💰 Wealth & Walls: Your Exclusive Real Estate & Economic Update

For the week of Mon. January 27, 2025

For the week of January 27, 2025

Featured Home

800 Cadence View Henderson, NV 89011

$10,000 Buyer Incentive

📲 702.720.1141

— TIP OF THE WEEK —

What To Do If Your Home Didn’t Sell

(Infographic)

- Ask About Property Management Services -

UP AGAIN... The major stock indexes gained two weeks in a row, as President Trump's comments on interest rates, oil prices, regulations, and taxes, and hints at a softer stance on China tariffs lifted investor sentiment.

Traders' spirits were also elevated by a strong start to Q4 corporate earnings season, but all was not copacetic economically, as continuing jobless claims rose to their highest level in more than three years.

Consumer Sentiment also came in weaker than expected. But we did get that better-than-expected December Existing Home Sales report, plus the S&P Global U.S. Manufacturing read finally landed in expansion territory.

The week ended with the Dow UP 2.2%, to 44,424; the S&P 500 UP 1.7%, to 6,101; and the Nasdaq also UP 1.7%, to 19,954.

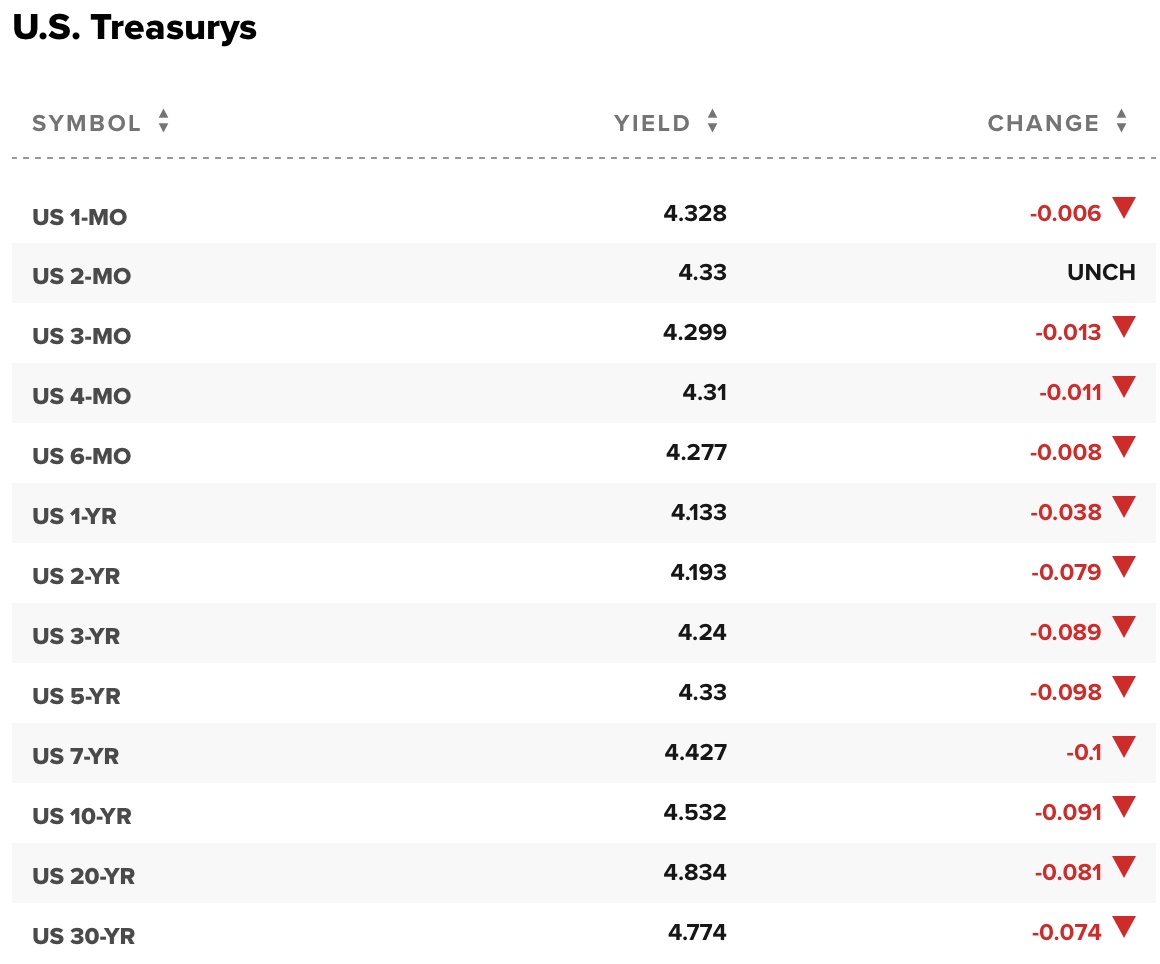

On the week, bonds edged up a tick overall, though the 30-Year UMBS 5.5% edged down a tick, 0.03, to $98.13. Freddie Mac's Primary Mortgage Market Survey reported the national average 30-year fixed mortgage rate headed back down.

Existing Home Sales finished the year up 2.2% in December and up 9.3% for the year—the fastest annual increase since 2021. It was the third straight month of yearly gains, with inventory higher than the same time a year ago.

Key Highlights

Existing-home sales rose 2.2% in December to a seasonally adjusted annual rate of 4.24 million, the strongest pace since February 2024 (4.38 million). Sales grew 9.3% from one year ago, the largest year-over-year gain since June 2021 (+23.0%). The median existing-home sales price progressed 6.0% from December 2023 to $404,400, the 18th consecutive month of year-over-year price increases and biggest year-over-year growth since October 2022 (+6.5%).

Even with the solid upturn in the fourth quarter, on an annual basis, existing-home sales (4.06 million) fell to the lowest level in nearly 30 years, while the median price reached a record high of $407,500 in 2024.

The inventory of unsold existing homes dropped 13.5% from the previous month to 1.15 million at the end of December, or the equivalent of 3.3 months' supply at the current monthly sales pace.

Realtor.com reports that last week saw “a pick-up in new listings,” while “prices fell annually by the largest margin in the data’s history for four of the last five weeks, setting buyers up for a more friendly market.”

An estimated 1.628 million new housing units were completed in 2024, up more than 12% over 2023. Title firm First American called this “good news for a housing market that has been underbuilt for over a decade.”

DID YOU KNOW… The Census Bureau reports the median size of new homes started fell from 2,326 square feet in Q3 2021 to 2,158 square feet in Q3 2024—a difference of 168 square feet, good news for buyers looking for smaller, more affordable homes.

— CURRENT 30-YEAR FIXED MORTGAGE RATE (CNBC) —

Last Monday's Close: 7.08

Note: Mortgage rates fluctuate frequently and are based on several factors

and will vary from borrower-to-borrower.

As of Mon. January 27, 2025 at 10:41am

OVERVIEW

Last year, as many as 1 in 3 sellers took their home off the market because it wasn’t selling. If this happened to you too, you don’t need to be embarrassed. What you need are answers. And a local real estate agent can help with that by seeing if it was priced too high, needs some repairs, or didn’t get the right exposure. If you still want to move, let’s connect to come up with a new strategy. Together, we can get your house sold.

Need to sell your home? Call our office at (702) 720-1141 for a complimentary consultation.

NEW AND PENDING HOME SALES, HOME PRICES, INFLATION, THE FED… Housing experts are forecasting December gains for both New Home Sales and the Pending Home Sales index of signed contracts on existing homes. November's S&P Case-Shiller Home Price Index should report no yearly gain. Economists expect December PCE Prices to show the annual inflation rate steady, though not diminishing. Virtually no one thinks the Fed's FOMC Rate Decision will move rates, but there will be much interest in Chair Powell's presser after the announcement.

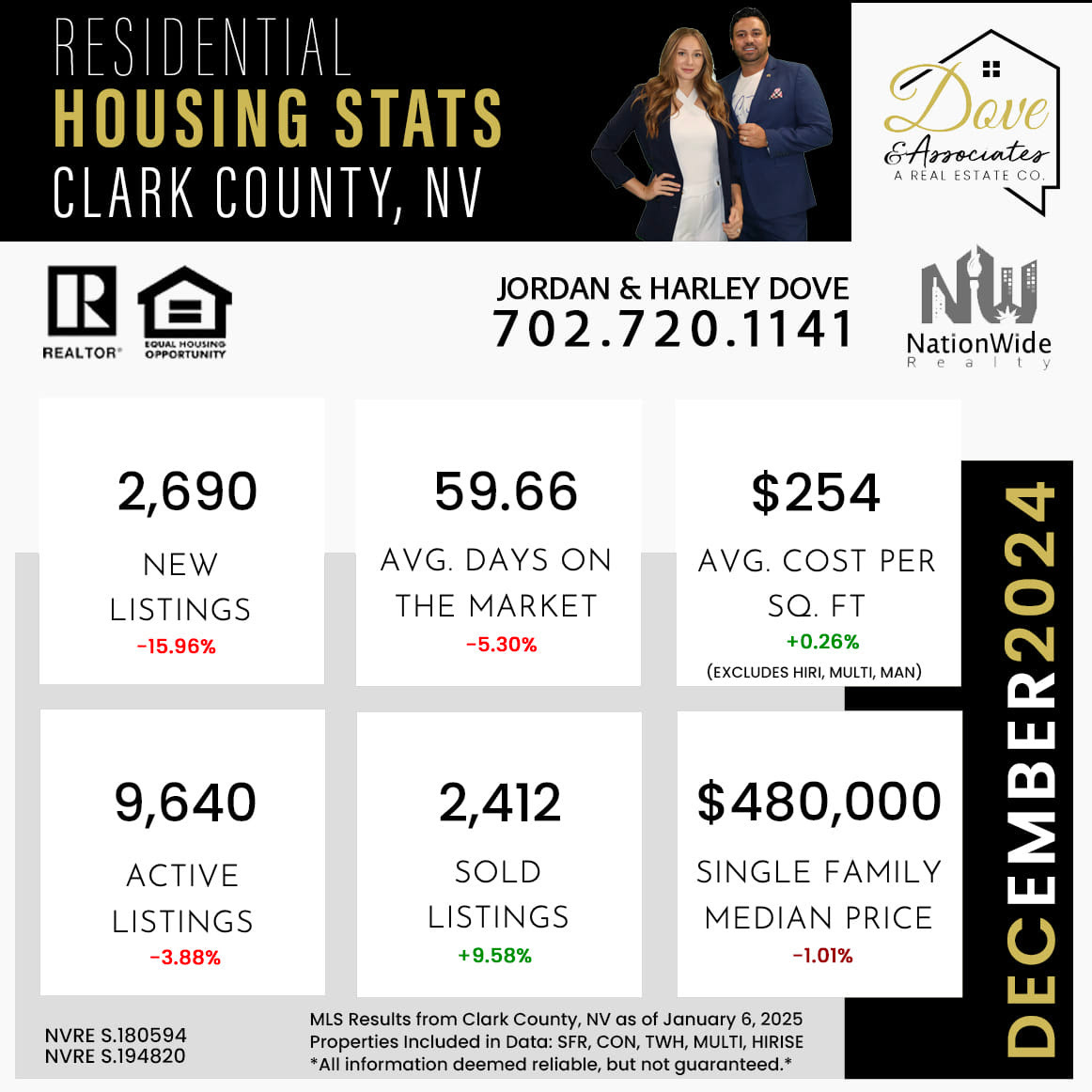

Each week we will update the current median price for the current month. These properties include all of the Southern Nevada MLS whereby the above graphic is only Clark County, NV MLS properties.

Keep in mind the majority of sales occur at the end of the month, so official numbers will be published on the first Monday of each month. The current median prices for January 2025 are calculated from 1,451 sold January listings in from the MLS as of January 27, 2024. (All counties in the Southern Nevada LVR MLS, not only Clark County as referenced in the above graphic.)

CURRENT JANUARY MEDIAN PRICES

Single Family

$490,000

+$15,000

Up from December of $475,000

Condo

$239,999

-$2,001

Down from December of $242,000

Townhomes

$350,000

-$7,995

Down from December of $357,995

Manufactured

$245,000

-$10,000

Down from December of $255,000

This week, we are going to analyze the data compared to last week's reading on January 21, 2025 for a peek into a weekly post-holiday market condition & data set as we gear up for the Spring selling season.

As of January 27, 2025 there are currently active (W/w change):

Past Seven Days Market Watch (W/w change):

This reading, there are 5 more active residential resale properties on the market compared to last week’s reading on January 21, 2025 for a total of 8,397 available properties - increasing weekly inventory by 0.06%.

— FEATURED LENDER —

Learn about financing a purchase or refinancing a current mortgage...

Call Chuck:

$10,000 BUYER’S INCENTIVE

FOR THIS CADENCE HOME IN HENDERSON

5855 Pearlite Ave.

Las Vegas, NV 89120 | MLS 2523540

5 BED | 3 BATHS | 3,307 SF

4.35 ACRES | POOL & SPA

IRREVOCABLE WATER/IRRIGATION RIGHTS (10 ACRE FEET)

EQUESTRIAN ARENA | BARN | FERTILE SOIL

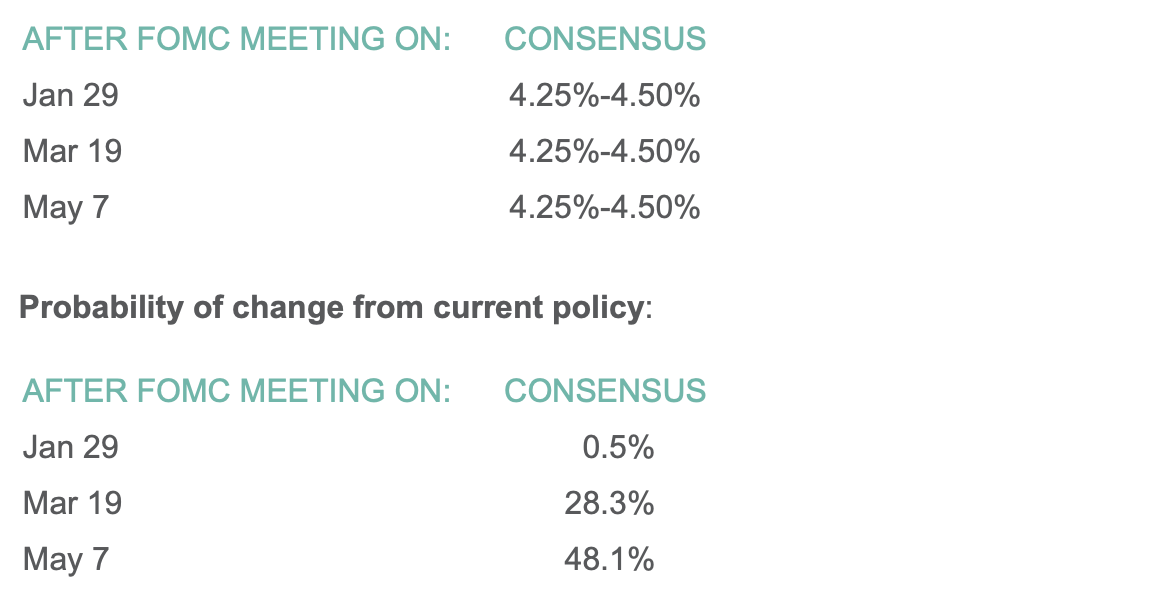

Forecasting Federal Reserve policy changes in coming months. Wall Streeters still see no rate change at this year's first three Fed meets, although sentiment is growing for a cut come May. Note: In the lower chart, the 0.5% probability of change is a 99.5% probability the rate will stay the same. Current rate is 4.25%-4.50%.

With gratitude,

Jordan C. Dove, ABR® SFR®

MANAGING PRINCIPAL | REALTOR®

Dove & Associates Powered by Nationwide Realty

702.720.1141 (office)

702.767.5557 (mobile)

Jordan@DoveandAssociates.com

JordanDove.com | DoveandAssociates.com

Subscribe to my YouTube Channel

3960 E. Patrick Ln. Ste. 204

Las Vegas, NV 89120

NVRE LIC. S.180594

PM.180594