“If you have a Plan B, you are not completely focused and committed to Plan A.”

- Jordan Dove - Entrepreneur, Author

Southern Nevada Statistics based on the past week moving averages

Existing Home Sales were off 5.4% in June, blamed on falling affordability. Yet 88% of the homes sold were listed less than a month. Good to see inventory rising relatively rapidly, up 2.4% from a year ago.

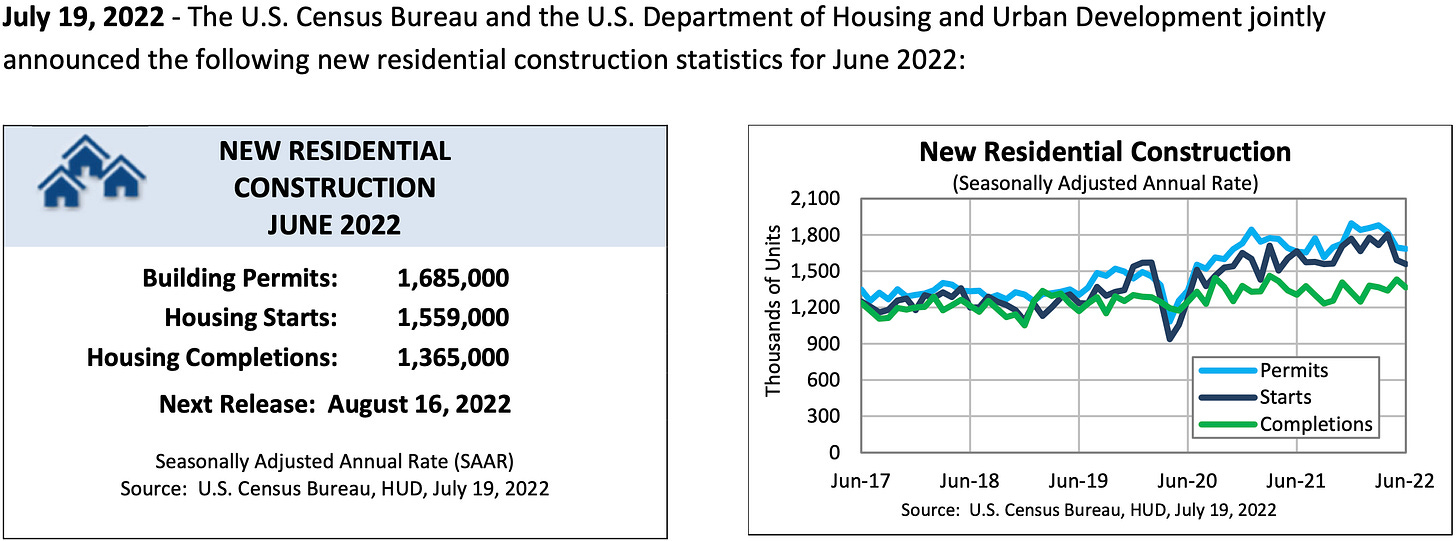

Housing Starts slipped 2.0% in June, all due to single-families, down 15.7% the past year. But the slowdown makes sense, as homes already under construction sit at the highest level on record back to 1970.

The NAHB index of builder sentiment posted its largest monthly decline since early in the pandemic, dropping from 67 in June to 55 in July. Builders worry mortgage rates are temporarily pricing some buyers out of the market.

Active listing across the United States have surpassed July 2021 levels as of June 30, 2022. Fed housing data shows 619,305 active listings. This count is of active single-family and condo/townhome listings for the US market.

Another key data marker from FRED is price reduction on active listing in the United States. As of June 2022, there were 266,812 price reductions compared to 619,305 active listings. That is 36.62% of all listings reduced their price in June.

Median prices in July 2022 will give us a clearer picture of the national market trend and the direction we are heading. As you can see, the early data models are starting to reflect a cool-down in the housing market sparked by higher interest rates (essentially making homes at their current levels unaffordable), growing inventory and hedge funds/private equity revising their housing acquiring prices downward.

National Economic Notes

FED expected to raise rates 75 basis points at the FOMC meeting beginning Wednesday July 27, 2022.

Wholesale inflation (leading indicator) at 11.3%

Current US Inflation (lagging indicator) at 9.1%

July 28, 2022 announces Q2 GDP Numbers. (The White House is trying to change the definition of recession)

Auto loan default rates rising at fastest rate since pandemic - credit standards loosening - used vehicle price has inflected and production increases, inventory slightly higher.

INVERTED YIELD CURVE WATCH:

10 Year Treasury Bond Yield 2.816%

5 Year Treasury Bond Yield: 2.899%

2 Year Treasury Bond Yield: 3.029%

The gap between available inventory (10,040) to closed sales (649) this week has widened even further. Although we saw a reduction in new listings this week, property is sitting on the market longer and sales have dipped which has increased available inventory.

Our local real estate market saw almost 2,000 price reductions on available inventory - about 20% - with an average of 4% in price reduction.

The current absorption rate for the Southern Nevada market the past four weeks is 28.79%. For context, 6 months ago, the absorption rate was over 100%.

A market with an absorption rate at or above 20% is typically called a seller’s market, whereas an absorption rate below 15% signal a buyer’s market.

The past 19 weeks have seen consistent growth of properties coming on the resale market in Southern Nevada.

As of July 25, 2022, there are currently active (%’s compared to 1 weeks ago):

7,552 Single Family Homes +5.25%

1,010 Condos +3.91%

666 Townhouses +7.25%

259 Manufactured Homes +4.02%

444 High Rise Units +4.47%

109 Multiple Dwellings +4.91%

2,365 Parcels of Land +3.10%

2,622 Rentals On Market +1.47%

Past Seven Days Market Watch (%’s compared to 1 week ago):

1,381 New Listings -2.12%

238 Back On Market -3.64%

80 Price Increases -11.11%

1,905 Price Decreases +6.48%

804 Accepted an Offer -2.19%

649 Sold -2.60%

64 Expired +10.34%

441 Taken Off Market +7.04%

88* properties are coming soon -20.00%

As of July 25, 2022 there are 494 more active residential resale properties for a total of 10,040 on the market compared to one week ago, an increase of 5.17%.

*Properties coming soon do not indicate all of the upcoming properties. These are listing that are entered into the MLS prior to list date.

WHAT RECESSION?…THIS ADMINISTRATION IS ATTEMPTING TO DOWNPLAY THE GDP NUMBERS THIS THURSDAY AND THE BIDEN CARTER ADMINISTRATION IS ATTEMPTING TO CHANGE THE DEFINITION OF A RECESSION.

Ignoring signs of a slowing economy and another big rate hike from the Fed coming this Wednesday, investors sent the three major stock indexes to strong gains for the week. Was this a dead-cat bounce? A bull trap? I genuinely think so in my opinion.

I know several small business owners who have seen a slow-down in business over the past month.. e-Commerce, mobile car detailing, dry cleaning, food prep companies, restaurant owners. Just about everybody I know in the business sector is seeing a slow down in consumer spending.

In addition to the disappointing housing data, initial jobless claims topped 250,000, the Leading Economic Index dropped for the fourth month in a row, and a preliminary July read showed the services sector contracting.

Some analysts feel this bad news has already been priced into the market. Plus, with about a fifth of the S&P 500 reporting Q2 earnings, profit growth has exceeded expectations by roughly 4%. Not bad.

The week ended with the Dow UP 2.0%, to 31,900; the S&P 500 UP 2.6%, to 3,962; and the Nasdaq UP 3.3%, to 11,834.

Bonds advanced as well, the 30-year UMBS 5.0% UP 0.10, to $101.29. In Freddie Mac's Primary Mortgage Market Survey, the national average 30-year fixed mortgage rate inched up. Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up-to-the-minute information.

DID YOU KNOW… Freddie Mac reports, “Consumer concerns about rising rates, inflation and a potential recession are manifesting in softening demand. As a result of these factors, we expect house price appreciation to moderate noticeably.”

More homes are being listed in Phoenix than anywhere else in the USA

Las Vegas construction industry facing new normal

What the Federal Reserve’s next major interest rate hike means for you

NEW AND PENDING HOME SALES DOWN, INFLATION AND THE FED RATE UP... This data-packed week includes June New Home Sales and Pending Home Sales, both forecast down. Inflation is expected up by the PCE Prices measure the Fed likes. Consequently, the Fed's FOMC Rate Decision on Wednesday should see their rate rise another 0.75%. Coincidentally, the FED will release Q2 GDP Growth numbers which are expected to be negative, confirming two quarters of negative GDP growth confirming that we are, and have been in - a recession.