For the week of March 20, 2023

“The most difficult thing is the decision to act, the rest is merely tenacity.” - Amelia Earhart

🔨 HOUSING STARTS UP 9.8% IN FEBRUARY

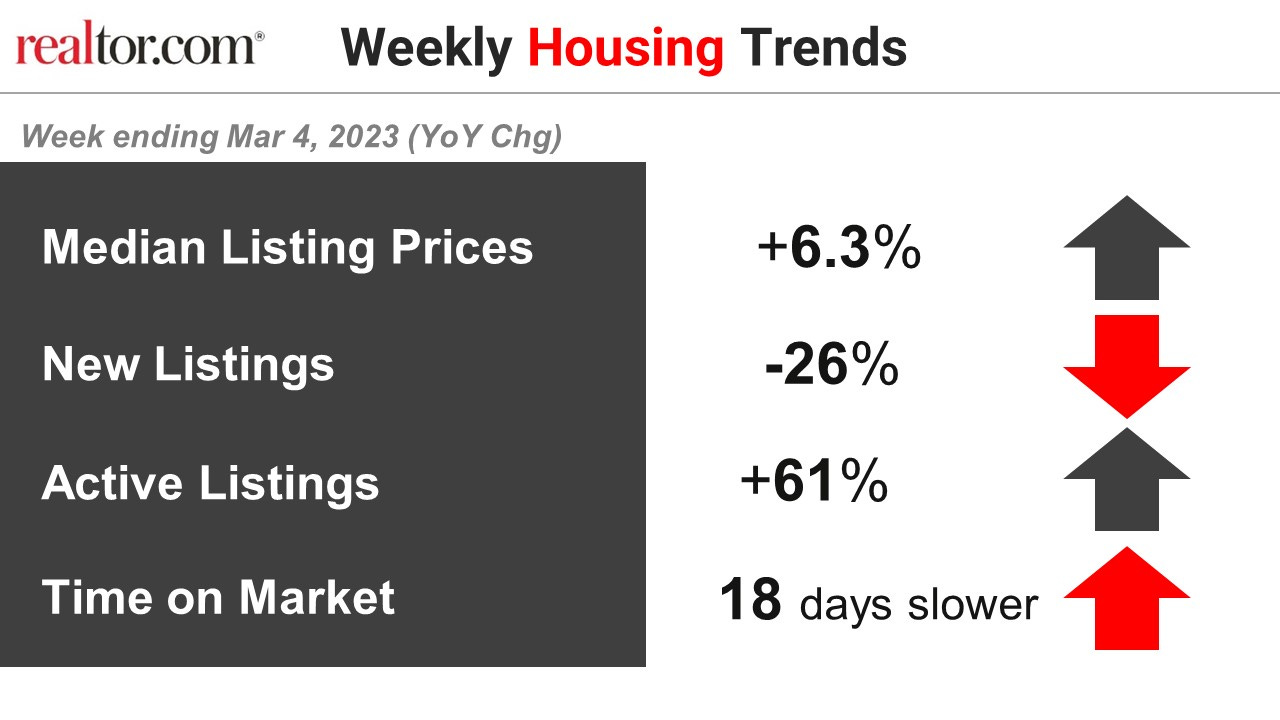

📈 NATIONAL RESALE HOUSING INVENTORY up 61% Y/Y

📉 VEGAS INVENTORY CONTINUES ITS DECLINE

📉 MORTGAGE RATES & TREASURY YIELDS DROPPING

😎 TIP OF THE WEEK: IS THE HOUSING MARKET GOING TO CRASH?

We hope you enjoy this edition of the ⚡️ market pulse. Our goal is to analyze and keep you informed on the economy and real estate market so you can make better, informed decisions. We’re here to help you with your real estate needs (residential, commercial & investments) when you’re ready.

Call/text us at (702) 721-7332 or e-mail Jordan@DoveandAssociates.com

WATCH ON YOUTUBE

Get ready for a wild ride on Wall Street! This week was full of ups and downs as traders placed their bets on big names outside the banking sector. Despite concerns about recent bank failures, investors took comfort in the decisive actions of the Fed, the Treasury, and the FDIC to support depositors and calm fears of a bank run.

While weaker retail sales in February raised some eyebrows, the good news was that CPI inflation fell to 6.0%, the smallest annual increase since September 2021, and initial jobless claims sank back below 200,000. And by the end of the week, the Dow slipped just a tick, while the S&P 500 and Nasdaq soared, with gains of 1.4% and 4.4%, respectively.

But it wasn't just stocks that were on the rise. Bonds also made impressive gains, with UMBS 5.5% up 1.08 in just the last two weeks, to $100.29. And for those in the market for a mortgage, the national average 30-year fixed rate headed downward in Freddie Mac's Primary Mortgage Market Survey.

So hold on tight and enjoy the ride – with all the twists and turns in the markets lately, it's sure to be an exhilarating one! And as always, be sure to check in with your financial advisor for the latest news and insights.

Increasing for the first time in six months, housing starts shot up 9.8% in February, with both single-family and multi-unit projects posting gains. Building permits did even better—up 13.8%, the largest monthly gain in two years.

Home builders are clearly feeling more optimistic. The homebuilder sentiment index headed up for the third straight month, indicating the housing market is starting to find its footing in the present mortgage rate environment.

Realtor.com reports active inventory keeps climbing—up 61% from a year ago. Homes are spending more time on the market than last year, but they’re still selling quicker than before the pandemic, suggesting continuing buyer demand.

DID YOU KNOW… Freddie Mac notes, “turbulence in the financial markets is putting significant downward pressure on rates,” sparking buyer demand. Last week, purchase mortgage applications rose a seasonally adjusted 7%.

Fed poised to approve quarter-point rate hike this week, despite market turmoil

The Federal Reserve likely will approve a quarter-percentage-point interest rate increase this week, according to market pricing and many Wall Street experts.

A rate increase would come just over a week after other regulators rolled out an emergency lending facility to halt a crisis of confidence in the banking industry.

“This might be one of those times where there’s a difference between what they should do and what I think they will do. They definitely should not tighten policy,” said Mark Zandi, chief economist at Moody’s Analytics.

Goldman Sachs cuts GDP forecast because of stress on small banks, which are key to U.S. economy

Goldman Sachs lowered its growth forecast by 0.3 percentage points to 1.2% for 2023, as gauged by the fourth quarter of 2022 to the fourth quarter of this year.

Analysts believe a pullback in lending will lead to substantial tightening in bank lending standards, dragging down growth already affected by tightening in recent quarters.

Banks with less than $250 billion in assets comprise about 50% of U.S. commercial and industrial lending.

Inflation gauge increased 0.4% in February, as expected and up 6% from a year ago

The consumer price index rose 0.4% in February and 6% from a year ago, in line with market expectations.

A drop in energy prices helped keep inflation in check, while shelter costs increased sharply.

The probability that the Fed would raise benchmark interest rates a quarter percentage point next week increased following the report.

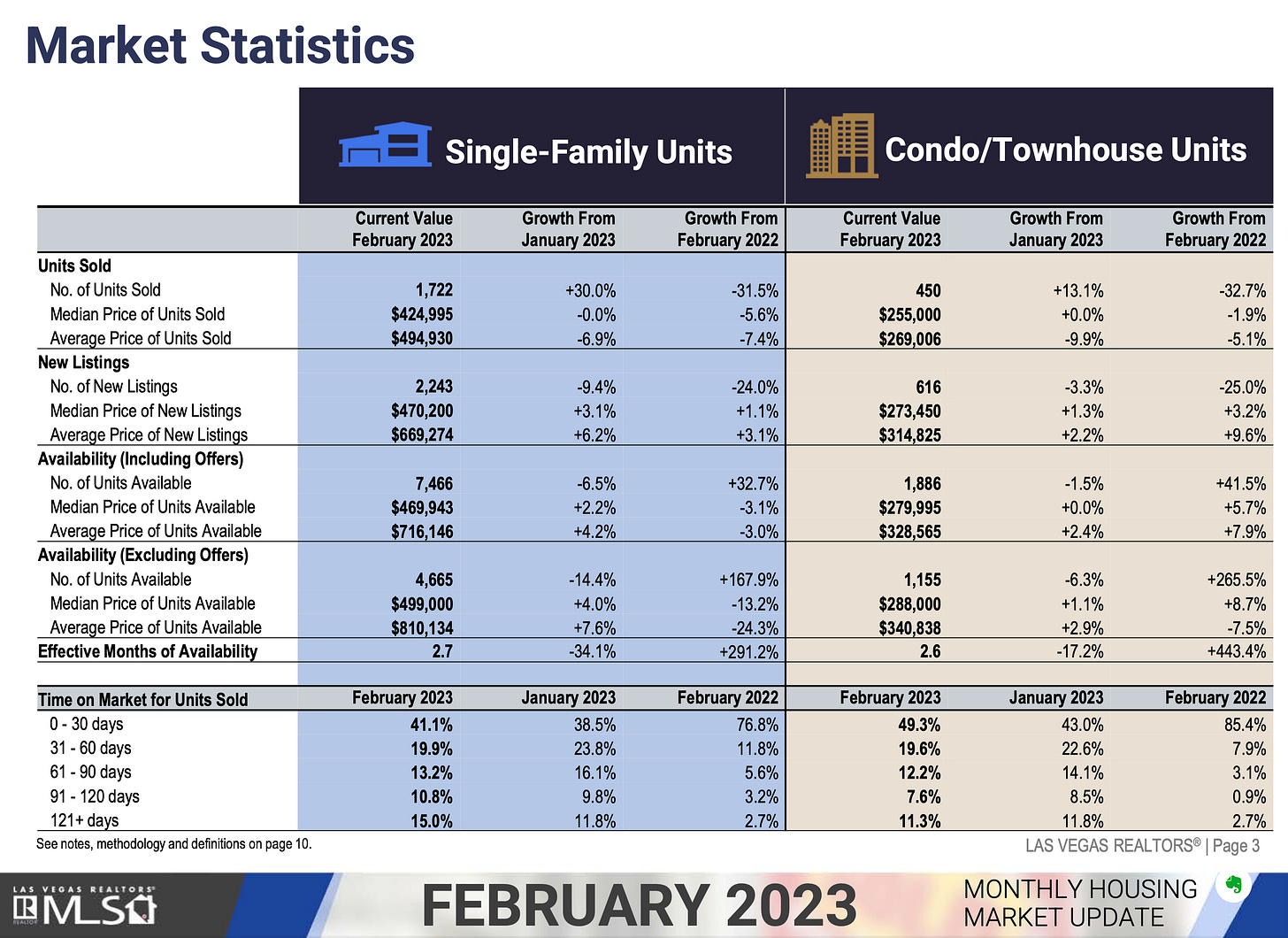

Sales remain steady while inventory continues falling keeping the Southern Nevada market at an elevated Absorption Rate Figure

Current ARF:

40.44% 🤯

The current absorption rate for the Southern Nevada market the past 30 days is 40.44%, up 1.03% 😱 (103 basis points) from the last absorption rate reading on March 13, 2023 (39.41%).

There is about 2.47 months of inventory available on the Southern Nevada housing market. Historically, 6 months of inventory is considered an even buyers & seller’s market, although we at D&A believe that 4 months is an even buyers & sellers market.

A market with an absorption rate at or above 20% is typically called a seller’s market, whereas an absorption rate below 15% signals a buyer’s market. 15-20% in considered an even market.

Each week we will update the current median price for the current month. Keep in mind the majority of sales occur at the end of the month, so official numbers will be published on the first Monday of each month. Median prices are of 1,607 sold listings from the MLS as of March 20, 2023.

Currently for the month of March 2023

Single Family

$425,000

+$10

Up from February of $424,990

Condo

$225,000

+$4,746

Up from February of $220,254

Townhomes

$318,000

+$8,500

Up from February of $309,500

Another week of inventory declines although inventory levels appeal to be flattening off with only a net loss of 71 total resale property.

Accepted contingent offers remain elevated from recent norms with 867 this week. Sales also remain steady compared to previous months with 632 closing the last 7 days.

There are currently 6,570 active single family homes, townhomes, condominiums, high-rises, manufactured and multi-families available on the market. Available rental properties also dipped down to 3,105 active rentals on the market this week.

As of March 20, 2023, there are currently active (W/w change):

4,744 Single Family Homes (-36) -0.75%

716 Condos (unch) +/- 0.00%

470 Townhouses (-20) -4.08%

241 Manufactured Homes (-12) -4.74%

340 High Rise Units (+1) +0.25%

59 Multiple Dwellings (-4) -6.35%

2,505 Parcels of Land (+4) +0.16%

3,105 Rentals On Market (-33) -1.05%

Past Seven Days Market Watch (W/w change):

725 New Listings (+29) +4.17%

212 Back on Market (+24) +12.76%

84 Price Increases (+20) +31.25%

627 Price Decreases (+11) +1.79%

867 Accepted an Offer (-91) -9.50%

632 Sold (+2) +0.32%

110 Expired (+2) +1.85%

294 Taken Off Market (-10) -3.29%

This week, there are 71 less active residential resale properties on the market compared to the last read on March 13, 2023 for a total of 6,570 - a decrease of 1.07%.

NEW AND EXISTING HOME SALES, THE FED RATE DECISION… Reports on the February housing market are expected to show Existing Home Sales on the rebound, but New Home Sales flat or posting a small decline. The biggest focus will be on Wednesday's FOMC Rate Decision. The Fed is expected to hike just a quarter percent, though we could see the central bankers take a pause.

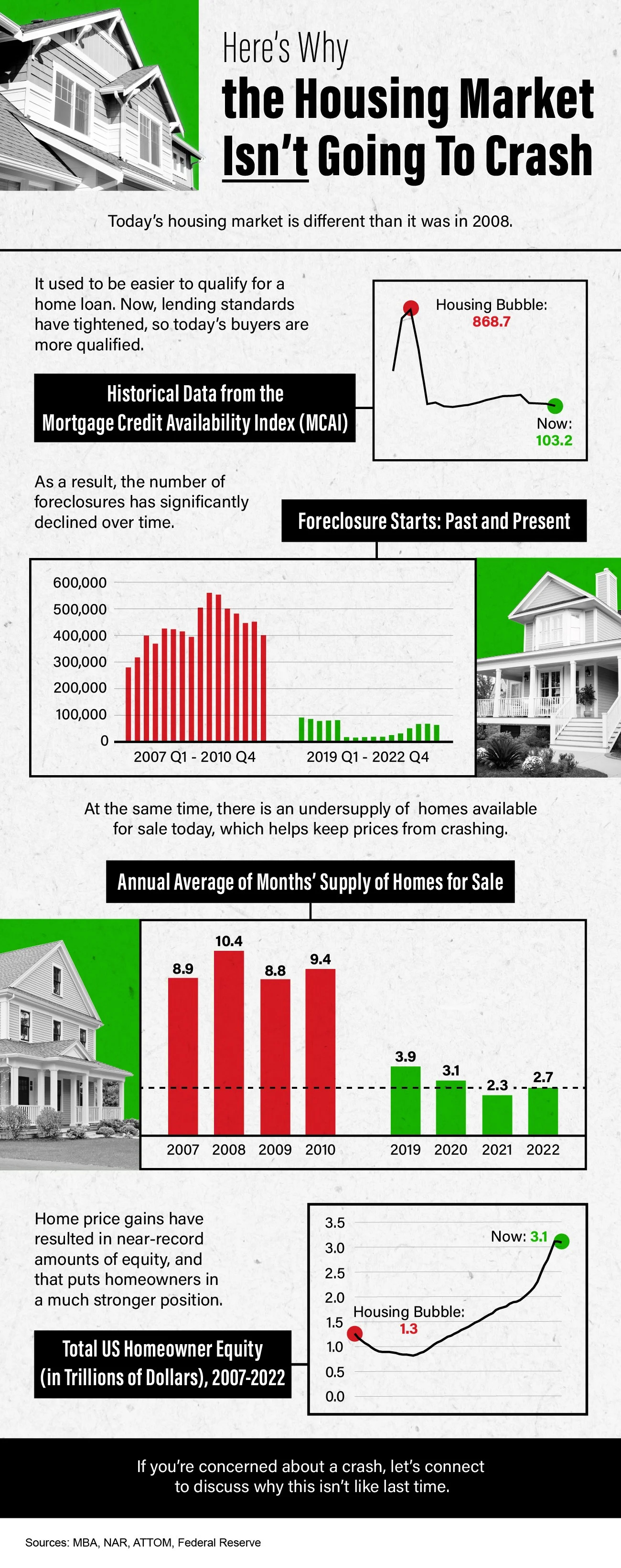

Today’s housing market is different than it was in 2008.

Lending standards have tightened, foreclosures have declined, home inventory is much lower, and homeowners have far more equity.

If you’re concerned about a crash, let’s discuss why this isn’t like last time.

Forecasting Federal Reserve policy changes in coming months. Given the recent news around banking, Wall Street feels we’ll only see a quarter percent rate hike this week, none in May, then a rate cut in June! Note: In the lower chart, a 73.8% probability of change is a 73.8% probability the rate will rise. Current rate is 4.50%-4.75%.

AFTER FOMC MEETING ON: CONSENSUS

Mar 22 4.75%-5.00%

May 3 4.75%-5.00%

Jun 14 4.50%-4.75%

Probability of change from current policy:

AFTER FOMC MEETING ON: CONSENSUS

Mar 22 73.8%

May 3 88.6%

Jun 14 51.5%