For the week of November 21, 2022

OCTOBER HOUSING UPDATE

“Once the game is over, the King and the pawn go back in the same box.” ― Italian proverb

After reading JD’s Market Pulse, you will know more about the real estate market and economy than 90% of the United States. Congratulations!

PULL BACK... Stocks suffered a down week as traders contemplated a slowing economy and hawkish comments from no less than six Fed officials who basically said we've still got a ways to go before rate hikes cease.

The U.S. leading economic index (LEI) fell in October for the eighth month in a row, and the worry is that consumer spending is apt to slow amidst high inflation, rising interest rates, and concerns about job security.

But when when the October Producer Price Index reported 8.0% wholesale price inflation, down from 8.4% in September, it was spun as “good news.” Plus, October Retail Sales surprised with 1.3% growth (consumer credit all-time-highs) after a flat read in September.

The week ended with the Dow virtually flat, at 33,746; the S&P 500 down 0.7%, to 3,965; and the Nasdaq down1.6%, to 11,146.

Equity capital went to bonds, raising prices, though the 30-year UMBS 5.5% ended down 0.08, at $100.14. In Freddie Mac's enhanced Primary Mortgage Market Survey, the national average 30-year fixed mortgage rate plunged 47 basis points (0.47%). Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up-to-the-minute information.

Existing Home Sales dipped 5.9% in October, blamed on affordability and mortgage rates. Median prices did rise year-over-year, but the good news is that mortgage rates recently dropped nearly half a percent.

Existing-home sales faded for the ninth month in a row to a seasonally adjusted annual rate of 4.43 million. Sales fell 5.9% from September and 28.4% from one year ago.

The median existing-home sales price rose to $379,100, an increase of 6.6% from the previous year.

The inventory of unsold existing homes slipped for the third consecutive month to 1.22 million at the end of October, or the equivalent of 3.3 months' supply at the current monthly sales pace.

Housing Starts dipped 4.2% and Building Permits slipped 2.4% in October, but both declined less than expected. In the past year, starts and permits for single-families are down, but up for multi-unit homes.

Yet builders are busy. The number of homes under construction is at the highest level since 1970. Plus, the backlog of projects authorized but not yet started is just below the record high going back to 1999.

DID YOU KNOW… After the prior week’s data indicated inflation growth had slowed, bond prices rose and mortgage rates fell. Consequently, purchase mortgage applications shot up 4%, according to the Mortgage Bankers Association.

READY FOR THE UPCOMING REAL ESTATE OPPORTUNITIES?

Household debt soars at fastest pace in 15 years as credit card use surges, Fed report says. Primarily due to hefty increases in credit card usage and mortgage balances. The credit card balance collectively rose more than 15% from the same period in 2021, the largest annual jump in more than 20 years, according to the New York Fed. The increase stems from “a combination of robust consumer demand and higher prices,” a Fed official said.

Jeff Bezos, Elon Musk, and Ken Griffin have sounded the alarm on a looming US recession, joining a chorus of CEOs, investors, and academics predicting a prolonged economic downturns. Carl Icahn, Jamie Dimon, and Charlie Munger are also bracing for the economy to shrink and unemployment to spike. These experts have flagged numerous growth headwinds, including the Federal Reserve hiking interest rates to cool red-hot inflation, and the Russia-Ukraine war and China's ongoing lockdowns disrupting global trade.

Hedge Funds stay bearish even after big short squeeze in stocks. JPMorgan’s clients cut positions in both long and short b books. Funds tracked by Goldman see trading lows fall for five weeks.

30 Year: 3.908% -15.8bps

(Last week: 4.066%)

10 Year: 3.84% -03.8bps

(Last week: 3.878%)

5 Year: 4.026% +1.9bps

(Last week: 4.007%)

2 Year: 4.565% +15.3ps

(Last week: 4.412%)

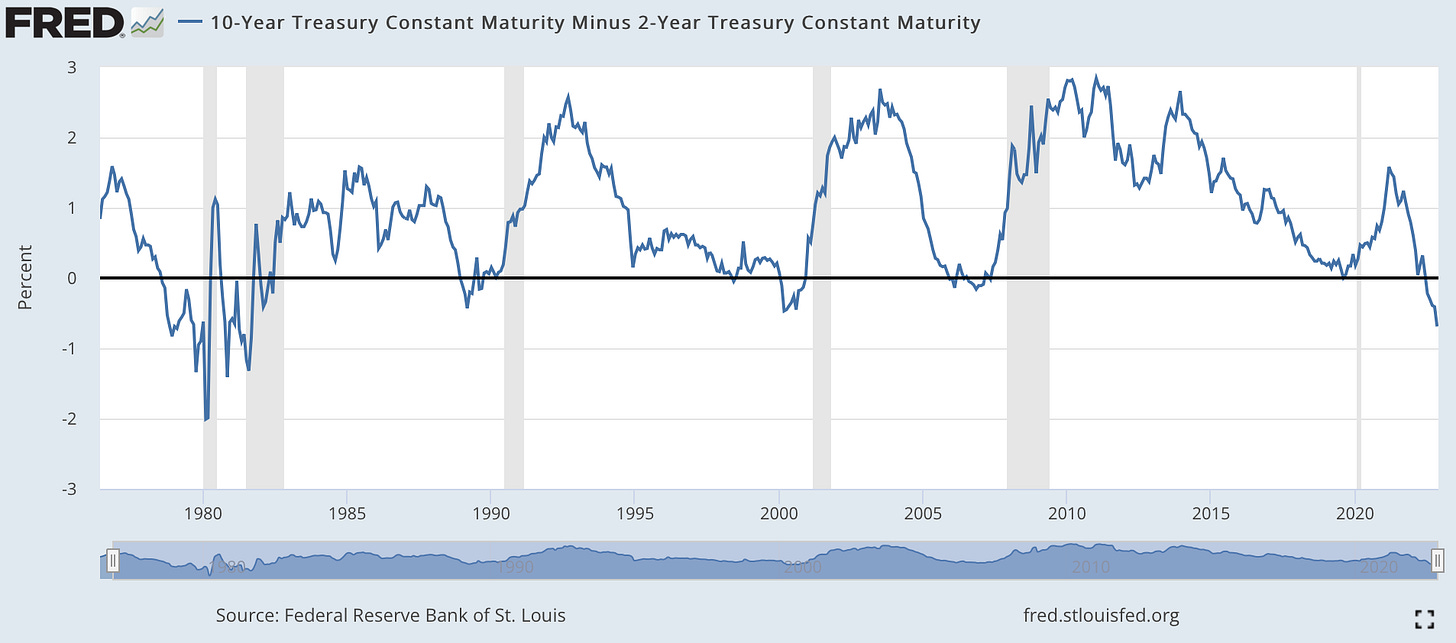

Note: The 2 year and 10 year spread (as shown below) has reached a 72.5 basis point spread. This is abnormally large. Historically, larger 2y/10y spreads indicate a harder, longer recession.

A South Carolina real estate giant has launched its first Las Vegas Valley ground-up apartment developments.

Greystar announced this month that it broke ground on a 257-unit rental complex in the northwest valley called Marlowe Centennial Hills. The project, on Deer Springs Way near the 215 Beltway-U.S. Highway 95 interchange, is scheduled to deliver its first units in 2024, according to a news release.

The company said it also started construction this summer on a 166-unit project in Henderson. The 55-and-older complex, Album Union Village, is near Galleria at Sunset mall.

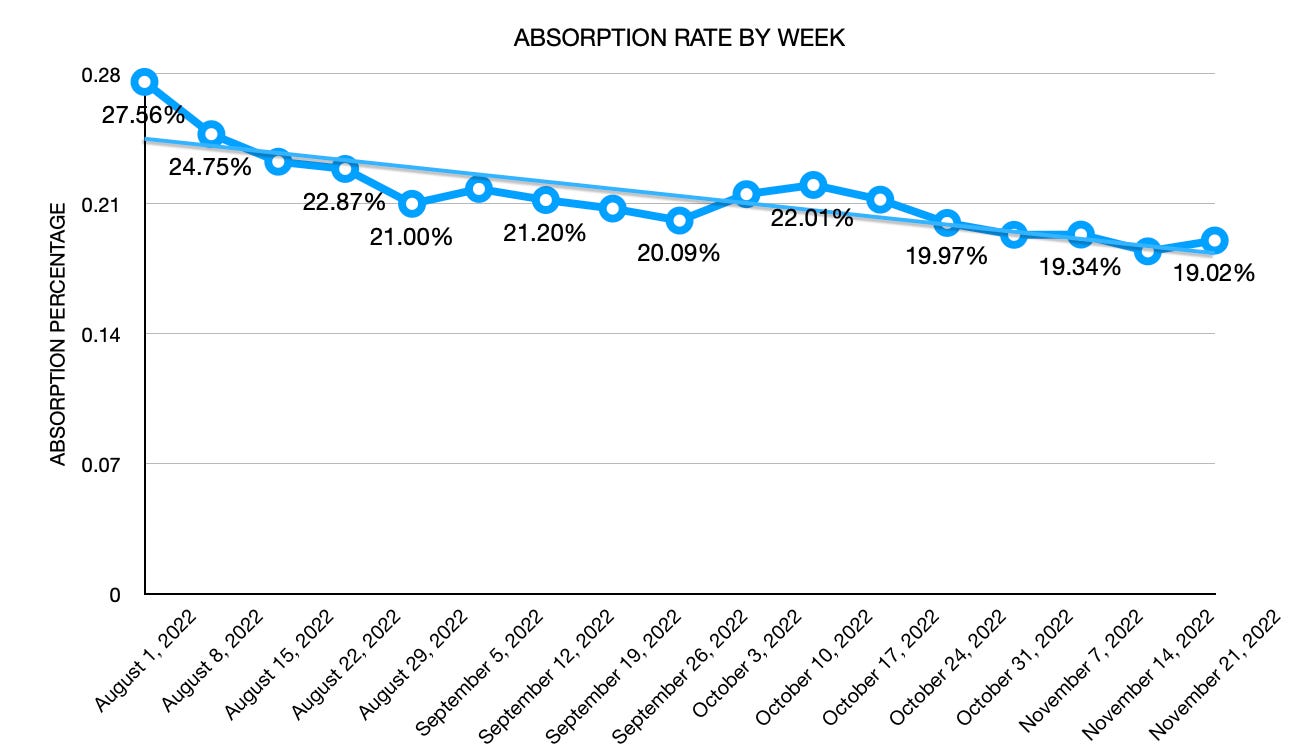

Southern Nevada Absorption Rate rises to above 19% with less inventory and bump in sales

Current Rate:

19.02%

The current absorption rate for the Southern Nevada market the past four weeks is 19.02%, up 58 basis points (0.58%) from last week's absorption rate. This is the fifth consecutive week that the Absorption Rate Figure (ARF) has remained BELOW the 20% mark. This marks a an increase in the ARF in 4 of the last 17 readings (downtrend). For much of 2021 and early 2022, the absorption rate was over 100%, meaning homes were selling faster than coming on the market!

A market with an absorption rate at or above 20% is typically called a seller’s market, whereas an absorption rate below 15% signals a buyer’s market.

Each week we will update the current median price for the current month. Keep in mind the majority of sales occur at the end of the month, so official numbers will be published on the first Monday of each month. Current median prices are calculated from 1,253 closed listings on the MLS (as of Mon. Nov. 21, 22)

Currently for the month of November 2022

Single Family

$430,000

-$10,000

Down from October of $440,000

May, 2022 ATH: $482,000 (-10.89%)

Condo

$224,000

-$2,500

Down from October of $226,500

May, 2022 ATH: $250,000 (-10.40%)

Townhouse

$313,500

-$11,500

Down from October of $325,000

May, 2022 ATH: $358,000 (-9.22%)

This week shows another week of a decline in inventory, but an increase in closed sales. This week marks the 6th time in 8 weeks that inventory shows a weekly decline in housing inventory (SFR, CON, TWH, MULTI, MAN & HIRI).

Inventory remains. below the 11,000 support level for the second time as since the August 29, 2022 reading as the market transitions into the slower time of the year for real estate transactions.

The chart below shows total available inventory to total weekly closed sales week-by-week. (Last updated November 21, 2022)

As of November 21, 2022, there are currently active (%’s versus 1 weeks ago):

8,064 Single Family Homes (-159) -1.93%

1,049 Condos (-29) -2.70%

754 Townhouses (+2) +0.26%

326 Manufactured Homes (-2) -0.61%

424 High Rise Units (-9) -2.07%

87 Multiple Dwellings (-9) -9.38%

2,687 Parcels of Land (-1) -0.04%

3,790 Rentals On Market (-56) -1.46%

Past Seven Days Market Watch (%’s versus 4 week ago):

746 New Listings (-223) -23.01%

171 Back on Market (-52) -23.32%

51 Price Increases (-35) -40.70%

1,299 Price Decreases (-358) -26.60%

683 Accepted an Offer (-57) -7.70%

569 Sold (-48) -7.78%

146 Expired (+18) +14.06%

497 Taken Off Market (-90) -15.33%

31* properties are coming soon (-16) -28.10%

This week, there are 208 less active residential resale properties on the market compared to one week ago for a total of 10,704 (-208), a decrease of 1.91%.

*Properties coming soon do not indicate all of the upcoming properties. These are listing that are entered into the MLS prior to list date.

A LOOK AT NEW HOME SALES, CONSUMER SENTIMENT, AND THE FED… For October, New Home Sales are forecast to slip a bit. The final November read for University of Michigan Consumer Sentiment is expected to still come in at an historically low level. We'll check out the FOMC Minutes from the Fed's last meet to see what they might reveal about future rate hikes.

U.S. financial markets will be closed this Thursday for Thanksgiving. Friday, the stock markets will close early, at 1 p.m., and the bond market at 2 p.m.

You may be wondering what needs to be renovated before you sell your house. In today’s shifting market, making your house appealing is more important than ever.

That’s why it’s essential to lean on a real estate professional who has in-depth knowledge of today’s housing market. They know what buyers are looking for and how to highlight any upgrades you make.

Let’s connect so you know where to focus your efforts so your house will stand out in a today’s market.

Forecasting Federal Reserve policy changes in coming months. The futures market continues to see the Fed doing half percent rate hikes in December and February, then holding in March. Note: In the lower chart a 100.0% probability of change is a 100.0% probability the rate will rise. Current rate is 3.75%-4.00%.

AFTER FOMC MEETING ON: CONSENSUS

Dec 14 4.25%-4.50%

Feb 1 4.50%-4.75%

Mar 22 4.75%-5.00%

Probability of change from current policy:

AFTER FOMC MEETING ON: CONSENSUS

Dec 14 100.0%

Feb 1 59.3%

Mar 22 82.8%