

1,052 Condos +1.84%

722 Townhouses +5.25%

277 Manufactured Homes +2.59%

438 High Rise Units +1.86%

114 Multiple Dwellings +5.56%

2,464 Parcels of Land +1.99%

2,755 Rentals On Market +2.30%

Past Seven Days Market Watch (%’s compared to 1 week ago):

1,327 New Listings -1.85%

240 Back On Market -1.30%

97 Price Increases -12.61%

1,868 Price Decreases -12.59%

802 Accepted an Offer -6.31%

521 Sold -35.52%

202 Expired +6.32%

467 Taken Off Market -10.36%

70* properties are coming soon -41.67%

This week, there are 355 more active residential resale properties on the market compared to one week ago for a total of 10,689, an increase of 3.43%.

STOCKS WEATHER JOBS JOLT... Friday, a blockbuster July jobs report rattled traders worried it would encourage the Fed to hike rates aggressively. But calm prevailed, with two major stock indexes up, one down a tick for the week.

With the 528,000 jobs added in July, nonfarm payrolls are finally higher than they were pre-pandemic, with 3.5% unemployment back to its pre-pandemic low. Too bad 5.2% wage growth isn't keeping up with 9.1% inflation.

Investors were buoyed by a drop in commodity prices and by corporate earnings largely better than feared. ISM Non-Manufacturing gained, ISM Manufacturing dipped, but both sectors remain in expansion territory.

The week ended with the Dow down 0.1%, to 32,803; the S&P 500 UP 0.4%, to 4,145; and the Nasdaq UP 2.2%, to 12,658.

Anticipating bigger Fed rate hikes, bonds sank, the 30-year UMBS 4.5% dropping 0.97, to $100.28. Yet the national average 30-year fixed mortgage rate fell for the third straight week in Freddie Mac's Primary Mortgage Market Survey. Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up-to-the-minute information.

DID YOU KNOW… The Q2 home ownership rate has increased for five straight quarters, showing buyers are finding paths to home ownership despite the headwinds, with households under 35 years old driving the growth.

REAL ESTATE NEWS

Las Vegas housing market gets slight break as mortgage rates dip

Mortgage rates dip below 5%; Buyers get a ’Second Chance Opportunity’

INFLATION STILL HIGH, CONSUMER SENTIMENT STILL LOW... For July, the Consumer Price Index (CPI) is expected to report inflation still rising. The same goes for wholesale price inflation, tracked by the Producer Price Index (PPI). Small wonder that University of Michigan Consumer Sentiment for August should remain near historic lows.

Forecasting Federal Reserve policy changes in coming months. The strong July jobs report has Wall Street now expecting another three-quarter percent rate hike in September, a quarter percent bump in November, and again in December. Note: In the lower chart a 68.0% probability of change is a 68.0% probability the rate will rise

AFTER FOMC MEETING ON: CONSENSUS

Sep 21 3.00%-3.25%

Nov 2 3.25%-3.50%

Dec 14 3.50%-3.75%

Probability of change from current policy:

AFTER FOMC MEETING ON: CONSENSUS

Sep 21 68.0%

Nov 2 82.0%

Dec 14 69.6%