For the week of February 03, 2025

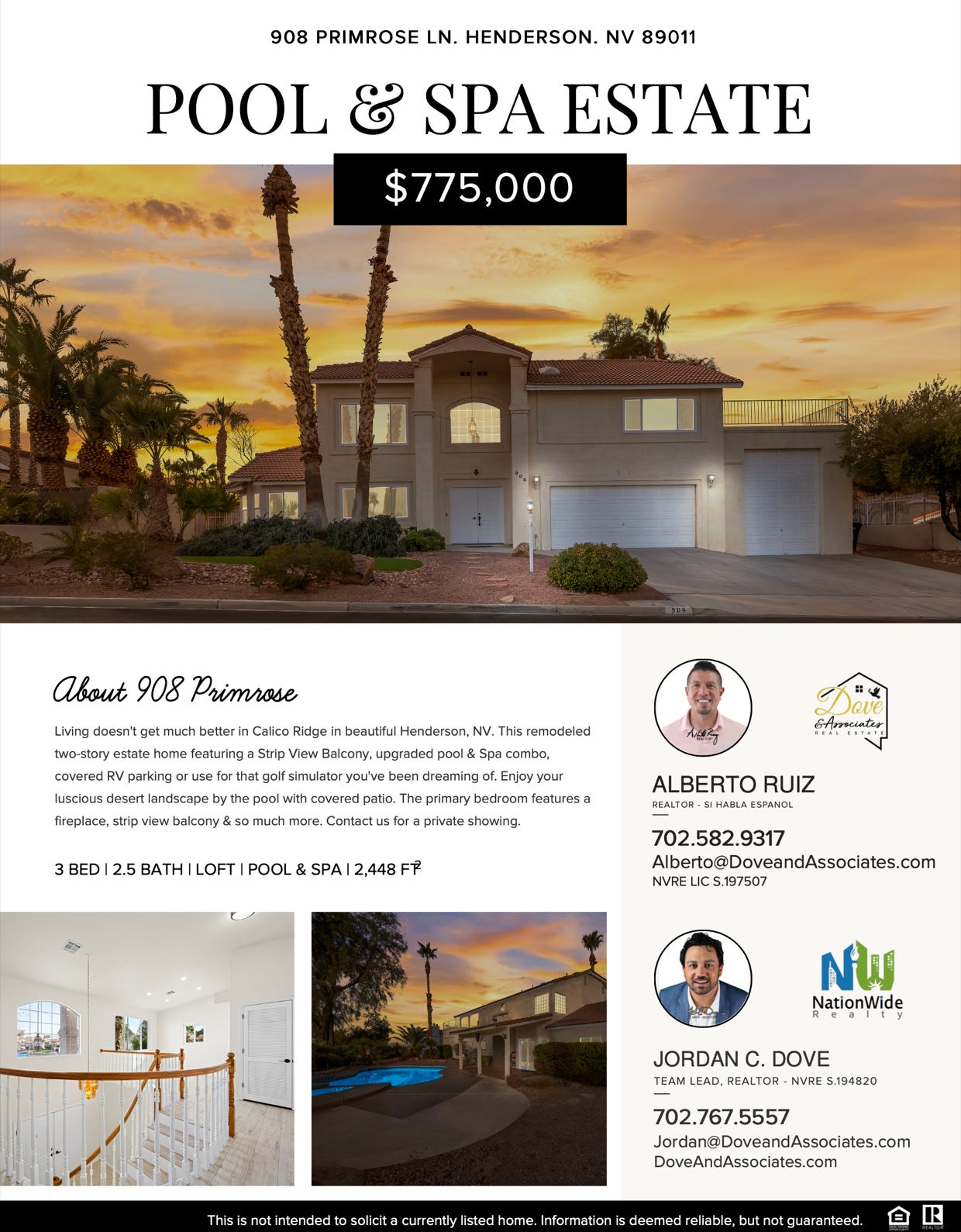

908 Primrose Ln. Henderson, NV 89011

📲 702.720.1141

— TIP OF THE WEEK —

Time in the Market Beats Trying to Time The Market

(Infographic)

- Ask About Property Management Services -

EVENTFUL... The week began with a focus on DeepSeek, a less resource-intensive Chinese AI platform, and ended with the announcement of imminent tariffs, with a Fed meet in between. Only the blue-chip Dow eked out a gain.

The Fed didn't cut rates, as expected, and Chair Powell said "we do not need to be in a hurry" to do so, as "inflation remains somewhat elevated." Friday's Core PCE read bore this out, with prices up 2.8% annually three months in a row.

But business spending was up in December, two months in a row, consumer spending is the strongest since the start of 2023, and the low level of initial jobless claims is a good signal for growth prospects.

The week ended with the Dow UP 0.3%, to 44,545; the S&P 500 down 1.0%, to 6,041; and the Nasdaq down 1.6%, to 19,627.

Investor money moved over to bonds, sending them up overall, the 30-Year UMBS 5.5% UP 0.16, to $98.29. The national average 30-year fixed mortgage rate was down slightly in Freddie Mac's Primary Mortgage Market Survey.

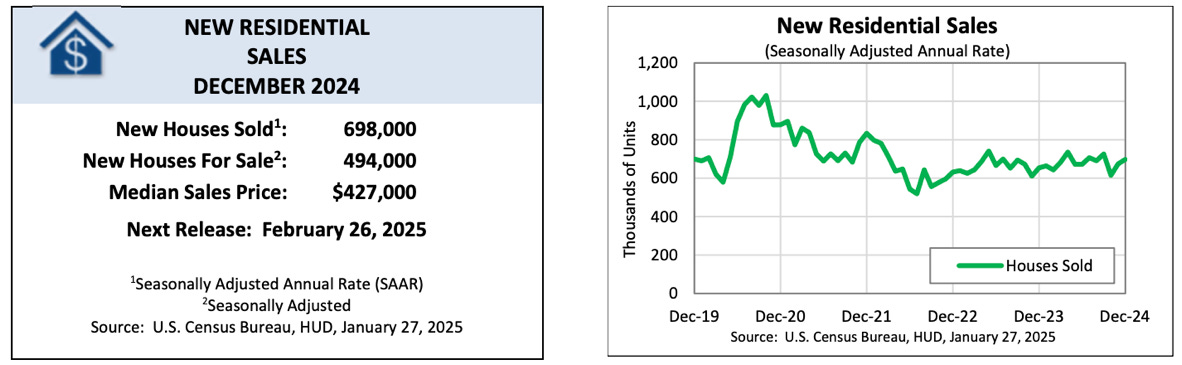

New Home Sales rose in December for the second month in a row, a 6.7% year-over-year gain, to their highest level since 2021. Plus, the median sale price is 7.2% below its October 2022 peak, thanks to more lower-priced homes.

Pending Home Sales slipped in December, but the National Association of Realtors notes: “After four straight months of gains in contract signings, one step back…is not entirely surprising. Economic data never moves in a straight line.”

Pending home sales in December decreased 5.5%.

Compared to one month ago, pending sales declined in all four U.S. regions, with the West recording the largest drop.

Year-over-year, contract signings retreated in all four U.S. regions, with the Midwest showing the biggest reduction.

Home prices booked moderate gains in November. The national Case-Shiller index is up 3.8% from a year ago, and the FHFA index of prices for homes purchased with conventional mortgages is up 4.2% versus a year ago.

DID YOU KNOW… The Mortgage Bankers Association reports that in December, purchase mortgage applications for new homes were up nearly 9% year-over-year, as “first-time homebuyers remained active in the new home segment.”

— CURRENT 30-YEAR FIXED MORTGAGE RATE (CNBC) —

Last Monday's Close: 7.07

Note: Mortgage rates fluctuate frequently and are based on several factors

and will vary from borrower-to-borrower.

As of Mon. February 3, 2025 at 12:38pm

OVERVIEW

Are you torn between whether to buy a home now or wait? Consider this. Forecasts show prices will climb for at least the next 5 years. If you wait, the price of a home will be higher later on. But, if you buy a $400K now, you could gain roughly $83K in equity as prices rise. If you're able to buy now, this equity is one reason why it'll be worth it in the long run. Let’s connect if you're ready to talk through ways we can make it happen.

Ready to buy a home this year? Call our office at (702) 720-1141 for a complimentary consultation.

CONSTRUCTION SPENDING, CONSUMER SENTIMENT, JOBS… December Construction Spending is forecast to increase again overall, and we'll watch the residential segment. Economists expect February's preliminary University of Michigan Consumer Sentiment index to head up a bit. Friday should give us a modest December gain in new Nonfarm Payrolls and Average Hourly Earnings, with the Unemployment Rate holding at 4.1%

Each week we will update the current median price for the current month. These properties include all of the Southern Nevada MLS whereby the above graphic is only Clark County, NV MLS properties.

Keep in mind the majority of sales occur at the end of the month, so official numbers will be published on the first Monday of each month. The final median prices for January 2025 are calculated from 2,041 sold January listings in from the MLS as of February 3, 2025. (All counties in the Southern Nevada LVR MLS, not only Clark County as referenced in the above graphic.)

FINAL JANUARY MEDIAN PRICES

Single Family

$485,000

+$10,000

Up from December of $475,000

Condo

$237,000

-$5,000

Down from December of $242,000

Townhomes

$354,445

-$3,550

Down from December of $357,995

Manufactured

$250,000

-$5,000

Down from December of $255,000

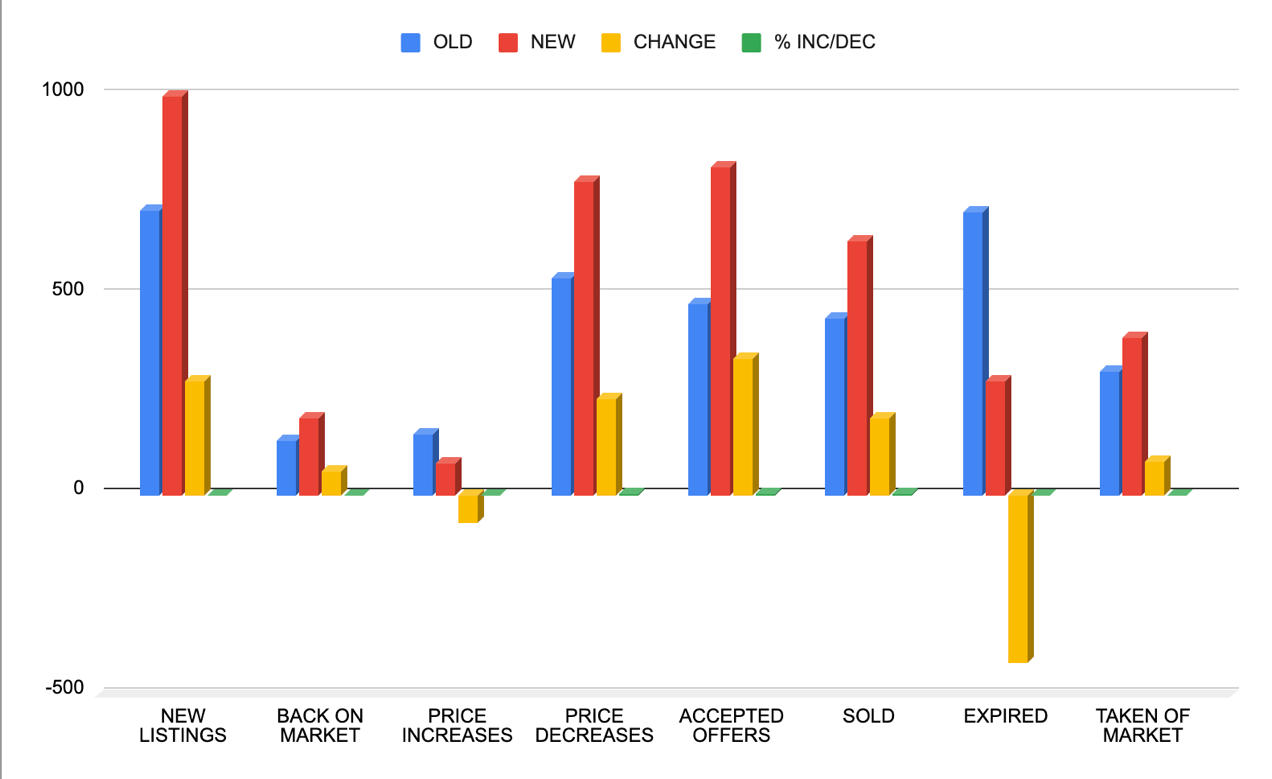

This week, we are going to analyze the data compared to last month's reading on January 6, 2025 for a month-to-month data set as we move towards the 2025 spring selling market.

As of February 3, 2025 there are currently active (M/m change):

Past Seven Days Market Watch (M/m change):

This reading, there are 365 more active residential resale properties on the market compared to last month's’s reading on January 6, 2025 for a total of 8,358 available properties - increasing monthly inventory by 4.57%.

— FEATURED LENDER —

Learn about financing a purchase or refinancing a current mortgage...

Call Chuck:

$10,000 BUYER’S INCENTIVE

FOR THIS CADENCE HOME IN HENDERSON

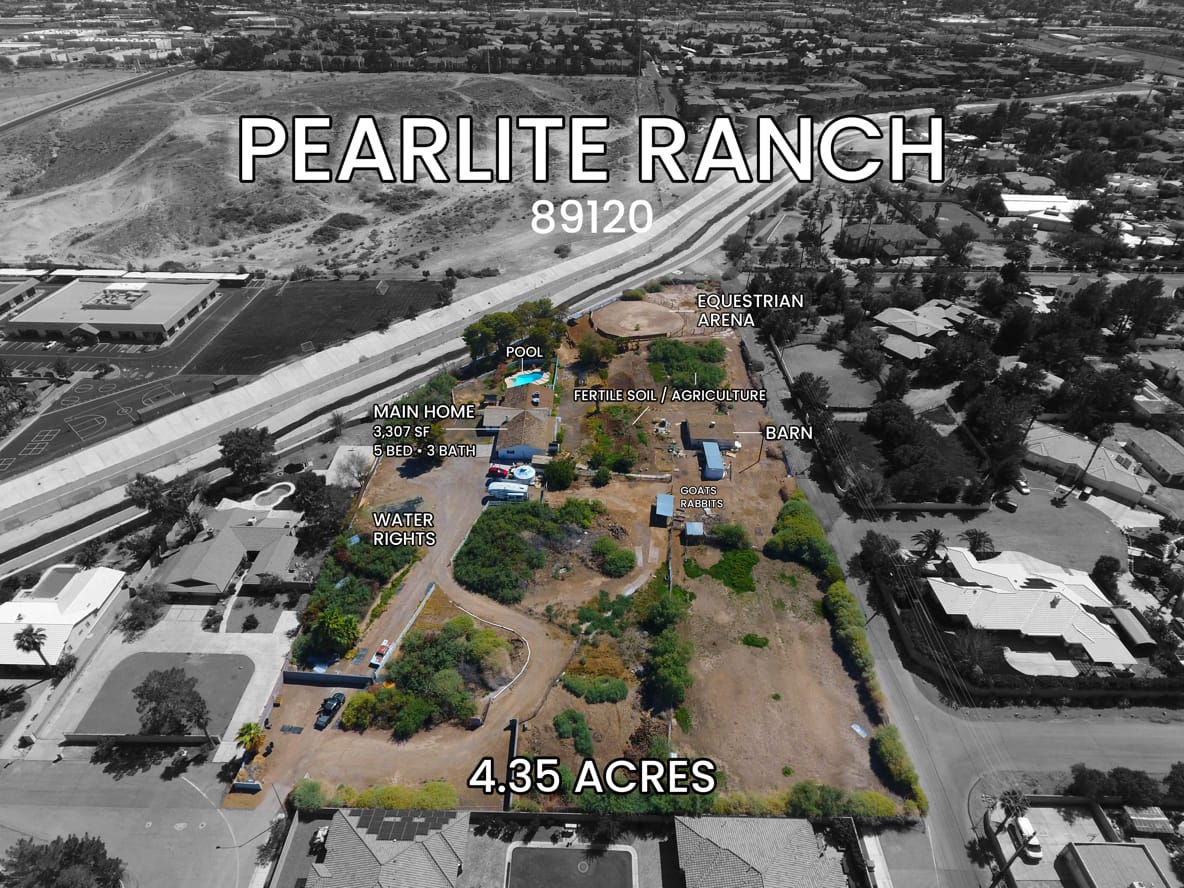

Las Vegas, NV 89120 | MLS 2523540

5855 Pearlite Ave.

5 BED | 3 BATHS | 3,307 SF

4.35 ACRES | POOL & SPA

IRREVOCABLE WATER/IRRIGATION RIGHTS (10 ACRE FEET)

EQUESTRIAN ARENA | BARN | FERTILE SOIL

Forecasting Federal Reserve policy changes in coming months. The futures market has now pushed out its expectation for this year's first Fed rate cut to June. Note: In the lower chart, the 15.5% probability of change is an 84.5% probability the rate will stay the same. Current rate is 4.25%-4.50%.With gratitude,

Jordan C. Dove, ABR® SFR®

MANAGING PRINCIPAL | REALTOR®

Dove & Associates Powered by Nationwide Realty

702.720.1141 (office)

702.767.5557 (mobile)

Jordan@DoveandAssociates.com

JordanDove.com | DoveandAssociates.com

Subscribe to my YouTube Channel

3960 E. Patrick Ln. Ste. 204

Las Vegas, NV 89120

NVRE LIC. S.180594

PM.180594