For the week of May 8, 2023

“Your time is limited, so don’t waste it living someone else’s life. Don’t be trapped by dogma - which is living with the results of other people’s thinking.” - Steve Jobs

LAST WEEK’S REVIEW

GOOD JOBS NOT GOOD ENOUGH... Friday's unexpectedly upbeat April jobs report sparked a market rally, but wasn't enough to send the Dow and the S&P 500 into positive territory, though the Nasdaq eked out a gain.

The Fed hiked rates an expected quarter percent, implied they'd keep them there a while, wouldn't say when they'd start rate cutting, but stressed that the "U.S. banking system is sound and resilient."

Then April's better-than-forecast 253,000 nonfarm payrolls, bump in hourly earnings, and drop in the unemployment rate, gave support to the idea that we could still see a soft landing for the economy.

The week ended with the Dow down 1.2%, to 33,674; the S&P 500 down 0.8%, to 4,136, and the Nasdaq UP 0.1%, to 12,235.

Bonds overall finished up a smidge, the 30-Year UMBS 5.5% ending UP 0.11, at $100.88. In Freddie Mac's Primary Mortgage Market Survey, the national average 30-year fixed mortgage rate ticked down.

Of course, it's always important to remember that mortgage rates can be volatile, so make sure you stay up-to-date by talking to a mortgage professional, like Chuck! Give him a call at (702) 234-5335 for all your mortgage questions.

NATIONAL HOUSING MARKET UPDATE

From Q1 1963 - Q1 2023 median housing prices in the United States have appreciated 2,353.93%. Although the market has ebbed & flowed, historically, according to the chart, real estate has always appreciated - long term.

The CoreLogic Home Price Index (HPI) reported year-over-year home price growth fell to 3.1% in March, hitting its lowest appreciation rate in 11 years.Monthly price growth fell to 1.6%.

Although construction spending was up overall in March, residential spending came in a tick below February at a still respectable $827.2 billion annual rate. Given the low existing home inventories, builders are optimistic but cautious.

Realtor.com’s latest weekly report saw active inventory 39% above a year ago. Sellers have more competition, but homes are still spending 15 fewer days on the market than before the pandemic.

DID YOU KNOW… The National Association of Realtors reports 63% of agents surveyed found promoting energy efficiency is very or somewhat valuable, and 48% said consumers were interested in sustainability.

TREASURY BOND YIELDS WATCH

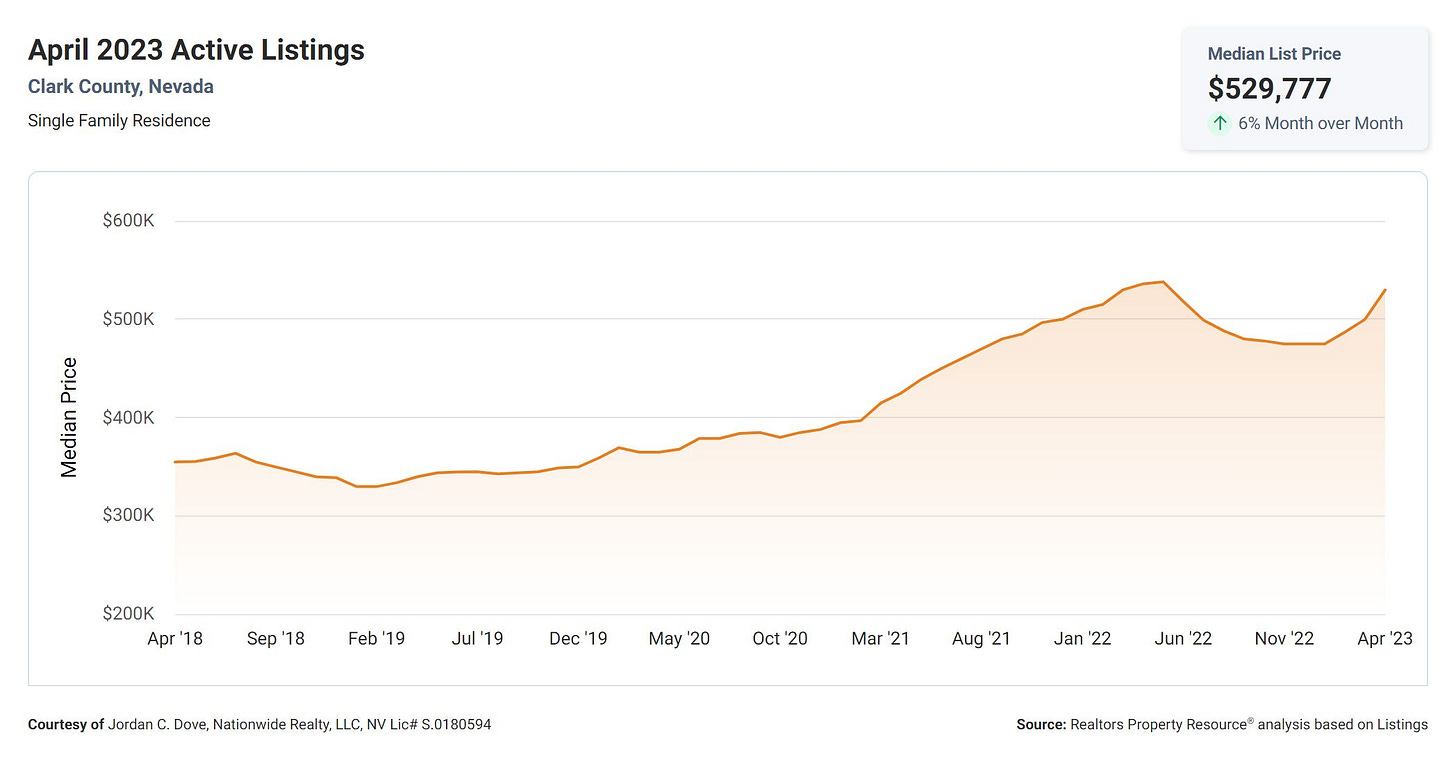

SOUTHERN NEVADA HOUSING MARKET UPDATE

MEDIAN HOUSING PRICES

Each week we will update the current median price for the current month. Keep in mind the majority of sales occur at the end of the month, so official numbers will be published on the first Monday of each month. Median prices are calculated from 597 sold listings from the MLS as of May 8, 2023.

Currently for the month of May 2023

Single Family

$435,000

+$5,000

Up from April of $430,000

Condo

$220,000

-$10,000

Down from April of $230,000

Townhomes

$323,000

+$3,000

Up from April of $320,000

HOUSING STATISTICS

Southern Nevada housing inventory continues its slide month-over-month. Nationally, inventory continues to rise, but still well below an even housing supply on the resale side.

There are currently 5,786 active single family homes, townhomes, condominiums, high-rises, manufactured and multi-families available on the market. Available rental properties also dipped down to 2,954 active rentals on the market this week, a decrease of 4.03% compared to one month ago.

As of May 10, 2023, there are currently active (4w change):

4,091 Single Family Homes (-301) -6.85%

653 Condos (-60) -8.41%

443 Townhouses (-46) -9.41%

212 Manufactured Homes (-34) -13.82%

322 High Rise Units (-14) -4.17%

51 Multiple Dwellings (-7) -12.07%

2,408 Parcels of Land (-55) -2.23%

2,954 Rentals On Market (-124) -4.03%

Past Seven Days Market Watch (4w change):

803 New Listings (-2) -0.25%

191 Back on Market (+2) +1.06%

111 Price Increases (+19) +20.65%

475 Price Decreases (-43) -8.30%

875 Accepted an Offer (-90) -9.33%

658 Sold (+37) +6.13%

209 Expired (+115) +122.34%

299 Taken Off Market (-3) -0.99%

This week, there are 682 less active residential resale properties on the market compared to the one month ago on April 10, 2023 for a total of 5,786 - a decrease of 10.54%.

FEATURED PROPERTY

THIS WEEK’S PREDICTIONS

INFLATION, RETAIL SALES, CONSUMER SENTIMENT… We'll get two reads on inflation—the Consumer Price Index (CPI) measure of the prices we pay, and the Producer Price Index (PPI) gauge of wholesale prices. Both are forecast up a bit. Retail Sales are expected to decline in March, which may cause the Fed to ease up on rate hikes. University of Michigan Consumer Sentiment should be up a tad in April, though still well below a year ago.

REAL ESTATE TIP OF THE WEEK

Not sure if selling your house is the right move today? You should know there are a number of reasons it still makes sense to sell now.

Your house will stand out because inventory is low. That’s why the number of offers on recently sold homes is on the rise. And most homeowners have a lot of equity that can fuel a move.

If you’re thinking about selling your house, let’s connect to discuss if now may be the time to move.

FEDERAL RESERVE WATCH

Forecasting Federal Reserve policy changes in coming months. The futures market feels the Fed will hold the rate at its current level in June and July, then cut a quarter percent in September. Note: In the lower chart, a 9.6% probability of change is a 90.4% probability the rate will stay the same. Current rate is 5.00%-5.25%.

AFTER FOMC MEETING ON: CONSENSUS

Jun 14 5.00%-5.25%

Jul 26 5.00%-5.25%

Sep 20 4.75%-5.00%

Probability of change from current policy:

AFTER FOMC MEETING ON: CONSENSUS

Jun 14 9.6%

Jul 26 43.7%

Sep 20 74.8%

With gratitude,

Jordan C. Dove, ABR® SFR®

MANAGING PRINCIPAL | REALTOR®

Dove & Associates Powered by Nationwide Realty

702.767.5557 | Jordan@DoveandAssociates.com

JordanDove.com | DoveandAssociates.com

Subscribe to my YouTube Channel

3960 E. Patrick Ln. Ste. 204

Las Vegas, NV 89120

NV Lic. # S.0180594