For the week of October 17, 2022

MORE LISTINGS = MORE OPTIONS

COYOTE SPRINGS DEVELOPMENT SHUT DOWN BY COUNTY COMMISSION

“Unless we change direction, we are likely to end up where we are headed.”—Anonymous

Watch this market update on YouTube

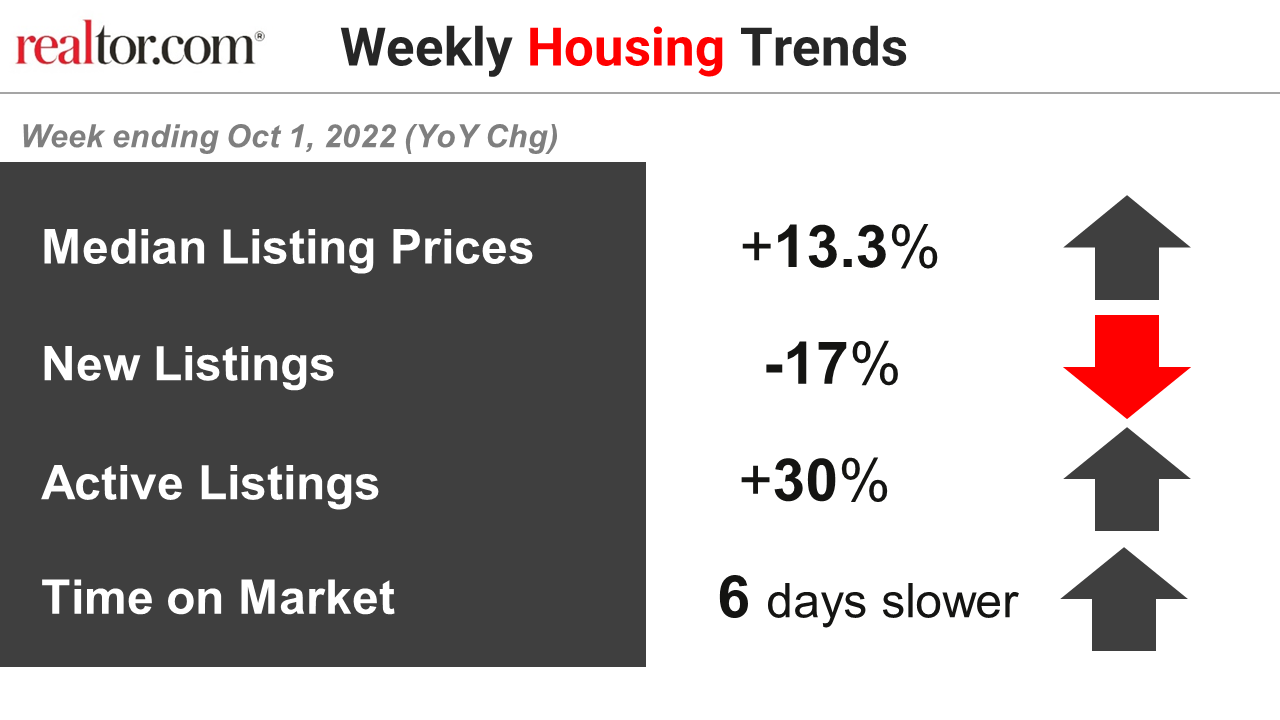

Realtor.com reports active inventory continued to grow in the week ending October 1, 30% above one year ago, although down from pre-pandemic levels. Homes spent six more days on the market than a year ago.

The median listing price grew by 13.3% over last year. New listings–a measure of sellers putting homes up for sale–were again down, dropping 17% from one year ago. Active inventory continued to grow, increasing 30% above one year ago.

Fitch Ratings expects home prices to fall but sees more of a correction rather than a crash, citing “still constrained” housing inventory, a “strong job market,” and “prudent lending standards.”

The Mortgage Bankers Association noted, “The news that job growth and wage growth continued in September is positive for the housing market, as higher incomes support housing demand.”

DID YOU KNOW… Existing home sales have been forecast at 5.15 million in 2022, down 15.8% from 2021’s 15-year high. But compared to the average existing home sales of the eight years before the pandemic (2012-2019), 2022 is down only 0.9%.

ECONOMIC NOTES

September’s CPI (Consumer Price Index) rose higher-than-expected to 8.2% as there are no signs of inflation slowing.

Core CPI, excluding food and energy, rose to its highest level in 40 years and the Producer Price Index (PPI) saw wholesale prices up 8.5%

China delays release of key economic data (G.D.P + other economic data) amid party congress.

Consumer spending was flat in September and below expectations.

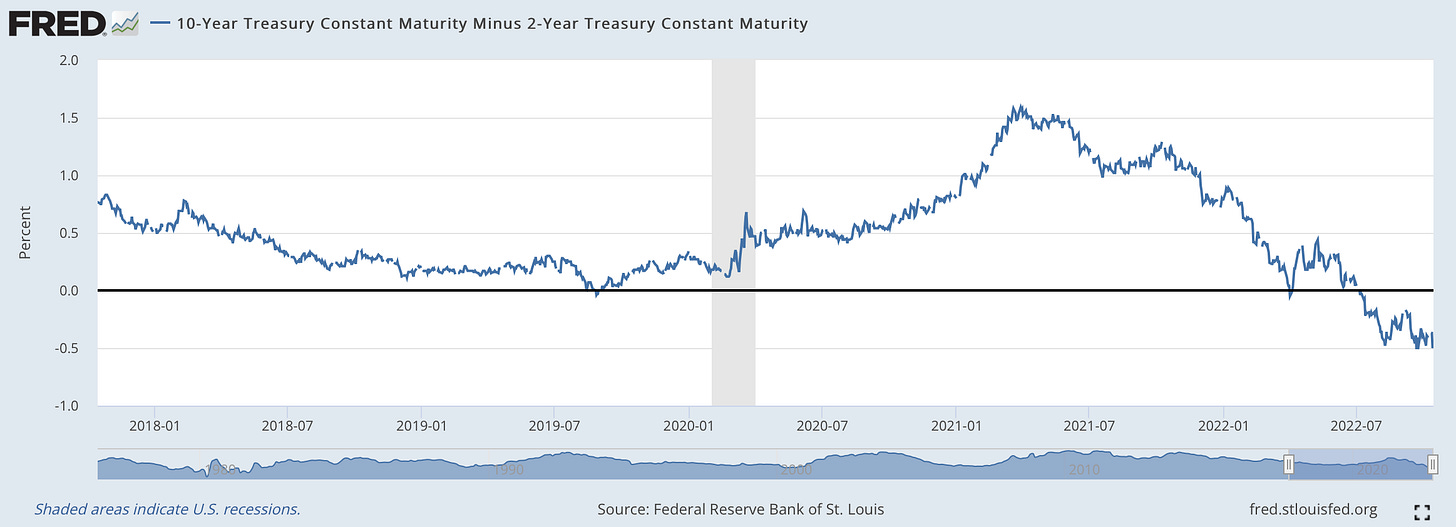

Inverted Yield Curve Watch

30 Year Treasury Yield: 4.014% (Last week’s reading: 3.848%)

10 Year Treasury Yield: 4.002% (Last week’s reading: 3.888%)

5 Year Treasury Yield: 4.232% (Last week’s reading: 4.149%)

2 Year Treasury Yield: 4.454% (Last week’s reading: 4.312%)

LOCAL MARKET UPDATE (SOUTHERN NEVADA)

Coyote Springs faces setback after subdivision plans denied

Clark County commissioners have dealt a setback to Coyote Springs, the long-sought community outside Las Vegas.

The commission voted 7-0 last week to deny a 575-home subdivision map for Coyote Springs, blocking a step in the development process that’s needed to enable home construction. The Las Vegas Valley Water District had objected to the map.

Water rights for Coyote Springs’ development are “insufficient” because they cannot be used without “conflicting” with other rights or “impacting” the Moapa dace, a rare warm-water fish in Southern Nevada, the water district said in a letter to commissioners last month.

Coyote Springs, roughly 60 miles north of Las Vegas, has been in the works for some two decades. It has a golf course and infrastructure but not a single house, and even before the vote, there was no telling when homes would start to take shape.

The developers “will very likely refile” an application for the subdivision map, said Emilia Cargill, chief operating officer and general counsel at Wingfield Nevada Group, the company behind Coyote Springs.

Cargill, who previously told the Review-Journal that the subdivision would comprise Coyote Springs’ first residential village, said the developers view the denial as a “temporary setback.”

“We remain enthusiastic,” she told the Review-Journal last week. “It’s a good project; we have development rights … and we still seek to move forward.” ….

- Read full article by Eli Segall on the LVRJ

Clark County, NV Absorption Rate

21.22%

The current absorption rate for the Southern Nevada market the past four weeks is 21.22%, down 0.79% from last week's absorption rate. This marks a decrease this week for 14 out of the last 17 readings.

A market with an absorption rate at or above 20% is typically called a seller’s market, whereas an absorption rate below 15% signals a buyer’s market.

Each week we will update the current median price for the current month. Keep in mind the majority of sales occur at the end of the month, so official numbers will be published on the first Monday of each month.

Current October 2022 Median Prices

Single Family

$444,500 (-$5,500)

(Down from September of $450,000)

Condo

$226,000 (-$4,000)

(Down from September of $230,000)

Townhouse

$324,950 (+$4,950)

(Up from September of $320,000)

This week shows a slight rise in inventory. The past 29 of 30 weeks have seen an increase of available inventory. Chart below shows total available inventory to total weekly closed sales. (Last updated October 17, 2022)

As of October 17, 2022, there are currently active (%’s versus 1 weeks ago):

8,608 Single Family Homes (+43) +0.50%

1,144 Condos (+10) +0.88%

799 Townhouses (-2) -0.25%

324 Manufactured Homes (+5) +1.57%

453 High Rise Units (+2) +0.44%

99 Multiple Dwellings (-2) -1.98%

2,596 Parcels of Land (-5) -0.19%

3,569 Rentals On Market (-4) -0.11%

Past Seven Days Market Watch (%’s versus 4 week ago):

909 New Listings (-141) -13.43%

213 On Market (+8) +3.90%

58 Price Increases (-3) -4.92%

1,677 Price Decreases (-108) -6.05%

609 Accepted an Offer (-159) -20.70%

541 Sold (-78) -12.60%

120 Expired (+20) +20.00%

506 Taken Off Market (+82) +19.34%

46* properties are coming soon (-24) -34.29%

This week, there are 56 more active residential resale properties on the market compared to one week ago for a total of 11,427 (+56), an increase of 0.49%.

*Properties coming soon do not indicate all of the upcoming properties. These are listing that are entered into the MLS prior to list date.

FEATURED LISTING

REVIEW OF LAST WEEK

INFLATION DEFLATION... The Fed, the stock markets, and the rest of us are all looking for a sign inflation is easing, but it didn't come with September's higher-than-expected 8.2% Consumer Price Index (CPI).

Plus, Core CPI, excluding food and energy, rose to its highest level in 40 years and the Producer Price Index (PPI) saw wholesale prices up 8.5%. The S&P 500 and the Nasdaq ended the week deflated, the Dow with a modest gain.

Flat September Retail Sales showed inflation has consumers trimming spending and University of Michigan Consumer Sentiment posted higher inflation expectations, both pointing to more aggressive rate hikes from the Fed.

The week ended with the Dow UP 1.2%, to 29,635; the S&P 500 down 1.6%, to 3,583; and the Nasdaq down 3.1%, to 10,321.

Inflation-hating bonds got hammered, the 30-year UMBS 5.5% down 0.99, to $98.09. Lower bond prices mean higher rates, so the national average 30-year fixed mortgage rate moved up in Freddie Mac's Primary Mortgage Market Survey. Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up-to-the-minute information.

THIS WEEK’S FORECAST

HOUSING STARTS, EXISTING HOME SALES, JOBLESS CLAIMS ALL SLIP... September reports should show Housing Starts slowing, although Building Permits are expected to gain, a good sign. September Existing Home Sales are forecast down, but the drop in weekly Initial Jobless Claims will show the labor market stays strong.

TIP OF THE WEEK

If you’re trying to buy your first home in today’s housing market, you’ll want to know what you can do as mortgage rates rise and inventory stays low overall.

Connect with a lender to get pre-approved, prioritize your wish list, consider condos, and expand your search radius.

Your first home is out there. Let’s connect to explore your options and what other first-time buyers are doing to find their homes.

FEDERAL RESERVE WATCH

Forecasting Federal Reserve policy changes in coming months. With little indication inflation is abating, Wall Street expects the Fed will hike rates more aggressively, now three-quarters of a percent in November and December, and a half percent in February. Note: In the lower chart a 98.2% probability of change is a 98.2% probability the rate will rise. Current rate is 3.00%-3.25%.

AFTER FOMC MEETING ON: CONSENSUS

Nov 2 3.75%-4.00%

Dec 14 4.50%-4.75%

Feb 1 5.00%-5.25%

Probability of change from current policy:

AFTER FOMC MEETING ON: CONSENSUS

Nov 2 98.2%

Dec 14 65.3%

Feb 1 53.8%