For the week of May 15, 2023

“The possible is just the impossible that we’ve come to accept.”—Stewart Stafford, Irish-American novelist and poet

WHERE ARE THE HOMES? Vegas Inventory Drops 13.82% month-over-month.

INFLATION WANES, CONSUMERS WORRY... Traders sent the Dow and S&P 500 down for the week, though the tech-y Nasdaq gained, as inflation abated but consumer concerns about the economy grew.

University of Michigan Consumer Sentiment fell precipitously in April, threatening to cut the spending that supports 70% of the economy. Yet Consumer Price Index inflation, at 4.9%, hit its lowest rate in two years.

That gave investors hope the Fed may be finished with hikes and start cutting rates in a few months. They also felt good that 78% of companies reporting Q1 earnings have beaten expectations.

The week ended with the Dow down 1.1%, to 33,301; the S&P 500 down 0.3%, to 4,124, and the Nasdaq UP 0.4%, to 12,285.

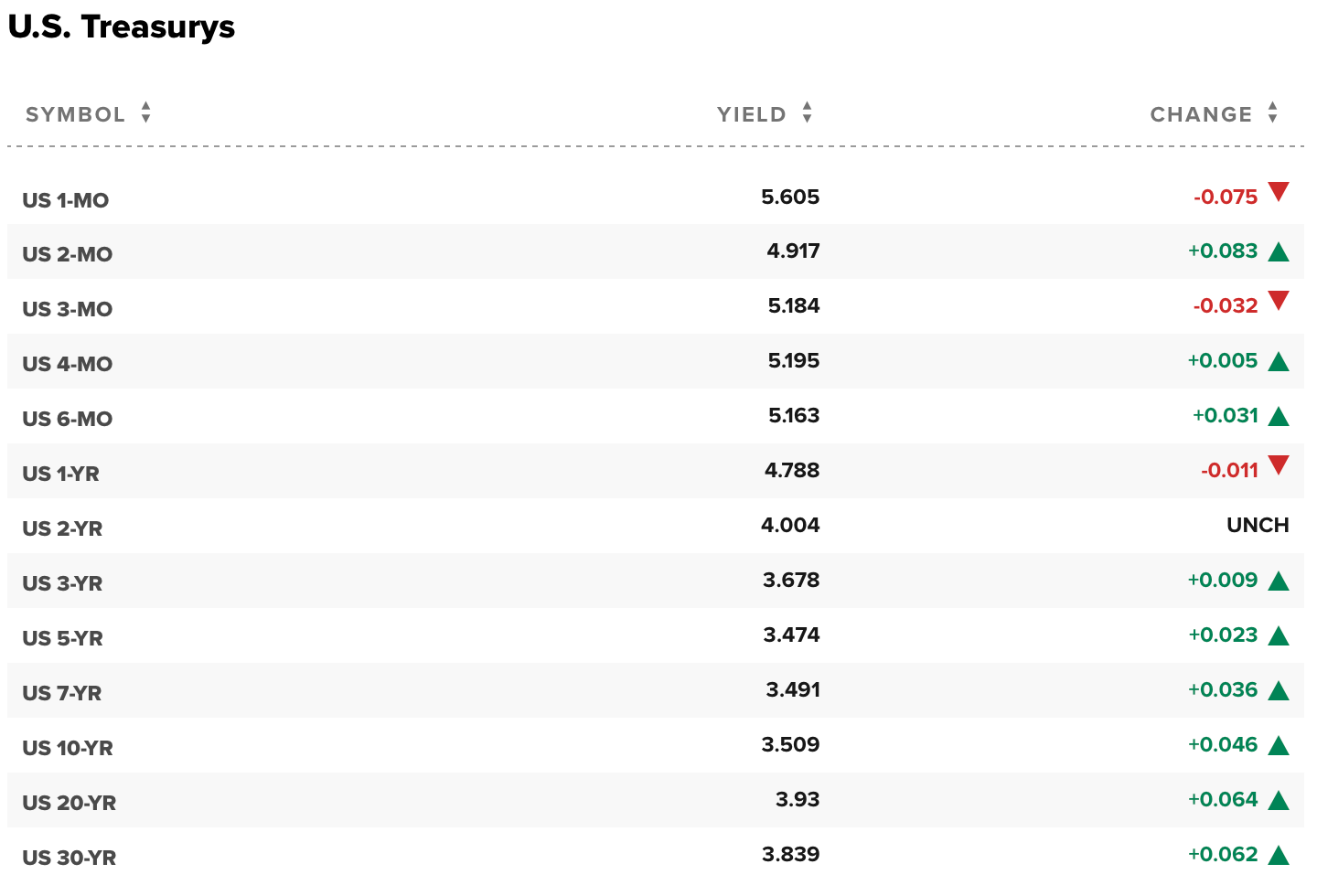

Bond prices receded overall, the 30-Year UMBS 5.5% ending down 0.27, at $100.61. The national average 30-year fixed mortgage rate inched down again in Freddie Mac's Primary Mortgage Market Survey.

Of course, it's always important to remember that mortgage rates can be volatile, so make sure you stay up-to-date by talking to a mortgage professional, like Chuck! Give him a call at (702) 234-5335 for all your mortgage questions.

The spring housing market is heating up. The Mortgage Bankers Association reported purchase mortgage applications rose 5% compared to the week before. Even refinancing applications spiked 10% from the prior week.

This is happening even as the National Association of Realtors reports that almost seven out of ten metros saw home prices rise the first three months of the year after roughly half a year of moderate price declines.

A new Zillow study supports this, reporting home values climbed 1% from March to April, as buyer demand for limited inventory is re-igniting the sellers’ market. Higher rents are also bringing more buyers onto the scene.

DID YOU KNOW… New data reports 55% of the potential homebuyers surveyed see this year’s market as more competitive than last year's, yet 54% want to buy when they planned or even speed up their home purchases.

APRIL 2023

Each week we will update the current median price for the current month. Keep in mind the majority of sales occur at the end of the month, so official numbers will be published on the first Monday of each month. Median prices are calculated from 1,182 sold listings from the MLS as of May 15, 2023.

Currently for the month of May 2023

Single Family

$435,000

+$5,000

Up from April of $430,000

Condo

$221,000

-$9,000

Down from April of $230,000

Townhomes

$328,000

+$8,000

Up from April of $320,000

WHERE ARE THE HOUSES? Despite the equity for many homeowners, they are opting to stay put with the highest interest rates. However, turn-key homes in the median price point range ($375k-$475k) are flying off the shelves with many receiving bidding wars again, although not as crazy as during the pandemic with historically low interest rates.

Southern Nevada housing inventory continues its slide month-over-month after peaking in October, 2022. Nationally, inventory continues a slight rise, but still well below an even housing supply on the resale side.

There are currently 5,574 active single family homes, townhomes, condominiums, high-rises, manufactured and multi-families available on the market. Available rental properties also dipped down to 3,006 active rentals on the market this week, a decrease of 1.54% compared to one month ago, but are up slightly week-over-week.

As of May 15, 2023, there are currently active (4w change):

3,949 Single Family Homes (-400) -9.20%

609 Condos (-59) -8.83%

442 Townhouses (-29) -6.16%

200 Manufactured Homes (-35) -14.52%

319 High Rise Units (-15) -4.50%

55 Multiple Dwellings (-4) -6.78%

2,459 Parcels of Land (-10) -0.40%

3,006 Rentals On Market (-47) -1.54%

Past Seven Days Market Watch (4w change):

683 New Listings (-70) -9.30%

135 Back on Market (-52) -27.81%

107 Price Increases (+44) +69.84%

421 Price Decreases (-219) -34.22%

966 Accepted an Offer (-35) -3.50%

634 Sold (+44) +7.46%

61 Expired (-46) -42.99%

301 Taken Off Market (+61) +25.42%

This week, there are 894 less active residential resale properties on the market compared to the one month ago on April 17, 2023 for a total of 5,574 - a decrease of 13.82%.

HOME BUILDING, EXISTING HOME SALES, RETAIL SALES... Builders are expected to report a tad fewer Housing Starts in April, but Building Permits are forecast up a bit. Analysts predict April Existing Home Sales will slide, given tight inventories. Retail Sales should come in ahead for April, showing consumers are still helping the economy.

While home prices vary by local area, they’ve already hit their low point nationally, and now they’re starting to rise again.

Last July, prices started to decline, but around February, they began climbing back up.

If you put your plans to move on hold waiting to see what would happen with home prices, let’s connect to discuss if now’s the right time to jump back in.

Forecasting Federal Reserve policy changes in coming months. Bond investors figure there's a better than 50-50 chance the Fed is done hiking rates and will start cutting them in September to hold off a recession. Note: In the lower chart, a 14.4% probability of change is an 85.6% probability the rate will stay the same. Current rate is 5.00%-5.25%.

AFTER FOMC MEETING ON: CONSENSUS

Jun 14 5.00%-5.25%

Jul 26 5.00%-5.25%

Sep 20 4.75%-5.00%

Probability of change from current policy:

AFTER FOMC MEETING ON: CONSENSUS

Jun 14 14.4%

Jul 26 37.4%

Sep 20 83.9%

With gratitude,

Jordan C. Dove, ABR® SFR®

MANAGING PRINCIPAL | REALTOR®

Dove & Associates Powered by Nationwide Realty

702.767.5557 | Jordan@DoveandAssociates.com

JordanDove.com | DoveandAssociates.com

Subscribe to my YouTube Channel

3960 E. Patrick Ln. Ste. 204

Las Vegas, NV 89120

NV Lic. # S.0180594