🏡🚨Housing Inventory Surges, Opendoor Smashed, & Las Vegas! JD's Market Pulse

For the week of November 7, 2022

HOUSING INVENTORY CONTINUES TO SURGE 📈

OPENDOOR GETS SMASHED, ALMOST LOSES A BILLION $ THIS Q3🗑

“People who never do any more than they get paid for never get paid for any more than they do.”—Elbert Hubbard, American writer, publisher, artist, and philosopher

MAKE SURE TO GET OUT AND VOTE TOMORROW, NOVEMBER 8, 2022!

IT MATTERS.

National Market Housing Update

Residential Construction Spending for September held pace with August, at a seasonally adjusted annual rate of $918.0 billion. It's now 12.7% ahead of a year ago, so more new homes will be coming on the market.

Realtor.com reports the active inventory of homes for sale continues to grow and is now 36% above its level of a year ago. This followed the prior week’s 34% increase, the first big gain in inventory since July.

The PWC and Urban Land Institute expect that days on the market for listed homes will continue to rise in 2023, good for buyers, and average home prices should be 30% higher than before the pandemic, good for sellers.

iBuyer Opendoor lost nearly $1B in Q3 in ‘once-in-40-years market transition.’ In total, Opendoor suffered a net loss of $928M between July and September, according to an earnings report Thursday. That’s up from a loss of just $57M during the third quarter of 2021. In a shareholder letter, Opendoor attributed $573 million of its net loss to “inventory valuation adjustments,” or in other words the reduced value of the homes Opendoor has in inventory.

DID YOU KNOW… Real estate analytics firm CoreLogic reported home prices dipped 0.5% in September. They're still up 11.4% from September a year ago, but that’s a slower annual growth rate compared to prior months.

HIP Top 10 Metro Change

The CoreLogic HPI provides measures for multiple market segments, referred to as tiers, based on property type, price, time between sales, loan type (conforming vs. non-conforming) and distressed sales. Broad national coverage is available from the national level down to ZIP Code, including non-disclosure states.

These large cities continued to experience price increases in September, with Miami on top at 25.6% year over year.

Hawaii currently holds the record for the highest median home prices in the USA at $636,400 and the lowest is West Virginia at $123,200.

Are you preparing for the opportunities that are coming in this downturn real estate market? We laid out the entire playbook for you to start to prepare for an opportunity that only happens once every decade or two 👇

ECONOMIC NOTES

U.S. payrolls surged by 261,000 in October, better than expected as hiring remains strong. Nonfarm payrolls grew by 261k, better than the estimate for 205k. The unemployment rate moved higher to 3.7%, while. Broader jobless measure also increased, to 6.8%. Big job gainers by industry included health care, professional and technical services, and leisure and hospitality. Average hourly earnings rose 0.4% for the month and were up 4.7% from a year ago - still below inflation numbers.

Labor costs show slower rise, while trade deficit widens and jobless claims nudge lower. Unit labor costs increased 3.5% for the July-to-September period, below the 4% Dow Jones estimate. The September trade deficit widened to $73.3 billion, $1 billion more than expected and up from August’s $65.7 billion.

The unemployment rate for Black men fell in October, but so did labor force participation. The rate fell to 5.3% in October from 5.8% a month earlier, according to data from the Bureau of Labor Statistics released Friday. This was for the wrong reasons, however - labor force participation and the employment to population ration fell. Black and Hispanic workers still have higher rates of unemployment than white counterparts.

Inverted Treasury Yield Curve Watch

30 Year: 4.291% (+9.5bps)

(Last week: 4.196%)

10 Year: 4.209% (+13.6bps)

(Last week: 4.073%)

5 Year: 4.393% (+14.5bps)

(Last week: 4.248%)

2 Year: 4.724% (+22.5bps)

(Last week: 4.499%)

LOCAL LAS VEGAS MARKET UPDATE

Ex-Golden Knight lists Summerlin mansion for nearly $12M

After his trade from the Golden Knights, Max Pacioretty is trying to sell his Las Vegas mansion for nearly $12 million — almost double what he paid for it last year.

Pacioretty, who was shipped to the Carolina Hurricanes this summer, put his luxury house in Summerlin on the market for $11.9 million on Oct. 25, listing sites show.

The one-story, six-bedroom home at 42 Crested Cloud Way spans 10,181 square feet. It boasts a wine cellar, gym, sauna, media room, sport court and 55-foot-long pool with a center island, listing materials say.

Pacioretty spent “millions” upgrading the house, including adding 2,000 square feet of livable space, according to listing agent Madison BenShimon of Las Vegas brokerage IS Luxury.

The hockey player demolished and rebuilt the basement, added a sport court and replaced every light fixture and the backyard landscaping.

The home’s “left wing” — Pacioretty’s position — includes the main bedroom, guest rooms and an office, listing materials say.

The athlete’s mansion sits on a half-acre lot in The Ridges, a wealthy enclave off Flamingo Road at Town Center Drive that features massive, custom-built homes near the desert’s edge with close-up mountain views. (Read full article on LVRJ by Eli Seagall)

Southern Nevada Absorption Rate remains below 20% for the third consecutive week.

19.34%

The current absorption rate for the Southern Nevada market the past four weeks is 19.34%, up a single basis point (0.01%) from last week's absorption rate. This is the third time in consecutive weeks that the Absorption Rate Figure (ARF) has remained BELOW the 20% mark. This marks the first increase - albeit extremely fractional - after four consecutive weeks of a decline with a decline in 12 of the last 15 readings. For much of 2021 and early 2022, the absorption rate was over 100%.

A market with an absorption rate at or above 20% is typically called a seller’s market, whereas an absorption rate below 15% signals a buyer’s market.

Each week we will update the current median price for the current month. Keep in mind the majority of sales occur at the end of the month, so official numbers will be published on the first Monday of each month.

Current November 2022 Median Prices

Single Family

$435,777 (-$4,223)

(Down from October of $ 440,000)

Condo

$229,750 (+$3,250)

(Up from October of $226,500)

Townhouse

$299,900 (-$25,100)

(Down from October of $325,000)

This week shows another week of a decline in inventory, and a decrease in sales. This week marks the 4th time in 6 weeks that inventory shows a weekly decline. It appears that as we move into the fall and winter season, inventory is leveling off around the 11,000 level, and would-be home sellers are opting to stay or rent out their property as we have seen substantial increases in available rentals on the market

The chart below shows total available inventory to total weekly closed sales. (Last updated November 7, 2022)

As of November 7, 2022, there are currently active (%’s versus 1 weeks ago):

8,342 Single Family Homes (-170) -2.00%

1,094 Condos (-19) -1.71%

756 Townhouses (-19) -2.45%

313 Manufactured Homes (+1) +0.32%

435 High Rise Units (-9) -2.02%

99 Multiple Dwellings (+2) +2.06%

2,7105 Parcels of Land (-9) -0.40%

3,785 Rentals On Market (+134) +3.67%

Past Seven Days Market Watch (%’s versus 4 week ago):

792 New Listings (-222) -21.90%

183 Back on Market (-39) -17.57%

121 Price Increases (+54) +80.60%

1,338 Price Decreases (-453) -25.30%

620 Accepted an Offer (-67) -9.75%

519 Sold (-43) -7.65%

357 Expired (+236) +195.04%

507 Taken Off Market (-5) -0.98%

46* properties are coming soon (-4) -8.00%

This week, there are 229 less active residential resale properties on the market compared to one week ago for a total of 11,039 (-229), a decrease of 2.03%.

*Properties coming soon do not indicate all of the upcoming properties. These are listing that are entered into the MLS prior to list date.

Featured Listing

Review of Last Week

THE FED HIKES, STOCKS SLIDE... The Fed raised the funds rate by 0.75% for the fourth straight time and the Fed Chair said it was "very premature to think about pausing." Stocks sank on his hawkish outlook.

Plus, a better-than-expected October jobs report showed the economy isn't slowing enough for the Fed to take its foot off the gas, even as unemployment inched up to 3.7% and labor force participation slipped to 62.2%.

"Real" (inflation-adjusted) hourly wages are shrinking, with 4.7% wage growth well below the roughly 8% inflation. ISM Manufacturing and Non-Manufacturing Indexes still showed expansion, though Manufacturing bordered on contraction.

The week ended with the Dow down 1.4%, to 32,403; the S&P 500 down 3.3%, to 3,771; and the Nasdaq down 5.6%, to 10,475.

Following last week's rate hike, bonds also tanked, the 30-year UMBS 5.5% down 0.86, to $98.17. In Freddie Mac's Primary Mortgage Market Survey, the national average 30-year fixed mortgage rate dropped back thirteen basis points (0.13%). Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up-to-the-minute information.

This Week’s Forecast

INFLATION, JOBLESS CLAIMS, CONSUMER SENTIMENT… Inflation is forecast to come in even hotter in October by the Consumer Price Index (CPI). Unfortunately, Initial Jobless Claims are also expected up. Not surprisingly, the University of Michigan Consumer Sentiment index should remain at its recent historically low level.

Tip Of The Week

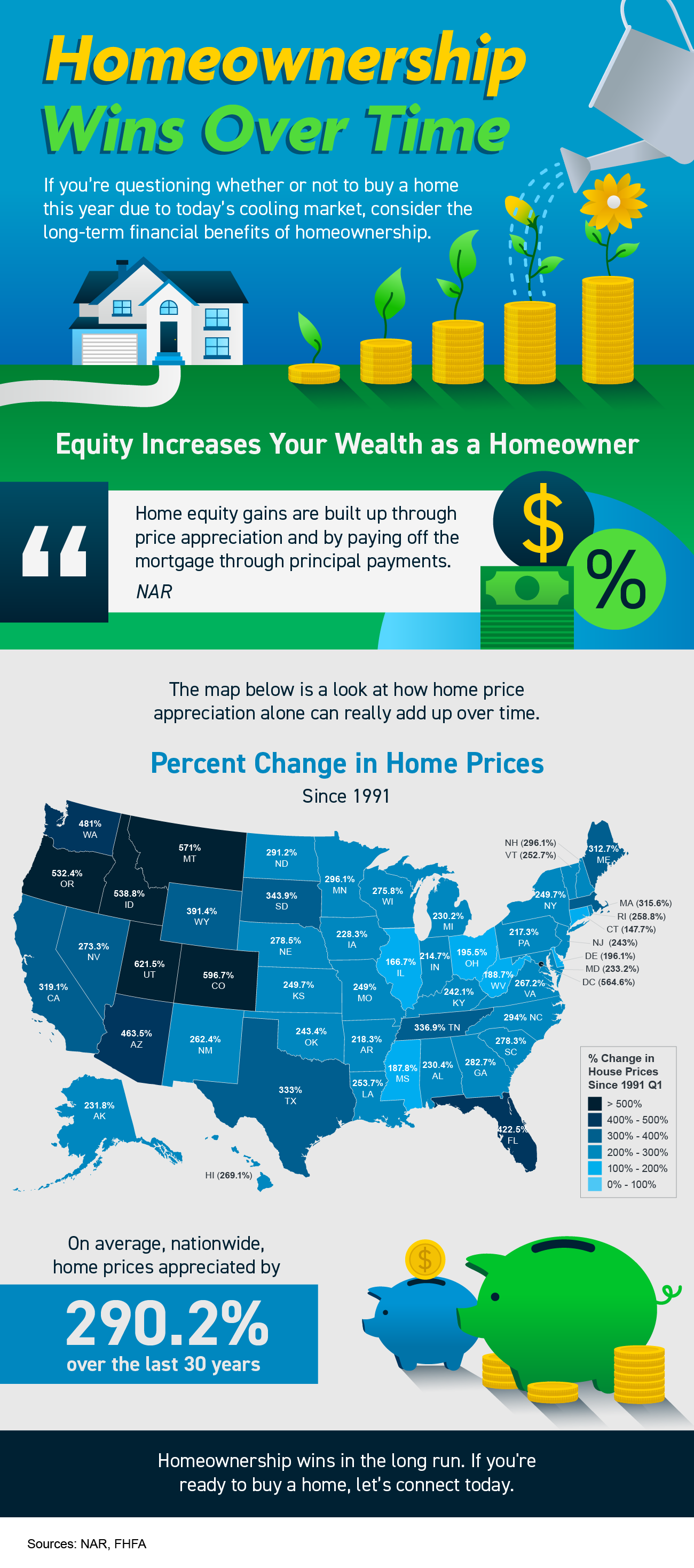

If you’re questioning whether or not to buy a home this year due to today’s cooling market, consider the long-term financial benefits of homeownership.

As a homeowner, equity increases your wealth. On average, nationwide, home prices appreciated by 290.2% since 1991.

Homeownership wins in the long run. If you’re ready to buy a home, let’s connect today.

FEDERAL RESERVE WATCH

Forecasting Federal Reserve policy changes in coming months. The futures market now sees half percent rate hikes in December and February, then a quarter percent bump in March, as the Fed eases up but does not pause. Note: In the lower chart a 100.0% probability of change is a 100.0% probability the rate will rise. Current rate is 3.75%-4.00%.

AFTER FOMC MEETING ON: CONSENSUS

Dec 14 4.25%-4.50%

Feb 1 4.75%-5.00%

Mar 22 5.00%-5.25%

Probability of change from current policy:

AFTER FOMC MEETING ON: CONSENSUS

Dec 14 100.0%

Feb 1 70.1%

Mar 22 65.9%

With gratitude,

Jordan C. Dove

Managing Principal | REALTOR

Dove & Associates Powered by Nationwide Realty

Jordan@DoveandAssociates.com

NV LIC S.0180594

3960 E. Patrick Ln. Ste. 204

Las Vegas, NV 89120

NV Lic. # S.0180594