💰 WEALTH & WALLS 🏡

Your Exclusive Economic & Real Estate Update

For the week of August 26, 2024

“Time is nature’s way of keeping everything from happening at once.”

—John Archibald Wheeler, American theoretical physicist

How can we help you sell or acquire more property?

Respond to this email or call us at 702.720.1141

🕵🏼♀️ TIP OF THE WEEK

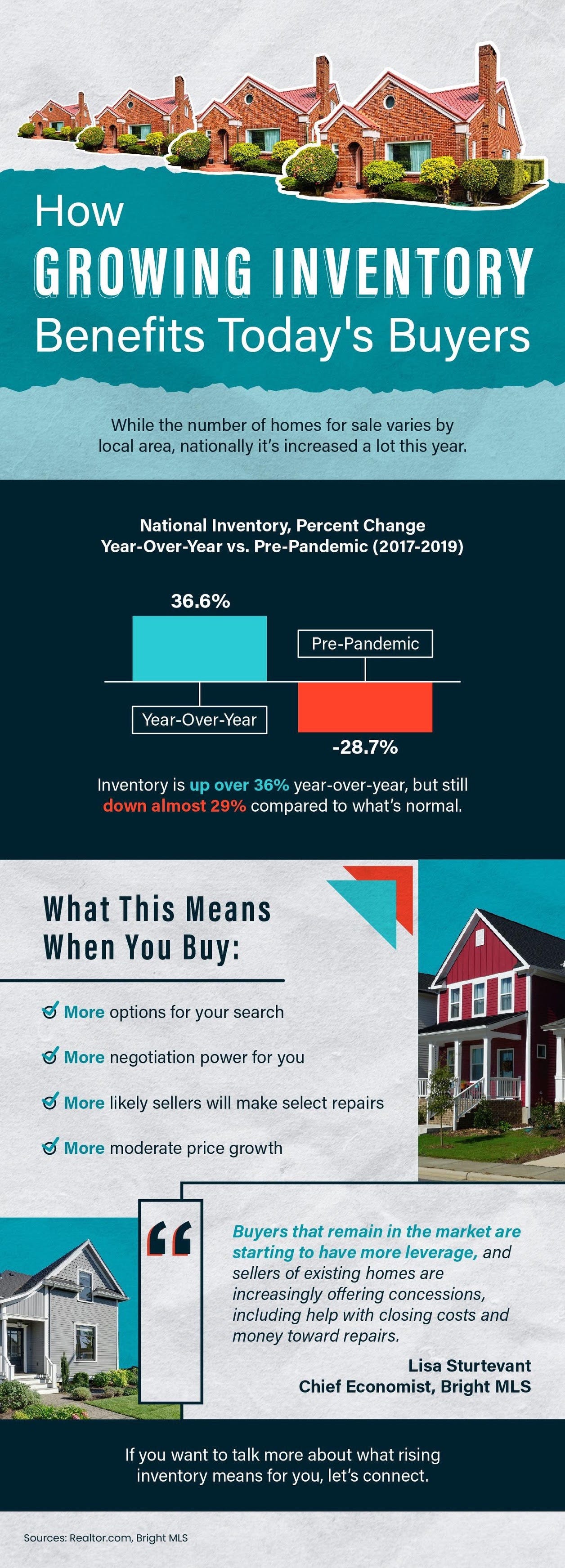

How Growing Inventory Benefits Today’s Buyers (Infographic)

🚨 Now Offering Property Management Services 🚨

RATE CUTS COMING!... After treading water all week, stocks surged Friday when Fed Chair Powell announced at the Jackson Hole Symposium, "the time has come for policy to adjust," making a September cut a slam dunk.

Powell's "confidence has grown" inflation is on the way to 2%, and is putting his focus on the labor market, which just reported there were 818,000 fewer jobs created the past year than had first been reported!

We also got the Leading Economic Index down for the second month in a row, worse-than-expected manufacturing data and initial jobless claims, but better-than-expected services data and home sales.

An unfortunate headline that makes you scratch your head about the official data is the U.S. Bureau of Labor Statistics on Wednesday revised down its estimated of total employment in March 2024 by a whopping 818,000, the largest such downgrade in 15 years. That effectively means there were 818,000 fewer job gains than first believed from April 2023 through March 2024.

The week ended with the Dow UP 1.3%, to 41,175; the S&P 500 UP 1.4%, at 5,635; and the Nasdaq UP 1.4%, to 17,878.

Bonds also rose on rate cut expectations, the 30-Year UMBS 5.5% UP 0.07, to $100.24. In Freddie Mac's Primary Mortgage Market Survey, the national average 30-year fixed mortgage rate dipped, re-establishing its lowest level in over a year. Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up-to-the-minute information.

July New Home Sales shot up more than 10% above June’s upwardly revised number. The median sale price is now 6.6% below its 2022 peak, while the supply of completed homes is up over 200% from the 2022 bottom.

After slipping the past four months, Existing Home Sales posted a nice 1.3% gain in July. Inventories are up nearly 20% the past year, with the months’ supply of homes for sale near the highest in more than four years.

Existing-home sales grew 1.3% in July to a seasonally adjusted annual rate of 3.95 million, stopping a four-month sales decline that began in March. However, sales slipped 2.5% from one year ago.

The median existing-home sales price elevated 4.2% from July 2023 to $422,600, the 13th consecutive month of year-over-year price gains.

The inventory of unsold existing homes edged higher by 0.8% from the prior month to 1.33 million at the end of July, or the equivalent of 4.0 months' supply at the current monthly sales pace.

An online real estate database reports home sale prices rose a tiny 0.2% in July for the second straight month, noting, “There aren’t enough sellers…to cause prices to fall and there aren’t enough buyers to drive prices up significantly.”

DID YOU KNOW… The supply of homes for sale has grown significantly this year. Here’s what that growth means: More options for your move More negotiation power for you More likely sellers will make some repairs More moderate price growth DM me if you want to talk more about how this benefits you when you buy a home.

CURRENT 30-YEAR FIXED MORTGAGE RATE (CNBC)

Last Monday's Close: 6.53

Note: Mortgage rates fluctuate frequently and are based on several factors and will vary from borrower-to-borrower.

As of Mon. August 26, 2024 2:25 PM PST

OVERVIEW:

While the number of homes for sale varies by local area, nationally we’re up over 36% year-over-year, but still down almost 29% compared to what’s normal. Here’s what that means when you buy: more options for your search, more negotiation power for you, it’s more likely sellers will make select repairs, and more moderate price growth. If you want to talk more about what rising inventory means for you, let’s connect.

HOME SALES, MORTGAGE APPLICATIONS, FED MINUTES... The predictions are for both Existing Home Sales and New Home Sales to head up a bit in July. We'll keep an eye on MBA Mortgage Applications to see if the upward trend of the past two weeks continues. Finally, we'll check the FOMC Minutes from the Fed's July meet for signs of what to expect in September.

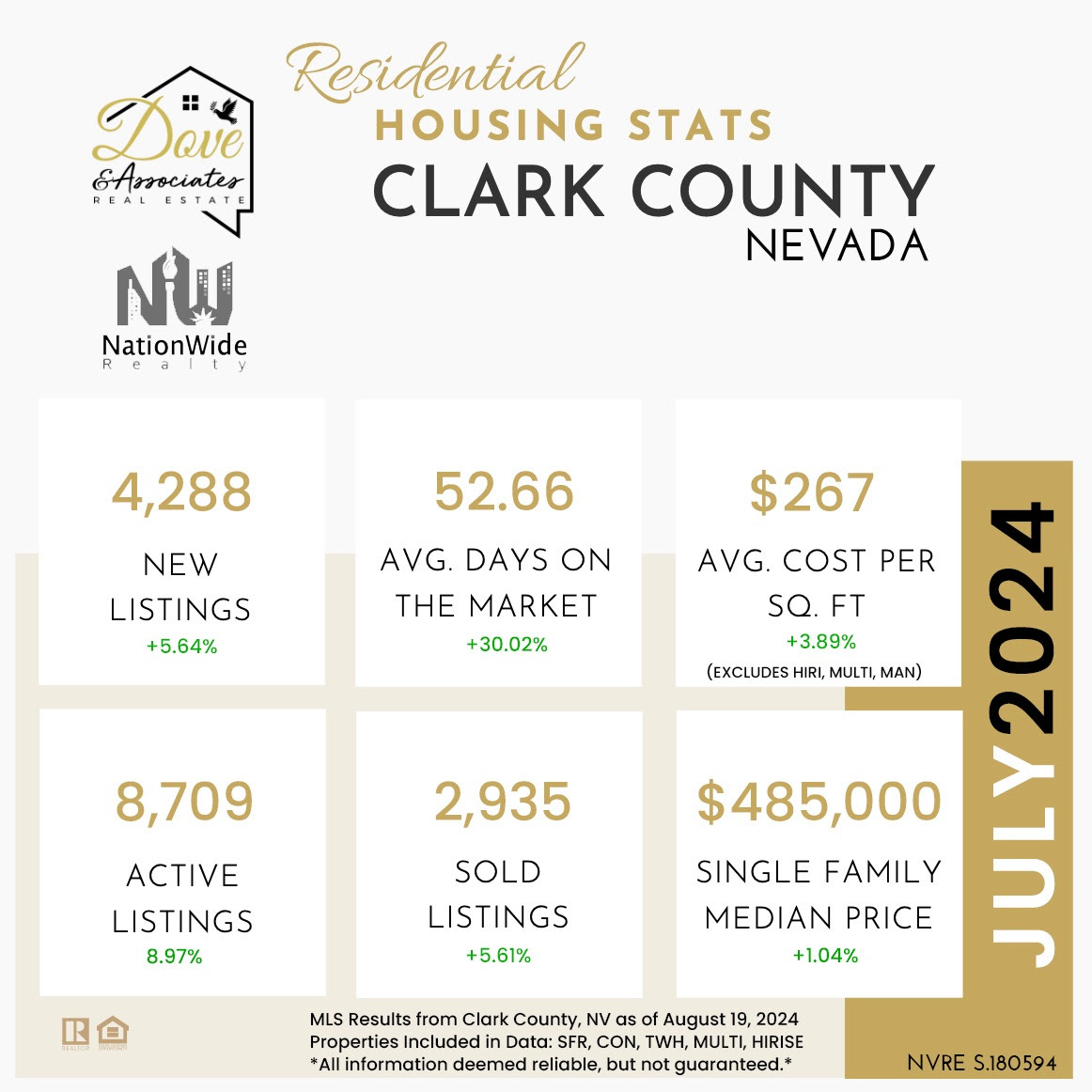

Each week we will update the current median price for the current month. These properties include all of the Southern Nevada MLS whereby the above graphic is only Clark County, NV MLS properties.

Keep in mind the majority of sales occur at the end of the month, so official numbers will be published on the first Monday of each month. The current median prices are calculated from 1,987 sold August listings in from the MLS as of August 26, 2024. (All counties in the Southern Nevada LVR MLS, not just Clark as referenced in the above graphic.)

CURRENT AUGUST MEDIAN PRICES

Single Family

$475,500

-$4,500

Down from July of $480,000

Condo

$250,000

Unch.

Unchanged from July of $250,000

Townhomes

$345,000

-$19,100

Down from July of $364,100

Manufactured

$234,950

+$4,950

Up from July of $230,000

This week, we are going to analyze the data compared to last week's reading on August 19, 2024 for a weekly data perspective on current market conditions.

As of August 26, 2024, there are currently active (W/w change):

5,430 Single Family Homes (+108) +1.97%

1,126 Condos (+27) +2.45%

582 Townhouses (+10) +1.74%

264 Manufactured Homes (+12) +4.76%

476 High Rise Units (+4) +0.84%

93 Multiple Dwellings (-6) -6.06%

2,162 Parcels of Land (+5) +0.23%

3,850 Rentals On Market (+19) +0.49%

Past Seven Days Market Watch (W/w change):

940 New Listings (-99) -9.52%

191 Back on Market (+14) +7.90%

96 Price Increases (+16) +29.41%

820 Price Decreases (-90) -9.89%

759 Accepted an Offer (-22) -2.81%

613 Sold (-81) -11.67%

77 Expired (-2) -2.53%

326 Taken Off Market (+5) +1.55%

This reading, there are 152 more active residential resale properties on the market compared to last week's reading on August 19, 2024 for a total of 7,971 available properties - increasing inventory week-over-week by 1.94%.

UNDER CONTRACT:

AVAILABLE:

Las Vegas, NV 89120 | MLS 2523540

5855 Pearlite Ave.

5 BED | 3 BATHS | 3,307 SF

4.35 ACRES | POOL & SPA

IRREVOCABLE WATER/IRRIGATION RIGHTS (10 ACRE FEET)

EQUESTRIAN ARENA | BARN | FERTILE SOIL

Forecasting Federal Reserve policy changes in coming months. The only debate about September is whether the Fed will cut by a quarter or a half percent, with the consensus now at a quarter. Fed watchers expect this to be followed by a half percent cut in November, then a quarter percent in December. Note: In the lower chart, the 100.0% probability of change is a 0.0% probability the rate will stay the same. Current rate is 5.25%-5.50%.

With gratitude,

Jordan C. Dove, ABR® SFR®

MANAGING PRINCIPAL | REALTOR®

Dove & Associates Powered by Nationwide Realty

702.720.1141 (office)

702.767.5557 (mobile)

Jordan@DoveandAssociates.com

JordanDove.com | DoveandAssociates.com

Subscribe to my YouTube Channel

3960 E. Patrick Ln. Ste. 204

Las Vegas, NV 89120

NV Lic. # S.0180594

© Copyright 2024 Dove & Associates, LLC at Nationwide Realty, LLC.

3960 E. Patrick Ln. Ste. 204 Las Vegas, NV 89120

This e-mail is an advertisement for Jordan Dove. The material provided is for informational and educational purposes only and should not be construed as investment, real estate and/or mortgage advice, or a commitment to lend. Although the material is deemed to be accurate and reliable, there is no guarantee of its accuracy. The material contained in this message is the property of Dove and Associates, LLC and cannot be reproduced for any use without prior written consent. The material does not represent the opinion of Dove and Associates, LLC at Nationwide Realty, LLC. This information is subject to change.