Mortgage Rates Dropping + Vegas Home Prices Below U.S. Average

Jordan Dove's Market Pulse for the week of December 19, 2022

For the week of December 19, 2022

📉 MORTGAGE RATES CONTINUE DROPPING

📉 VEGAS HOME PRICES DROP BELOW US AVERAGE

“If you come to a fork in the road, take it.”—Yogi Berra, American professional baseball catcher, manager, and coach

After spending 10 minutes reading the market pulse,

you will know more about the real estate market and economy

than 90% of your peers.

GOOD NEWS, BAD NEWS... The Fed only hiked the rate by 0.50%—good news—but estimated their final rate would top 5%—bad news—and indicated they wouldn't pivot to rate cuts during 2023. Stocks dropped.

Investors feared the Fed's commitment to sit on an elevated rate until inflation fell to 2% would trigger a recession. Disappointing Retail Sales and Industrial Production data made it look like we're headed in that direction.

But CPI inflation saw a lower-than-expected monthly rise, and a big drop from 7.7% to 7.1% year-over-year, so inflation is clearly slowing. Plus, initial jobless claims fell by 20,000.

The week ended with the Dow down 1.7%, to 32,920; the S&P 500 down 2.1%, to 3,852; and the Nasdaq down 2.7%, to 10,705.

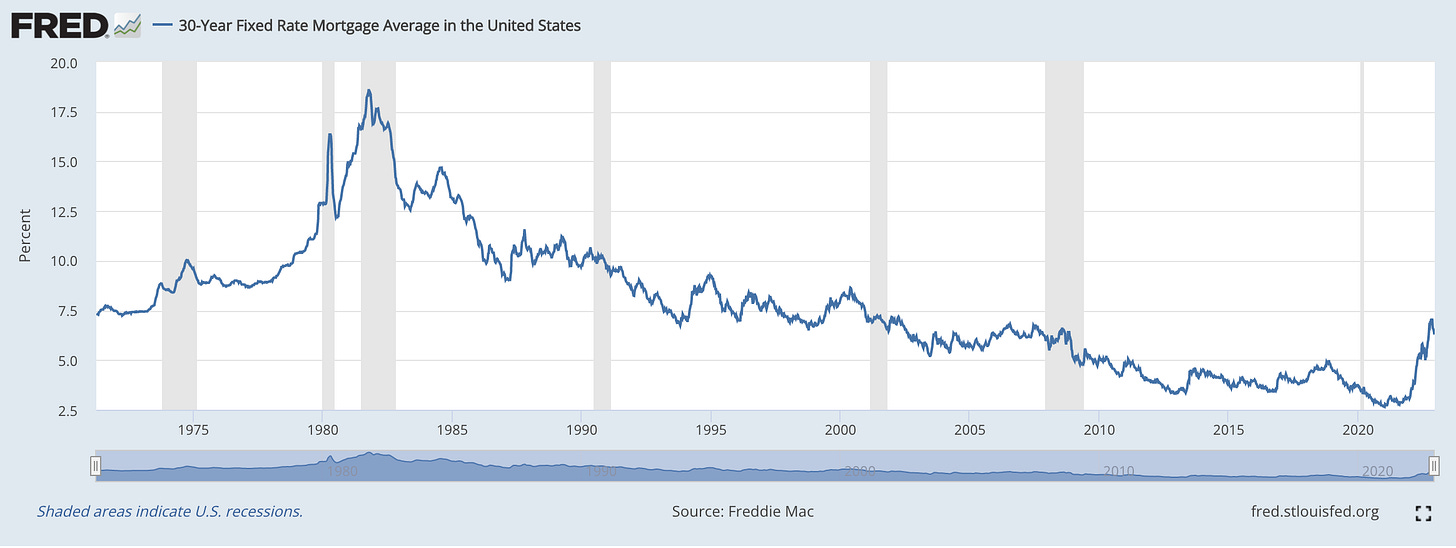

Bond prices overall showed some strength, although the UMBS 5.5% slipped 0.13, to $101.13. In Freddie Mac's Primary Mortgage Market Survey, the national average 30-year fixed mortgage rate dropped for the fifth straight week. Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up-to-the-minute information

Last week, the Fed’s decision to slow the pace of rate hikes from 0.75% to 0.50%, along with lower-than-expected consumer price inflation, sent mortgage rates lower. Both signaled that inflation may be starting to cool.

Freddie Mac confirmed: “Mortgage rates continued their downward trajectory this week…. The good news for the housing market is that recent declines in rates have led to a stabilization in purchase demand.”

As of Thursday Dec. 15, 2022, the average 30-year fixed mortgage rate in the United States was 6.31%. (Historical chart below)

The Mortgage Bankers Association chimed in with the view that declining rates should “encourage more homebuyers to return to the market in early 2023,” as overall mortgage applications already rose 3.2% last week.

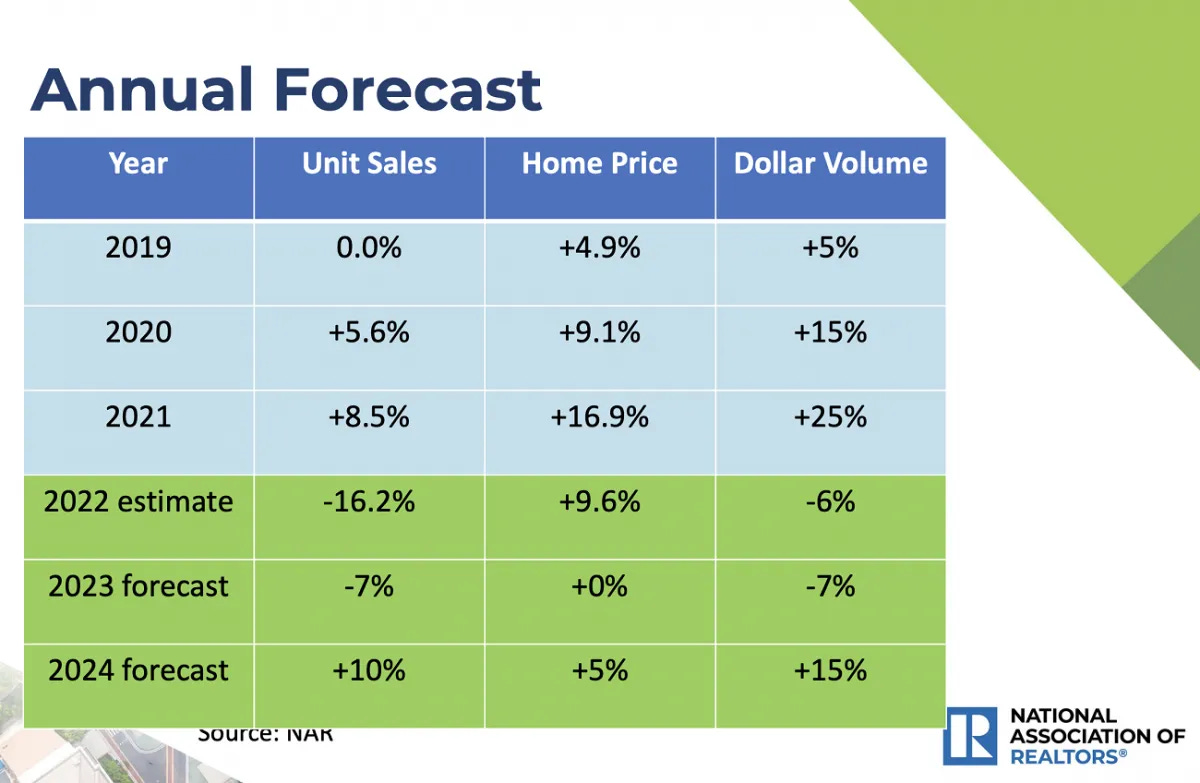

DID YOU KNOW… The National Association of Realtors expects the median home price will stay flat in 2023, up just 0.3%, to $385,800, noting “half of the country may experience small price gains, while the other half may see slight price declines.”

Retail sales fell 0.6% in November as consumers feel the pressure from inflation. This is worse than the Dow Jones estimate for a 0.3% drop.

Weekly jobless claims fell to 211,000 a decline of 20,000 from the previous period and well below the Dow Jones estimate for 232,000.

Fed surveys from the New York and Philadelphia regions showed contraction in manufacturing activity in December.Consumer prices rose less than expected in November, up 7.1% from a year ago. The consumer price index rose just 0.1% from the previous month, and increased 7.1% from a year ago, compared with respective estimates of 0.3% and 7.3%.

Core CPI rose 0.2% on the month and 6% on an annual basis, compared with respective estimates of 0.3% and 6.1%.

Inflation-adjusted average hourly earnings for workers rose 0.5% for the month, though they were still down 1.9% from a year ago.

30 Year: 3.636% +5.9bps

(Last week: 3.577%)

10 Year: 3.59% -2.3bps

(Last week: 3.613%)

5 Year: 3.719% -7.4bps

(Last week: 3.793%)

2 Year: 4.264% -12.0bps

(Last week: 4.384%)

Note: The 2 year and 10 year spread (as shown below) is currently at a 67.4 basis point spread and it seems to be narrowing out, albeit it is still considered a large spread.

Las Vegas Homes Prices Drop Below U.S. Average

Las Vegas home prices dropped further than the national average in September, a new report shows, as buyers around the country pull back over higher mortgage rates.

House prices in Southern Nevada fell 2.4 percent from August to September, compared with a 1 percent dip nationally in that time, according to the S&P CoreLogic Case-Shiller index released Tuesday.

Prices are still up from year-ago levels, but the gains have tailed off.

Las Vegas’ home prices were up almost 13 percent year-over-year in September, compared with a 28.5 percent annual increase in March, according to Case-Shiller data.

Locally and nationally, homebuyers have been largely pumping the brakes for months, following last year’s cheap-money-fueled buying binge. The Federal Reserve has raised interest rates multiple times this year in a bid to fight inflation, and the jump in borrowing costs has sparked fewer home sales.

Selma Hepp, deputy chief economist with housing tracker CoreLogic, said in a statement Tuesday that housing markets “continue to face a loss of consumer confidence” and an “ongoing standoff between buyers and sellers.”

Potential buyers are “held back by the rapidly rising cost of homeownership and fears of price declines,” said Hepp, who added that potential sellers have financial incentives to stay put, as they might already have a lower mortgage rate than what they’d get on a new purchase.

The average rate on a 30-year home loan was 6.58 percent last week, up from 3.1 percent a year earlier, according to mortgage buyer Freddie Mac.

“While buyers are stepping aside waiting for more affordable prices and rates — causing the slowdown on price growth — would-be sellers are sticking their ground and holding tight to the inventory they currently own,” Nicole Bachaud, senior economist with listing site Zillow, said in a statement Tuesday.

Amid the jump in borrowing costs, sales totals in Southern Nevada have fallen sharply from year-ago levels, sellers have increasingly slashed their prices, and builders have offered more incentives to house hunters and higher commissions to agents who bring in buyers.

On the resale side, 1,724 houses traded hands last month, down 44 percent from October 2021, and 7,906 houses were on the market without offers at the end of October, up 140.5 percent year-over-year, trade association Las Vegas Realtors reported.

Single-family homes sold for a median price of $440,000 in October, down from a record-high $482,000 in May, according to the association.

Higher mortgage rates have “shrunk the buyer pool,” which has led to increased inventory and, ultimately, lower sales prices, Las Vegas Realtors President Brandon Roberts told the Review-Journal last month.

During the pandemic’s sales frenzy, buyers often had to “settle for whatever they could get,” he noted. But the market changed quickly this year as interest rates marched higher.

“It was almost overnight,” he said. (Article by Eli Segall of LVRJ)

Southern Nevada Absorption Rate

almost reaches 205% again with decreasing

inventory and steady sales.

Current ARF:

19.96%

The current absorption rate for the Southern Nevada market the past four weeks is 19.96%, up 65 basis points (0.65%) from last week's absorption rate (19.31%). This is the 9th consecutive week that the Absorption Rate Figure (ARF) has remained BELOW the sellers market marker of 20%.

A market with an absorption rate at or above 20% is typically called a seller’s market, whereas an absorption rate below 15% signals a buyer’s market.

Each week we will update the current median price for the current month. Keep in mind the majority of sales occur at the end of the month, so official numbers will be published on the first Monday of each month. Current median prices are calculated from 1,049 closed listings on the MLS (as of Mon. Dec. 19, 22)

Currently for the month of December 2022

Single Family

$430,000

-$990

Down from November of $430,990

May, 2022 ATH: $482,000 (-10.78%)

Condo

$213,444

-$13,806

Down from November of $227,250

May, 2022 ATH: $250,000 (-14.62%)

Townhomes

$323,000

+$8,000

Up from November of $315,000

May, 2022 ATH: $358,000 (-9.78%)

This week marks the 10th time in 11 weeks that inventory shows a weekly decline in housing inventory after a significant run-up in inventory from May 2, 2022 to peaking October 24, 2022 with 11,427 available residential properties. There are currently 9,643 active single family homes, townhomes, condominiums, high-rises, manufactured and multi-families available on the market.

As of December 19, 2022, there are currently active (%’s versus 1 weeks ago):

7,252 Single Family Homes (-194) -2.61%

931 Condos (-42) -4.32%

688 Townhouses (-5) -0.72%

320 Manufactured Homes (+5) +1.59%

370 High Rise Units (-14) -3.65%

82 Multiple Dwellings (-4) -4.65%

2,638 Parcels of Land (+5) +0.19%

3,734 Rentals On Market (-103) -2.68%

Past Seven Days Market Watch (%’s versus 4 week ago):

557 New Listings (-189) -25.33%

170 Back on Market (-1) -0.58%

52 Price Increases (+1) +1.96%

727 Price Decreases (-572) -44.03%

650 Accepted an Offer (-33) -4.83%

511 Sold (-58) -10.19%

185 Expired (+39) +26.71%

497 Taken Off Market (-114) -22.94%

This week, there are 254 less active residential resale properties on the market compared to one week ago for a total of 9,643 (-254), a decrease of 2.57%.

HOME BUILDING, HOME SALES, INFLATION, GDP… Both Housing Starts and Building Permits are expected to report small dips in November. New and Existing Home Sales are also forecast to be off a tad. Gaining, unfortunately, should be PCE Prices, the Fed's favorite inflation measure. The GDP-Third Estimate for Q3 is predicted to come in unchanged.

Friday December 23, the stock markets are open, but the bond markets close early in observance of Christmas Eve. Monday December 26, all financial markets are closed in observance of Christmas Day.

From home sales to prices, the 2023 housing market will be defined by mortgage rates. And where rates go depends on what happens with inflation.

If you’re thinking of buying or selling a home this year, let’s connect so you understand where the housing market is headed in 2023.

Forecasting Federal Reserve policy changes in coming months. The new expectations from the futures market are for a quarter percent rate hike in February, which should hold through March and May. Note: In the lower chart a 100.0% probability of change is a 100.0% probability the rate will rise. Current rate is 4.25%-4.50%.

AFTER FOMC MEETING ON: CONSENSUS

Feb 1 4.50%-4.75%

Mar 22 4.75%-5.00%

May 3 4.75%-5.00%

Probability of change from current policy:

AFTER FOMC MEETING ON: CONSENSUS

Feb 1 100.0%

Mar 22 70.1%

May 3 76.9%