🏘 Market Pulse - Home Sales Drop 📉 Vegas Median Down

For the week of August 1, 2022

HOME SALES DROP / VEGAS SFR MEDIAN DIPS

“There are always flowers for those who want to see them.”—Henri Matisse, French visual artist

Southern Nevada Statistics based on the past week moving averages

New Home Sales dove 8.1% in June, and are now down 17.4% from a year ago. This was blamed on declining affordability. Median prices are up 7.4% from a year ago. though they've fallen two months straight.

Pending Home Sales slipped 8.6% in June. The NAR’s chief economist blamed it on climbing mortgage rates, but added, “There are indications that mortgage rates may be topping or very close to a cyclical high in July.” The past week has actually seen mortgage rates dip, down closer to 5% with the 10-year bond yield sinking.

Home price growth is also slowing. The Case-Shiller index reported annual price gains decelerated in May, and the FHFA index of prices for homes financed with conforming mortgages dipped from its February peak.

National Economic Notes

Amazon sheds record 99k employees after overstaffing warehouses, will slow office hiring.

Layoffs continue: Ford (8000), Just Eat (390), Invitae (1000), Olive (450) (CytomX Therapeutics (40%), Arrival (30%), Tonal (35%), LoanDepot (2000), Peloton (2000), Meta (350), Rivian (700), Unacedemy (600), Twitter (30%), Ohio Health (637), Tesla (200), Spotify (Hiring Freeze), Netflix (300), Coinbase (1100), CVS Health (208), Carvana (2,500), Oracle (Thousands)

House Speaker Nancy Pelosi lands in Taiwan as the CCP pushes back with military theater.

July 28, 2022 announces Q2 GDP Numbers. (The White House is trying to change the definition of recession)

San Francisco Fed President Mary Dale stats “Fed nowhere near finished with inflation fight"

INVERTED YIELD CURVE WATCH:

30 Year Treasury Bond Yield 2.991%

10 Year Treasury Bond Yield 2.745%

5 Year Treasury Bond Yield: 2.863%

2 Year Treasury Bond Yield: 3.083%

The rate at which properties are available on the market is showing signs of slowing, but sales overall are down year-over-year.

Our local real estate market saw 2,137 price reductions on available inventory - about 21% of all active residential property.

The current absorption rate for the Southern Nevada market the past four weeks is 27.55% - down about a point from last weeks rate. For context, 6 months ago, the absorption rate was over 100%.

A market with an absorption rate at or above 20% is typically called a seller’s market, whereas an absorption rate below 15% signal a buyer’s market.

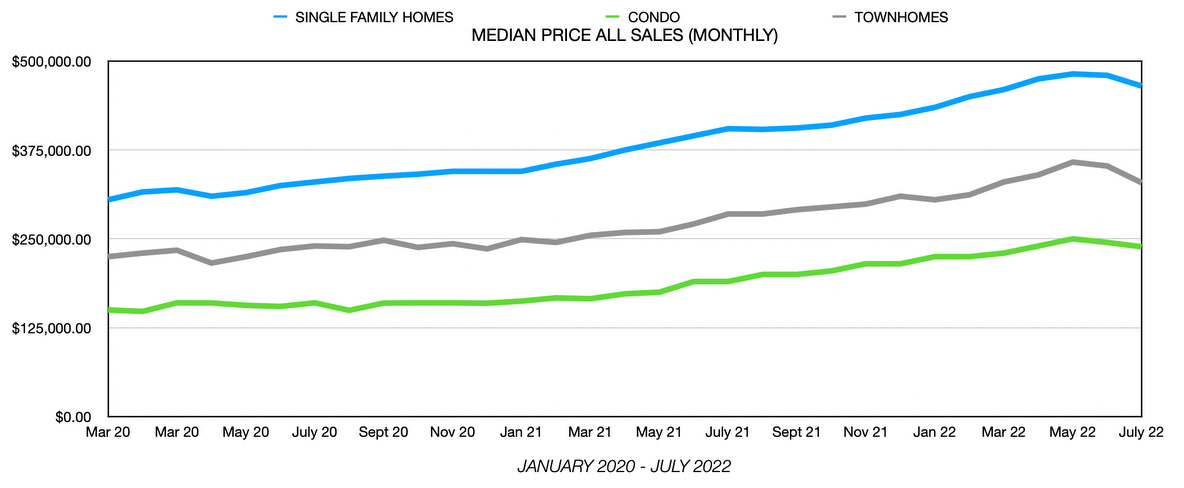

Median sales price for July are as follows:

Single Family: $465,000 (Down from May peak of $482,000)

Condo: $238,978 (Down from May peak of $250,000)

Townhouse: $329,000 (Down from May peak of $358,000)

The past 20 weeks have seen consistent growth of properties coming on the resale market in Southern Nevada.

As of August 1, 2022, there are currently active (%’s compared to 1 weeks ago):

7,806 Single Family Homes +3.36%

1,033 Condos +2.28%

686 Townhouses +3.00%

270 Manufactured Homes +4.25%

431 High Rise Units -2.93%

108 Multiple Dwellings -0.92%

2,416 Parcels of Land +2.16%

2,693 Rentals On Market +2.71%

Past Seven Days Market Watch (%’s compared to 1 week ago):

1,352 New Listings -2.10%

276 Back On Market +15.97%

111 Increases +38.75%

2,137 Price Decreases +12.18%

856 Accepted an Offer +6.47%

808 Sold +24.50%

190 Expired +196.87%

521 Taken Off Market +18.14%

120* properties are coming soon +36.36%

As of August 1, 2022 there are 294 more active residential resale properties for a total of 10,334 on the market compared to one week ago, an increase of 2.93%.

*Properties coming soon do not indicate all of the upcoming properties. These are listing that are entered into the MLS prior to list date.

Have questions about the real estate market? Considering buying or selling in this market? Know the advantages. Ask me.

WEAK ECONOMY, STRONG MARKET... Investors digested disappointing economic news and a 0.75% Fed rate hike, yet they sent the three major stock indexes to big gains for the week and huge gains for the month. It makes no sense!

They felt the bad news of a softer economy would bring the good news of slower Fed rate hikes. The bad news included a negative GDP read for the second straight quarter, the technical definition of a recession. But the White House says we are not in a recession! Clown world!

Investors shrugged off the highest PCE inflation reading since 1982, which could get the Fed hiking aggressively, and instead reveled in decent Q2 corporate earnings, with 76% of companies reporting beating forecasts.

The week ended with the Dow UP 3.0%, to 32,845; the S&P 500 UP 4.3%, to 4,130; and the Nasdaq UP 4.7%, to 12,391.

Bond prices gained overall, the 30-year UMBS 4.5% edging up to $101.25. After climbing for two weeks, the national average 30-year fixed mortgage rate fell in Freddie Mac's Primary Mortgage Market Survey. Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up-to-the-minute information.

DID YOU KNOW… Realtor.com reports active inventory keeps growing, "rising 29% above one year ago.” Plus, “homes sold in June spent a record low time on market” and “data continues to suggest that homes priced well are selling.”

Home prices cooled at a record pace in June, according to housing data firm.

Las Vegas homebuilders’ sales falling amid rising mortgage rates

Home buyers seeing more opportunity with higher inventory and some lower prices

CONSTRUCTION SPENDING UP, MANUFACTURING AND SERVICES DOWN, MORE JOBS... June Construction Spending is expected to be up overall, but we'll check the residential part. Both ISM Manufacturing and ISM Non-Manufacturing Indexes are forecast down for July, though still indicating expansion. Analysts predict a 250,000 bump in Nonfarm Payrolls for July and Hourly Earnings increasing, yet not as much as inflation.

Forecasting Federal Reserve policy changes in coming months. After last week’s 0.75% hike to 2.25%-2.50%, Fed watchers expect a half percent rise in September, followed by smaller bumps through the end of the year. Note: In the lower chart a 100.0% probability of change is a 100.0% probability the rate will rise.

AFTER FOMC MEETING ON: CONSENSUS

Sep 21 2.75%-3.00%

Nov 2 3.00%-3.25%

Dec 14 3.25%-3.50%

Probability of change from current policy:

AFTER FOMC MEETING ON: CONSENSUS

Sep 21 100.0%

Nov 2 100.0%

Dec 14 72.0%