💰 Wealth & Walls: Your Exclusive Weekly Economic & Real Estate Update

For the week of June 17, 2024

💰 Wealth & Walls:

📰 Your Exclusive Weekly Economic & Real Estate Update

For the week of June 17, 2024

The month of June is dedicated to men's mental health awareness, and June 10-16 is International Men's Health Week. It's meant to, not only raise awareness of men's mental health issues, but to also encourage men to seek help. There is often a stigma placed around men's mental health.

Need help with real estate services or need a solar proposal?

Call, Text or Respond to This E-Mail

🕵🏼♀️ TIP OF THE WEEK:

GALLUP: For the 12th Year in a Row, Real Estate Voted Best Long-Term Investment (Infographic)

MIXED MESSAGES... After four weeks of rallying, last week's market told differing tales. The blue-chip Dow skidded, the broadly based S&P 500 finished flat, while the tech-y Nasdaq hit a fresh all-time high.

The economic news was similar. We got mixed corporate earnings from a slate of retailers, while the FOMC Minutes from the Fed's last meet revealed rate cuts are off the table for the near future.

But we also got some impressive earnings reports from the tech sector, positive reads on the U.S. Manufacturing and Services sectors, and Durable Goods Orders data that showed businesses are continuing to invest.

The week ended with the Dow down 2.3%, to 39,070; the S&P 500 up two points, to 5,305; and the Nasdaq UP 1.4%, to 16,921.

Bond prices took a small hit overall, the 30-Year UMBS 6.0% down .15, to $100.03. The national average 30-year fixed mortgage rate fell for the third straight week in Freddie Mac's Primary Mortgage Market Survey. Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up-to-the-minute information.

The Mortgage Bankers Association (MBA) reports purchase mortgage applications shot up 9%, while refinance applications surged 28% from the week before, 28% higher than a year ago.

The MBA also reported mortgage applications for new homes in May rose 13.8% over a year ago. Their home builders survey estimates May sales hit a 702,000 annual rate, the highest since last October.

CoreLogic says homeowners nationwide saw their equity increase the first three months of the year by 9.6%—an average gain of $28,000—over the same three months a year ago. It was the biggest gain since 2022.

U.S. homeowners with a mortgage pulled in $28,000 in equity gains year over year in first quarter of 2024, the highest number since late 2022.

California ($64,000), Massachusetts ($61,000) and New Jersey ($59,000) led the country for annual home equity gains in the first quarter.

Los Angeles topped major metro areas for year-over-year home equity growth at $72,000.

DID YOU KNOW… Although Realtor.com reports 16.6% of listed homes had price reductions in May, actual selling prices are still rising and are expected to keep doing so.

CURRENT 30-YEAR FIXED MORTGAGE RATE (CNBC)

Previous Close: 6.99

Note: Mortgage rates fluctuate frequently and are based on several factors and will vary from borrower-to-borrower.

As of Mon. June 17, 2024 12:26 PM PST

Each week we will update the current median price for the current month. These properties include all of Southern Nevada whereby the above graphic is only Clark County, NV.

Keep in mind the majority of sales occur at the end of the month, so official numbers will be published on the first Monday of each month. These median prices are calculated from 3,049 sold May listings in from the MLS as of May 13, 2024. (All counties in the LVR MLS, not just Clark as referenced in the above graphic.)

CURRENT JUNE MEDIAN PRICES

Single Family

$475,000

+$1,500

Up from May of $473,500

Condo

$256,500

+$6,500

Unchanged from May of $250,000

Townhomes

$350,000

-$5,545

Down from May of $355,545

This week, we are going to analyze the data compared to one year ago on our June 19, 2023 reading.

As of June 17, 2024, there are currently active (Y/y change):

4,316 Single Family Homes (+398) +10.15%

956 Condos (+391) +69.20%

487 Townhouses (+48) +10.93%

212 Manufactured Homes (+7) +3.41%

434 High Rise Units (+145) +50.17%

74 Multiple Dwellings (+23) +45.09%

2,186 Parcels of Land (-280) -11.35%

3,154 Rentals On Market (+112) +3.68%

Past Seven Days Market Watch (Y/y change):

1,039 New Listings (+324) +45.31%

199 Back on Market (+16) +8.74%

89 Price Increases (-12) -11.88%

760 Price Decreases (+305) +67.03%

894 Accepted an Offer (+45) +5.30%

677 Sold (+67) +10.98%

60 Expired (-5) -8.33%

291 Taken Off Market (-49) -14.41%

This reading, there are 1,021 more active residential resale properties on the market compared to last year's reading on June 19, 2023 for a total of 6,479 available inventory - an annual increase of 18.51%.

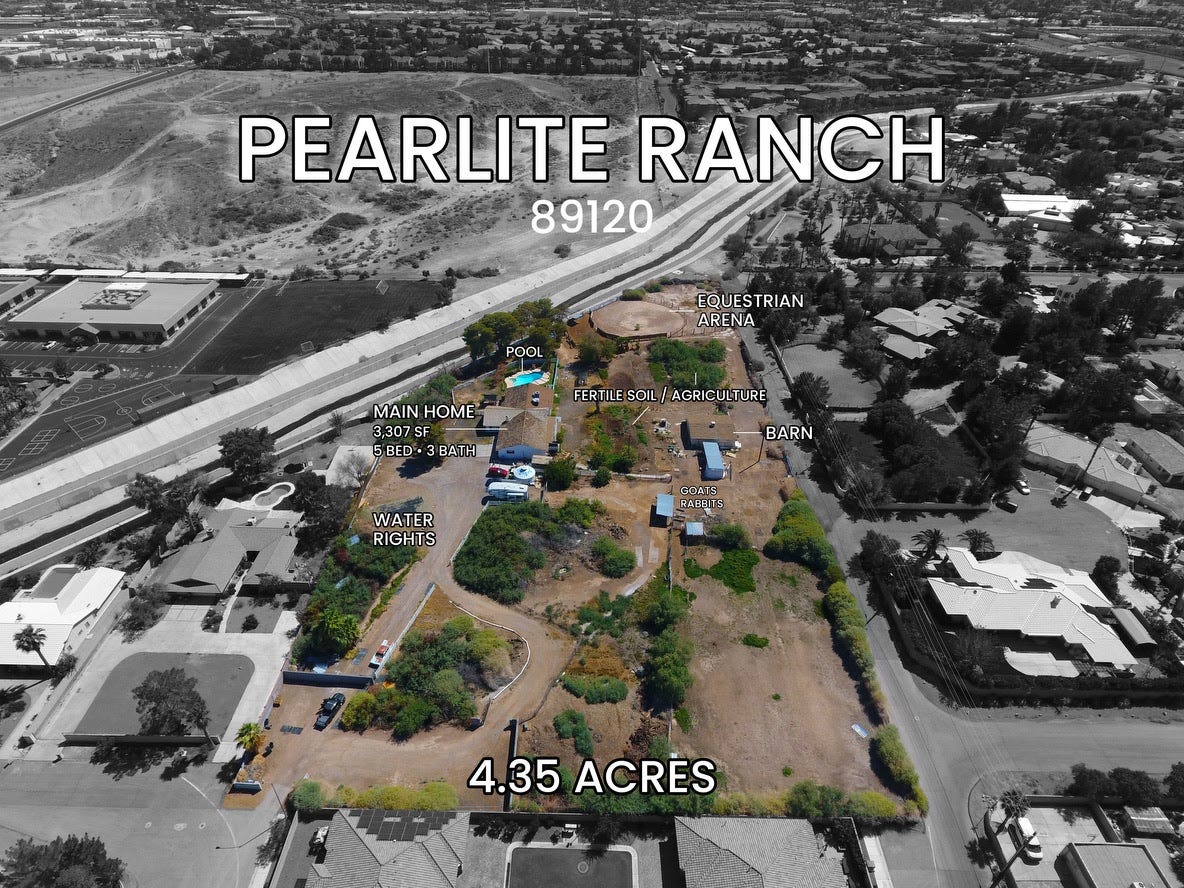

Las Vegas, NV 89120 | MLS 2523540

5855 Pearlite Ave.

5 BED | 3 BATHS | 3,307 SF

4.35 ACRES | POOL & SPA

IRREVOCABLE WATER/IRRIGATION RIGHTS (10 ACRE FEET)

EQUESTRIAN ARENA | BARN | FERTILE SOIL

HOME BUILDING, EXISTING HOME SALES, RETAIL SALES... Analysts expect home builders to ramp up activities in May, with both Housing Starts and Building Permits ahead for the month. More new homes will be welcome, as tight inventory is predicted to push down Existing Home Sales in May. Retail Sales are forecast up a bit in May, showing consumers keep helping things out.

All U.S. financial markets will be closed Wednesday, June 19, in observance of Juneteenth National Independence Day.

OVERVIEW:

According to a recent poll from Gallup, real estate has been voted the best long-term investment for twelve straight years. That’s because a home is so much more just than a roof over your head. It’s also an asset that typically grows in value over time. If you’ve been debating if it makes more sense to rent or buy, E-Mail me to talk about why homeownership can be a better bet in the long run.

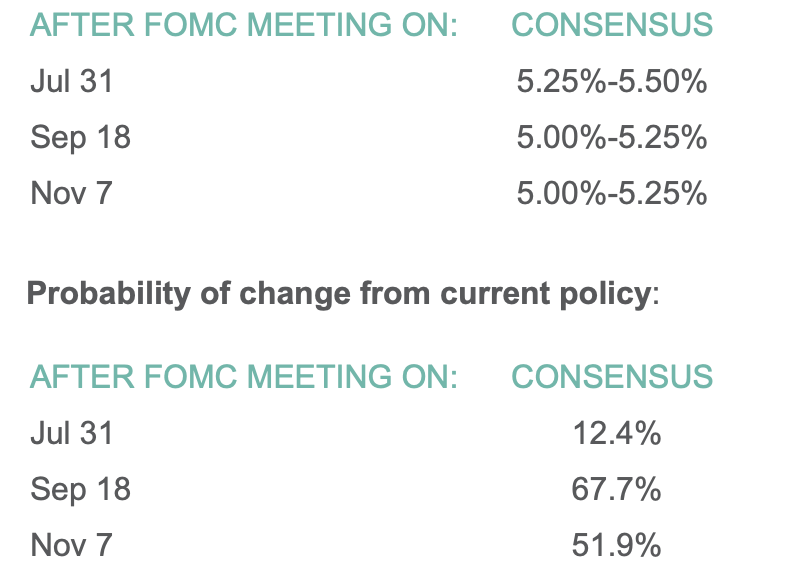

Forecasting Federal Reserve policy changes in coming months. The Fed futures market sees no rate cut in July, then one in September. For November, a slight majority sees another move, though sentiment is split between a cut and a hike back up. Note: In the lower chart, the 12.4% probability of change is an 87.6% probability the rate will stay the same. Current rate is 5.25%-5.50%.

With gratitude,

Jordan C. Dove, ABR® SFR®

MANAGING PRINCIPAL | REALTOR®

Dove & Associates Powered by Nationwide Realty

702.767.5557 | Jordan@DoveandAssociates.com

JordanDove.com | DoveandAssociates.com

Subscribe to my YouTube Channel

3960 E. Patrick Ln. Ste. 204

Las Vegas, NV 89120

NV Lic. # S.0180594