UPDATE ON HOME PRICES & THE ECONOMY

“Knowing yourself is the beginning of all wisdom.” - Aristotle

After reading this market pulse, you will know more about the real estate market and economy than 90% of the United States. Congratulations!

INFLATION SURPRISE SPIKES STOCKS... Wall Street traders got so excited over way better-than-expected Consumer Price Index (CPI) inflation, they sent the three major stock indexes to monumental gains for the week.

The October CPI fell from September's 8.2% pace to 7.7%, the smallest yearly increase since January. Core CPI, excluding food and energy, fell from 6.7% to 6.3%, so it seemed like inflation was finally heading in the other direction.

If so, that might compel the Fed to take a less aggressive approach to the rate hikes it's been doing to fight that inflation, which just sent University of Michigan Consumer Sentiment down again in November.

The week ended with the Dow UP 4.1%, to 32,403; the S&P 500 UP 5.9%, to 3,993; and the Nasdaq UP 8.1%, to 11,323.

Inflation-hating bonds did well after the CPI surprise, with the 30-year UMBS 5.5% UP 2.05, to $100.22. The national average 30-year fixed mortgage rate edged up slightly in Freddie Mac's Primary Mortgage Market Survey. Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up-to-the-minute information.

The National Association of Realtors reports home price growth hit single digits in most markets, falling from 14% in Q2 to below 9% in Q3. The median existing single-family home price was up just 8.6% from the year before.

The Mortgage Bankers Association weekly survey showed demand for purchase mortgages rose a tick, the first gain for purchase applications in seven weeks, though they’re still down from a year ago.

Key findings in the Weekly Housing Trends report published by Realtor.com shows:

The median listing price grew by 12.0% over the last year. The typical asking price of for-sale homes continues to exceed last year’s level by double-digits, hitting a 44th week at double-digit pace. However, the pace of growth shrank again. The typical price of a home for sale on Realtor.com was $425,000, down from summer’s peak of $450,000.

New listings–a measure of sellers putting homes up for sale–were again down, dropping 13% from one year ago. This marks the seventeenth week of year over year declines in the number of new listings coming up for sale. This week’s decline matched last week’s, but still means fewer new choices for home shoppers in the market.

Active inventory continued to grow, increasing 40% above one year ago. This is the third week of a more notable step up in inventory gains after rough stability since July. Find a good recap of recent inventory trends in the Housing Trends View from mid-October. As active inventory climbs sharply from its early year low, monthly data from October show that for the first time, inventory has surpassed what was available for the comparable month in 2020.

The NAHB says Q3 saw a spike in active homebuyers, as 59% of prospective buyers went from the planning stages of homebuying and became “fully engaged in the buying process,” up from 46% in Q1.

DID YOU KNOW… Realtor.com reports that homes spent six more days on the market compared to last year. Plus, for the third week in a row, active inventory kept growing, and is now up 40% from a year ago.

All markets swing up and down. Are you prepared to make the most of this downturn market? 90% of millionaires are created through real estate… We’ve laid out this upcoming opportunity in our playbook - are you on the list?

NAR chief economist predicts ’strong rebound’ in 2024. Lawrence Run said home prices will rise 1% and sales will dip 7% next year before recovering in 2024, in contract to a Fannie Mae forecast last month that predicted falling prices next year.

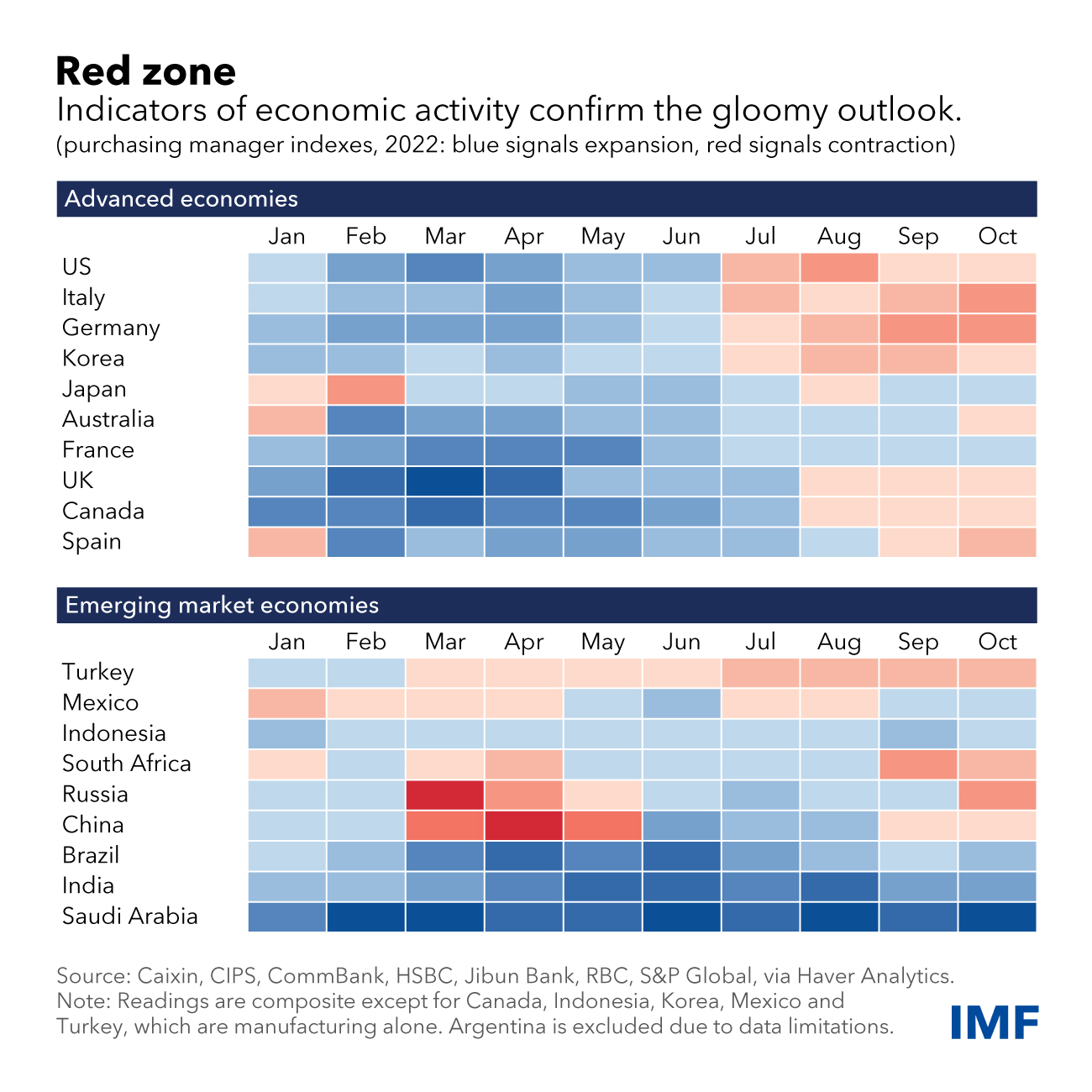

The IMF says slowing global economic growth is increasingly evident as high-frequency data shows. Global economic growth prospects are confronting a unique mix of headwinds, including from Russia’s invasion of Ukraine, interest rate increases to contain inflation, and lingering pandemic effects such as China’s lockdowns and disruptions in supply chains.

In turn, the latest World Economic Outlook, released last month, lowered the global growth forecast for next year to 2.7 percent, and they expect countries accounting for more than one third of global output to contract during part of this year or next.

Fed Vice Chair Brainard says it may ’soon’ be appropriate to move to slower pace of rate hikes. She indicated today that the central bank could soon slow the pace of its interest rate increases. “I think it will probably be appropriate soon to move to a slower pace of rate increases,” she told Bloomberg News in a live interview. However, this doesn’t mean the Fed will stop raising rates, but it at least will come off a pace that has seen four consecutive 75 basis points increase, an unprecedented pattern since the central bank started issuing short-terms rates to set monetary policy in 1990.

30 Year: 4.066% -22.5bps

(Last week: 4.291%)

10 Year: 3.878% -33.1bps

(Last week: 4.209%)5 Year: 4.007% -38.6bps

(Last week: 4.393%)2 Year: 4.412% -31.2bps

(Last week: 4.724%)With home purchases down, sellers cutting their prices and inventory soaring, it’s not exactly a ripe time to flip houses.

This week, one big company bailed on the business.

Redfin Corp., a national real estate brokerage that also bought and sold homes, announced Wednesday that it’s laying off 862 people and closing its home-flipping business.

In an email to staff, posted on its website, CEO Glenn Kelman said the home-flipping sector Redfin and other firms entered in recent years — known as “iBuying,” or instant buying — “is a staggering amount of money and risk for a now-uncertain benefit.”

“We’ve tied up hundreds of millions of dollars in houses that you yourself wouldn’t want to own right now,” he wrote.

Kelman also indicated that even before its overhead expenses, the company’s buy-and-sell-fast segment, RedfinNow, “will likely lose” $22 million to $26 million this year.

Southern Nevada, with its high-volume housing market, transient population and get-rich-quick image, has long been a popular place to flip houses. But locally and nationally, house hunters have been largely pumping the brakes for months amid a sharp jump in mortgage rates, creating big headwinds for sellers.

Seattle-based Redfin has offices around the country, including one in Las Vegas, and nearly 20 agents in Southern Nevada, its website indicated this week. It expanded its house-flipping business to Las Vegas in 2019, saying the service would let people get an all-cash offer in a “convenient and fast way to sell a home.”

Housing markets are prone to ups and downs, especially in Las Vegas, and there’s no telling how long the market will keep slowing or when it will shift course again.

But this being Vegas, where gambling extends far beyond the casino floors, don’t be surprised if more flippers lay money on the housing market at some point.

Read full article on LVRJ by Eli Seagall

Southern Nevada Absorption Rate dips 90 basis points week/week

Current Rate:

18.44%The current absorption rate for the Southern Nevada market the past four weeks is 18.44%, down 90 basis points (0.90%) from last week's absorption rate. This is the fourth consecutive week that the Absorption Rate Figure (ARF) has remained BELOW the 20% mark. This marks a decline in the ARF in 13 of the last 16 readings. For much of 2021 and early 2022, the absorption rate was over 100%, meaning homes were selling faster than coming on the market!

A market with an absorption rate at or above 20% is typically called a seller’s market, whereas an absorption rate below 15% signals a buyer’s market.

Each week we will update the current median price for the current month. Keep in mind the majority of sales occur at the end of the month, so official numbers will be published on the first Monday of each month.

Currently for the month of November 2022Single Family

$429,495

-$10,505

Down from October of $ 440,000

May, 2022 ATH: $482,000

Condo

$219,950

-$6,550

Down from October of $226,500

May, 2022 ATH: $250,000Townhouse

$329,000

+$4,000

Up from October of $325,000

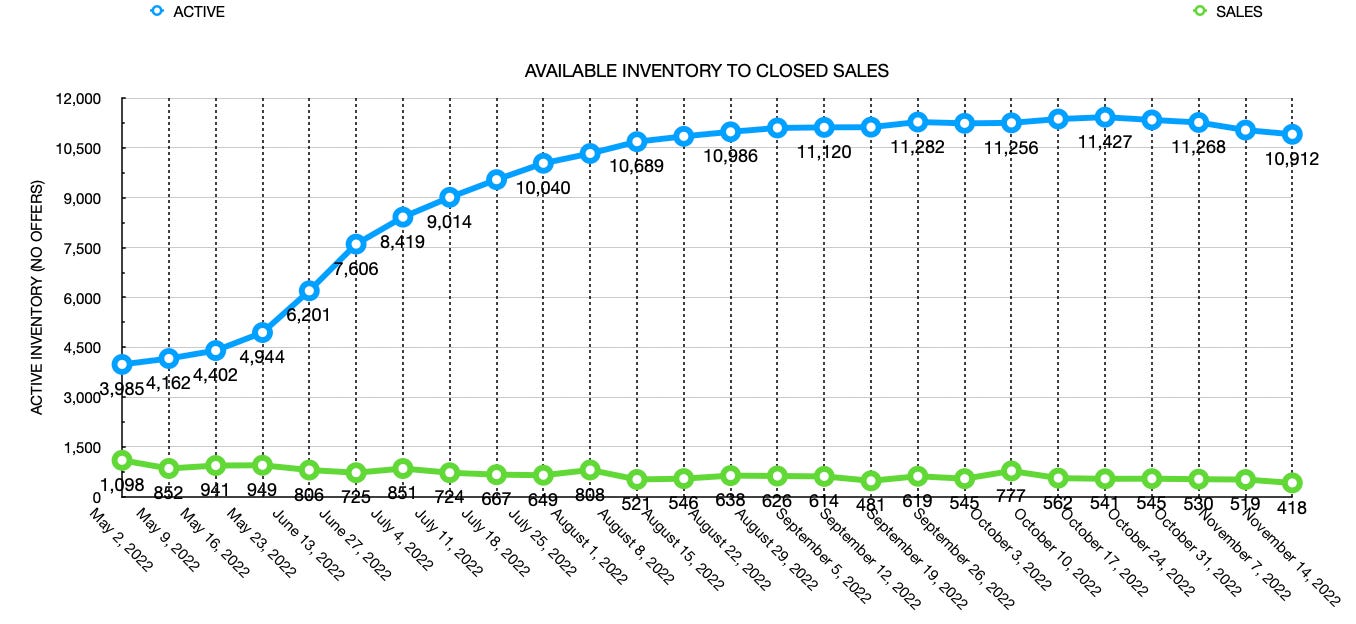

May, 2022 ATH: $358,000This week shows another week of a decline in inventory, and a substantial decrease in sales. This week marks the 5th time in 7 weeks that inventory shows a weekly decline in housing inventory (SFR, CON, TWH, MULTI, MAN & HIRI).

Inventory has dipped below the 11,000 support level for the first time as since the August 29, 2022 reading as the market transitions into the slower time of the year for real estate transactions.The chart below shows total available inventory to total weekly closed sales week-by-week. (Last updated November 14, 2022)

As of November 14, 2022, there are currently active (%’s versus 1 weeks ago):

8,223 Single Family Homes (-119) -1.43%

1,078 Condos (-16) -1.46%

752 Townhouses (-4) -0.53%

328 Manufactured Homes (+15) +4.79%

435 High Rise Units (+/- 0) no change

96 Multiple Dwellings (-3) -3.03%

2,688 Parcels of Land (-17) -0.63%

3,846 Rentals On Market (+61) +1.61%

Past Seven Days Market Watch (%’s versus 4 week ago):

762 New Listings (-147) -16.17%

161 Back on Market (-52) -24.41%

54 Price Increases (-4) -8.62%

1,266 Price Decreases (-411) -24.51%

638 Accepted an Offer (+29) +4.76%

418 Sold (-123) -22.74%

111 Expired (-9) -7.50%

452 Taken Off Market (-54) -10.67%

32* properties are coming soon (-12) -26.09%

This week, there are 127 less active residential resale properties on the market compared to one week ago for a total of 10,912 (-127), a decrease of 1.15%.

*Properties coming soon do not indicate all of the upcoming properties. These are listing that are entered into the MLS prior to list date.

HOME STARTS, SALES SLIP; WHOLESALE INFLATION, RETAIL SALES UP... October Housing Starts and Building Permits are forecast off a bit, as well as October Existing Home Sales. The Producer Price Index (PPI) should show wholesale inflation up for October, not good, but Retail Sales are also expected up, definitely good for the economy.

VA Loans can help make homeownership possible for those who have served our country.

These loans offer great benefits for eligible individuals and can help them buy a VA-approved house or condo, build a new home, or make improvements to their house.

Homeownership is the American Dream. One way we can honor and thank our veterans is to ensure they have the best information about the benefits of VA home loans.

Forecasting Federal Reserve policy changes in coming months. With last week’s inflation slowdown, the Fed is expected to do a half percent rate hike in December, then quarter percent bumps in February and March. Note: In the lower chart a 100.0% probability of change is a 100.0% probability the rate will rise. Current rate is 3.75%-4.00%.

AFTER FOMC MEETING ON: CONSENSUS

Dec 14 4.25%-4.50%

Feb 1 4.50%-4.75%

Mar 22 4.75%-5.00%Probability of change from current policy:

AFTER FOMC MEETING ON: CONSENSUS

Dec 14 100.0%

Feb 1 100.0%

Mar 22 82.8%JORDAN DOVE - LAS VEGAS REALTOR

JORDAN@DOVEANDASSOCIATES.COM

NV LIC # S.0180594