🏘 Housing Inventory Continues Growth - JD's Market Pulse 📊

National & local real estate market update for the week of September 19, 2022

NATIONAL HOUSING INVENTORY GROWS

CLARK COUNTY, NV ABSORPTION RATE NEARING 20%

FOR THE WEEK OF SEPTEMBER 19, 2022

“The best way to teach your kids about taxes is by eating 30% of their ice cream.”—Bill Murray, American actor and comedian

NATIONAL MARKET UPDATE

The National Association of Realtors reports active housing market inventory continues to grow, up 27% from a year ago. Versus last year, shoppers have more homes to consider, although inventory still isn’t back to pre-pandemic levels.

A recent study reveals adults with school-aged children will account for nearly one in four home sales over the next 10 months. Families with kids over 18 and empty nesters will also be active, singles and retirees not as much.

Freddie Mac: “Although the increase in rates will continue to dampen demand and put downward pressure on home prices, inventory remains inadequate," so, "while home price declines will likely continue, they should not be large.”

Economic Notes

FedEx reported quarterly results early and the delivery giant blurted out that spluttering demand across Asia and Europe stunted the amount of goods it shipped. Separate U.S. data shows the number of shipping containers arriving into Los Angeles - the country’s busiest port - dipped last month by the most since the early days of the pandemic.

Inflation rose 0.1% in August even with sharp drop in gas prices. Wholesale prices fell 0.1% in August amid inflation fears.

Food, shelter and medical services drove costs higher in August, slapping a costly tax on those least able to afford it. The food at home index has increased 13.5% over the past year, the largest such rise since March 1979.

For medical care services, the monthly increase of 0.8% was the fastest monthly gain since October 2019. Veterinary care was up 10% from a year ago.

Inverted Yield Curve Watch

30 Year Treasury Yield: 3.498% (Last week’s reading: 3.524%)

10 Year Treasury Yield: 3.477% (Last week’s reading: 3.328%)

5 Year Treasury Yield: 3.684% (Last week’s reading: 3.328%)

2 Year Treasury Yield: 3.942% (Last week’s reading: 3.491%)

LOCAL MARKET UPDATE

—

Clark County, NV Absorption Rate

20.74%

The current absorption rate for the Southern Nevada market the past four weeks is 20.74%, down 0.27% from last week's absorption rate. This marks two consecutive weeks of a decline and a decrease in 12 of the last 13 readings.

A market with an absorption rate at or above 20% is typically called a seller’s market, whereas an absorption rate below 15% signals a buyer’s market.

Each week we will update the current median price for the current month. Keep in mind the majority of sales occur at the end of the month, so official numbers will be published on the first Monday of each month.

Current September Median Prices

Single Family

$449,000

(Down from August of $450,000)

Condo

$222,000

(Down from August of $232,000)

Townhouse

$315,000

(Down from August of $325,000)

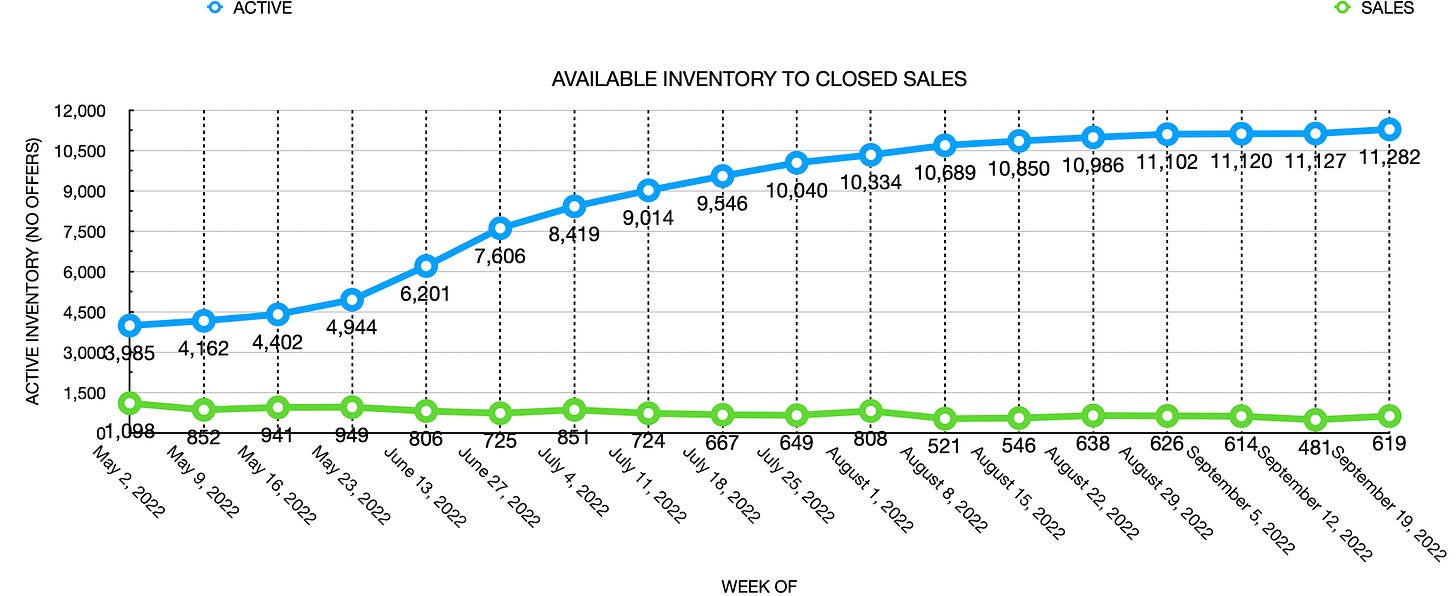

The past 26 weeks have seen an increase of residential resale inventory available on the open market in Southern Nevada. Chart below shows total available inventory to total weekly closed sales. (Last updated September 19, 2022

As of September 19, 2022, there are currently active (%’s versus 4 weeks ago):

8,497 Single Family Homes (+198) +2.38%

1,139 Condos (+28) +2.52%

788 Townhouses (+35) +4.65%

322 Manufactured Homes (+44) +15.83%

443 High Rise Units (-1) -0.23%

93 Multiple Dwellings (-8) -7.92%

2,626 Parcels of Land (+83) +3.26%

3,226 Rentals On Market (+189) +6.22%

Past Seven Days Market Watch (%’s versus 1 week ago):

1,050 New Listings (-20) -6.25%

205 Back On Market (-8) -3.75%

61 Price Increases (-8) -11.59%

1,785 Price Decreases (-28) -1.54%

768 Accepted an Offer (0) +/- 0.00%

619 Sold (+5) +0.81%

100 Expired (-171) -56.71%

424 Taken Off Market (-106) -20.00%

70* properties are coming soon (-19) -21.35%

This week, there are 155 more active residential resale properties on the market compared to one week ago for a total of 11,282 (+155), an increase of 1.45%.

*Properties coming soon do not indicate all of the upcoming properties. These are listing that are entered into the MLS prior to list date.

FEATURED LISTING

45 MALEENA MESA #1811

HENDERSON, NV 89074

$275,000

POTENTIAL CAP RATE

$275,000 Purchase Price

$1,750/Est. Mo. Rent

- $195/Mo. HOA

- $697/Annual Taxes

- $400/Annual Insurance

$17,563 EST. NOI / $275,000

= 6.39% CAP RATE

REVIEW OF LAST WEEK

INFLATION STRIKES BACK... Just when we thought the inflation surge was over, the August Consumer Price Index (CPI) went up. Stocks tanked, as traders feared this would spark more aggressive Fed rate hikes and a resulting recession.

The 0.1% CPI gain would have been bigger if gas prices hadn't dipped for the month (though they're still way up for the year), because other prices increased sharply, notably food and shelter, both up 0.8% for the month.

August Retail Sales ticked ahead 0.3%, driven by inflation. Thanks to lower gas prices, University of Michigan Consumer Sentiment stopped dropping, but it's still historically low, with uncertainty over inflation the highest since 1982.

The week ended with the Dow down 4.1%, to 30,822; the S&P 500 down 4.8%, to 3,873; and the Nasdaq down 5.5%, to 11,448.

Also hating inflation, bonds followed stocks south, the 30-year UMBS 5.0% down 0.98, to $99.18. In Freddie Mac's Primary Mortgage Market Survey, the national average 30-year fixed mortgage rate rose 13 basis points (0.13%). Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up-to-the-minute information.

DID YOU KNOW… Realtor.com reports the best time to buy a house in 2022 will be September 25 through October 1. Traditionally, there are about 8.4% more homes for sale, priced an average of $20,000 less than usual.

THIS WEEK’S FORECAST

HOME BUILDING UP, FED RATE UP, EXISTING HOME SALES DOWN... August Housing Starts are forecast to inch up, but so is the Fed Funds rate. The only question about the FOMC Rate Decision is whether the Fed will go for a full percentage point hike. August Existing Home Sales are expected to come down to a 4.7 million annual rate.

FEDERAL RESERVE WATCH

Forecasting Federal Reserve policy changes in coming months. With inflation still rising, Wall Street is certain of a three-quarter percent rate hike from the Fed this Wednesday, followed by another three-quarter percent bump in November, and a quarter percent lift in December. Note: In the lower chart a 100.0% probability of change is a 100.0% probability the rate will rise. Current rate is 2.25%-2.50%.

AFTER FOMC MEETING ON: CONSENSUS

Sep 21 3.00%-3.25%

Nov 2 3.75%-4.00%

Dec 14 4.00%-4.25%

Probability of change from current policy:

AFTER FOMC MEETING ON: CONSENSUS

Sep 21 100.0%

Nov 2 68.1%

Dec 14 89.4%