🔨 Home Builders Keep Buildin' & Home Sales Fall | JD's Market Pulse

For the week of September 26, 2022

BUILDERS KEEP BUILDIN'

NOT SURPRISINGLY, HOME SALES DOWN

“Budget—a mathematical confirmation of your suspicions.”—A. A. Latimer, German-born mathematician and theoretical physicist

NATIONAL MARKET UPDATE

It was a surprise to see August Housing Starts surge 12.2%, to a 1.575 million annual rate. Not surprising was the 10.0% dip in new Building Permits, since the backlog of homes authorized but not yet started sits near record highs.

Equally unsurprising, the September NAHB homebuilder sentiment index dropped for the ninth month in a row to a 46 read. Scores below 50 indicate more builders see conditions as poor, versus good.

August Existing Home Sales, off 0.4%, slipped for the seventh straight month, the longest streak since 2007. Annual median price growth fell to 7.7%. Demand stayed strong--81% of sold homes were on the market less than a month.

Recent volatility in mortgage rates makes it more difficult for many borrowers to qualify for a loan. Substantial week-to-week rate movements mean that many potential buyers are able to qualify for a loan one week, but not the next, or vice versa. Even buyers able to afford a house at current rates could feel frozen, waiting for mortgage rates to fall dramatically again like they did from the end of June to mid-July, when rates dropped 50 basis points in just two weeks.

As the share of median household income needed to pay monthly mortgage costs rises beyond the 30% level considered to be a financial burden, uncertainty itself could be holding up a large population of buyers who could otherwise still afford to move forward with a loan. It’s likely that this problem will continue until markets stabilize and return to some semblance of normalcy.

Economic Notes

As expected, the Fed raised their overnight rate 75 bps for its third consecutive large rate-hike. The current rate is 3.00%-3.25% and sent stocks in a downward spiral last week.

British borrowing costs surge and the sterling plunges after new tax-cut economic plan released spooks investors.

Fed’s Bostic says events in the UK could raise economic stress in Europe, U.S.

Boston Fed President says more rate increases needed to cool inflation.

OECD says Russia’s war in Ukraine to cost the global economy $2.8 trillion.

Inverted Yield Curve Watch

30 Year Treasury Yield: 3.711% (Last week’s reading: 3.498%)

10 Year Treasury Yield: 3.896% (Last week’s reading: 3.447%)

5 Year Treasury Yield: 4.169% (Last week’s reading: 3.684%)

2 Year Treasury Yield: 4.33% (Last week’s reading: 3.942%)

LOCAL MARKET UPDATE

MORTGAGES RATES REMAIN VOLATILE, ABSORPTION RATE TICKS DOWN, & SINGLE FAMILIES HOLDING STEADY...

Typical mortgage payments show an even starker picture of the astronomical growth of expenses for new homeowners over the past three years. The historic rise in home prices over the pandemic, compounded by this year’s spiking mortgage rates, has pushed the monthly mortgage payment on a newly purchased typical home in Las Vegas from $1,050 at the end of August 2019 to $2,047 last month, a 95% increase from this time of year before the pandemic, or about $997 dollars more per month.

Clark County, NV Absorption Rate

20.09%

The current absorption rate for the Southern Nevada market the past four weeks is 20.09%, down 0.65% from last week's absorption rate. This marks three consecutive weeks of a decline and a decrease in 13 of the last 14 readings.

A market with an absorption rate at or above 20% is typically called a seller’s market, whereas an absorption rate below 15% signals a buyer’s market.

Each week we will update the current median price for the current month. Keep in mind the majority of sales occur at the end of the month, so official numbers will be published on the first Monday of each month.

Current September Median Prices

Single Family

$450,000

(Unchanged from August of $450,000)

Condo

$222,250

(Down from August of $232,000)

Townhouse

$315,000

(Down from August of $325,000)

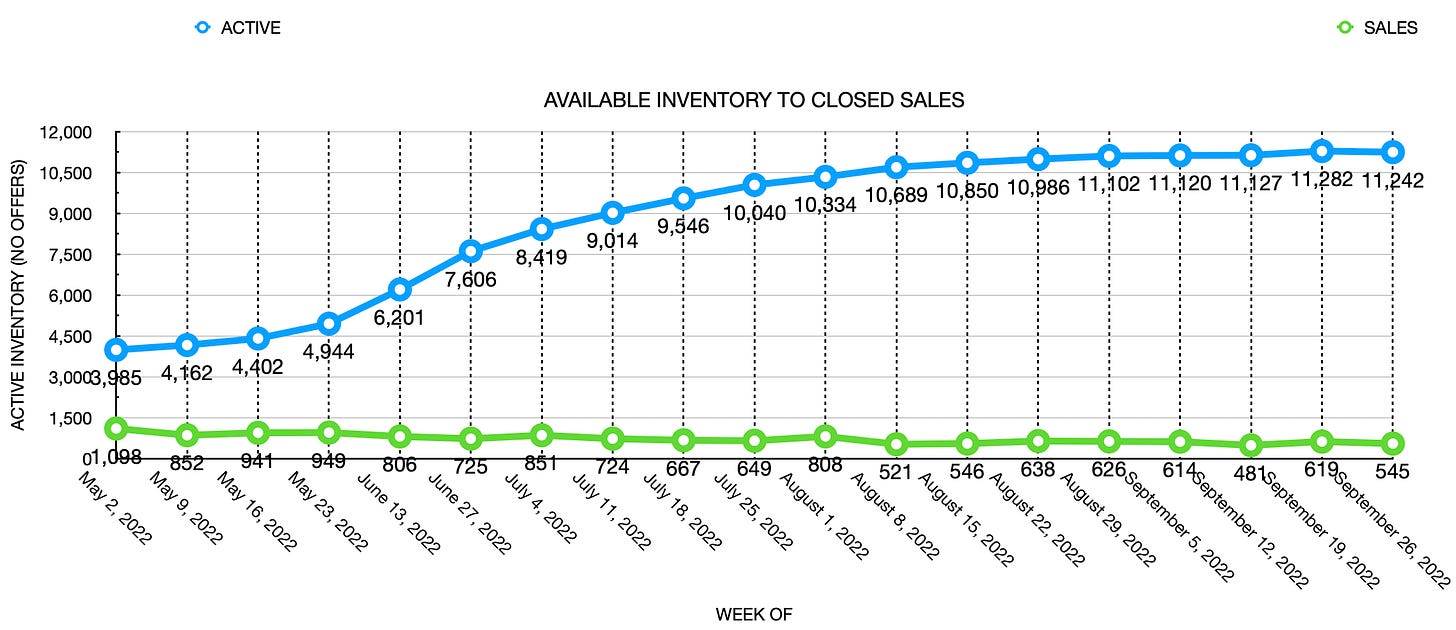

For the first time in 27 weeks, we have seen a decrease in residential resale inventory available on the open market in Southern Nevada. However, the past 26 of 27 weeks, we have seen an increase of available inventory. Chart below shows total available inventory to total weekly closed sales. (Last updated September 26, 2022)

As of September 26, 2022, there are currently active (%’s versus 4 weeks ago):

8,477 Single Family Homes (+107) +1.28%

1,143 Condos (+4) +0.35%

777 Townhouses (+8) +1.01%

320 Manufactured Homes (+39) +13.88%

439 High Rise Units (-7) -1.57%

86 Multiple Dwellings (-8) -11.34%

2,660 Parcels of Land (+76) +2.94%

3,236 Rentals On Market (+200) +6.87%

Past Seven Days Market Watch (%’s versus 1 week ago):

977 New Listings (-73) -6.95%

213 Back On Market (+8) +3.90%

86 Price Increases (+25) +40.98%

1,889 Price Decreases (+104) +5.83%

764 Accepted an Offer (-4) -0.52%

545 Sold (-74) -11.95%

108 Expired (+8) +8.00%

548 Taken Off Market (+124) +29.25%

64* properties are coming soon (-6) -8.57%

This week, there are 40 less active residential resale properties on the market compared to one week ago for a total of 11,242 (-40), a decrease of 0.35%.

*Properties coming soon do not indicate all of the upcoming properties. These are listing that are entered into the MLS prior to list date.

REVIEW OF LAST WEEK

FED HIKE SINKS STOCKS... The Fed's third straight big interest rate hike was all it took to send stocks to another week of losses, as investors feared the central bank's aggressiveness would drive the economy to a hard landing.

Fed Chair Jerome Powell added fuel to the fire, warning the job is not done with raising the rate to fight inflation. He thinks the Fed will get to 4.6% relatively quickly, and that's likely to cause pain by weakening the labor market.

Wall Streeters worry there will soon be large cuts to corporate earnings estimates, but good news came when the flash manufacturing Purchasing Managers Index (PMI) and the flash services PMI both rose for September.

The week ended with the Dow down 4.0%, to 29,590; the S&P 500 down 4.6%, to 3,693; and the Nasdaq down 5.1%, to 10,868.

The rate hike also hammered bond prices overall, with the 30-year UMBS 5.0% down 1.15, to $98.03. With bond prices down, the national average 30-year fixed mortgage rate moved up in Freddie Mac's Primary Mortgage Market Survey. Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up-to-the-minute information.

DID YOU KNOW… On Zillow’s national Index, the value of the typical U.S. home fell 0.3% in August after a 0.1% dip in July. The August decline is the largest monthly drop since 2011, though values are still up 14.1% year-over-year.

THIS WEEK’S FORECAST

HOME SALES, GDP DOWN, INFLATION UP... For August, both New Home Sales and the Pending Home Sales index of signed contracts on existing homes should be off. The GDP-Third Estimate for Q2 is also expected down, showing the overall economy is still contracting. Going in the other direction, unfortunately, is August inflation, still headed up by the PCE Prices measure the Fed favors.

FEDERAL RESERVE WATCH

Forecasting Federal Reserve policy changes in coming months. After the Fed’s statement last week, Wall Street expects another three-quarter percent rate hike in November, followed by a half percent rise in December, and a quarter percent bump in February. Note: In the lower chart a 76.2% probability of change is a 76.2% probability the rate will rise. Current rate is 3.00%-3.25%.

AFTER FOMC MEETING ON: CONSENSUS

Nov 2 3.75%-4.00%

Dec 14 4.25%-4.50%

Feb 1 4.50%-4.75%

Probability of change from current policy:

AFTER FOMC MEETING ON: CONSENSUS

Nov 2 76.2%

Dec 14 69.2%

Feb 1 75.1%