📰 Your weekly inside scoop on real estate

For the week of January 22, 2024

"Never let the future disturb you. You will meet it, if you have to, with the same weapons of reason which today arm you against the present.” - Marcus Aurelius

We’re here to help you with your real estate portfolios &

solar energy solutions. Respond to this e-mail with any questions.

🕵🏼♀️ TIP OF THE WEEK:

Key Terms Every Homebuyer Should Learn (Infographic)

UP AGAIN... The three major stock indexes rose sharply on Friday, finishing the four-day trading week solidly ahead, as the broadly-based S&P 500 set a new record high for the first time in more than two years.

Traders got enough positive economic data to foresee a soft landing for a slowing economy, as December Retail Sales, weekly jobless claims, and Housing Starts all came in stronger than expected.

This data doesn't indicate recession, but it could delay Fed rate cuts. Yet University of Michigan Consumer Sentiment hit its highest level since July 2021, as year-ahead inflation expectations fell to 2.9%, a three-year low.

The week ended with the Dow UP 0.7%, to 37,864; the S&P 500 UP 1.2%, to 4,840; and the Nasdaq UP 2.3%, to 15,311.

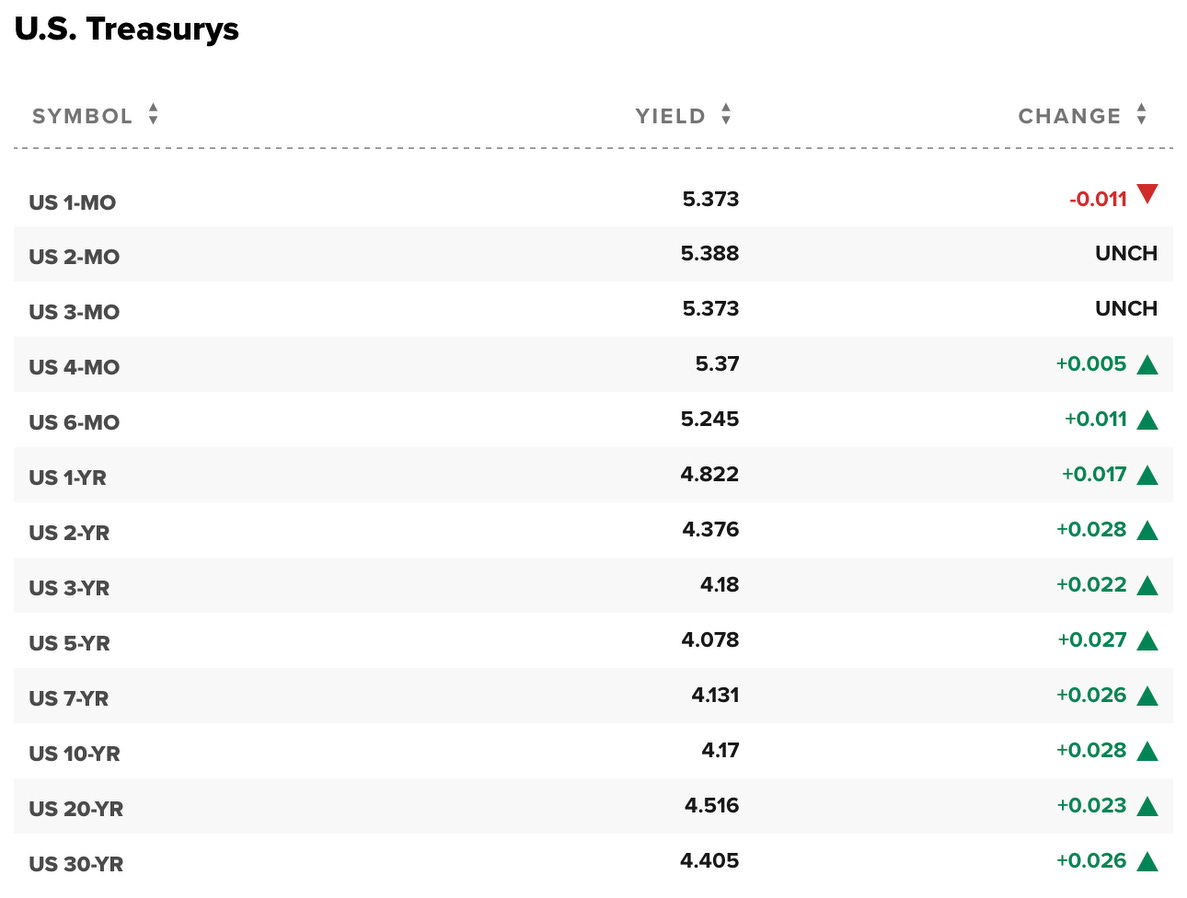

Amid dimming prospects of a March rate cut, bond prices fell, the 30-Year UMBS 5.5% down 0.89, to $99.22. In Freddie Mac's Primary Mortgage Market Survey, the national average 30-year fixed mortgage rate fell to its lowest level since May 2023. Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up-to-the-minute information.

Housing Starts were up a solid 7.6% compared to a year ago despite being off a bit during holiday-shortened December. The past year, single-family starts are up a very strong 15.8%, single-family permits up an impressive 32.9%.

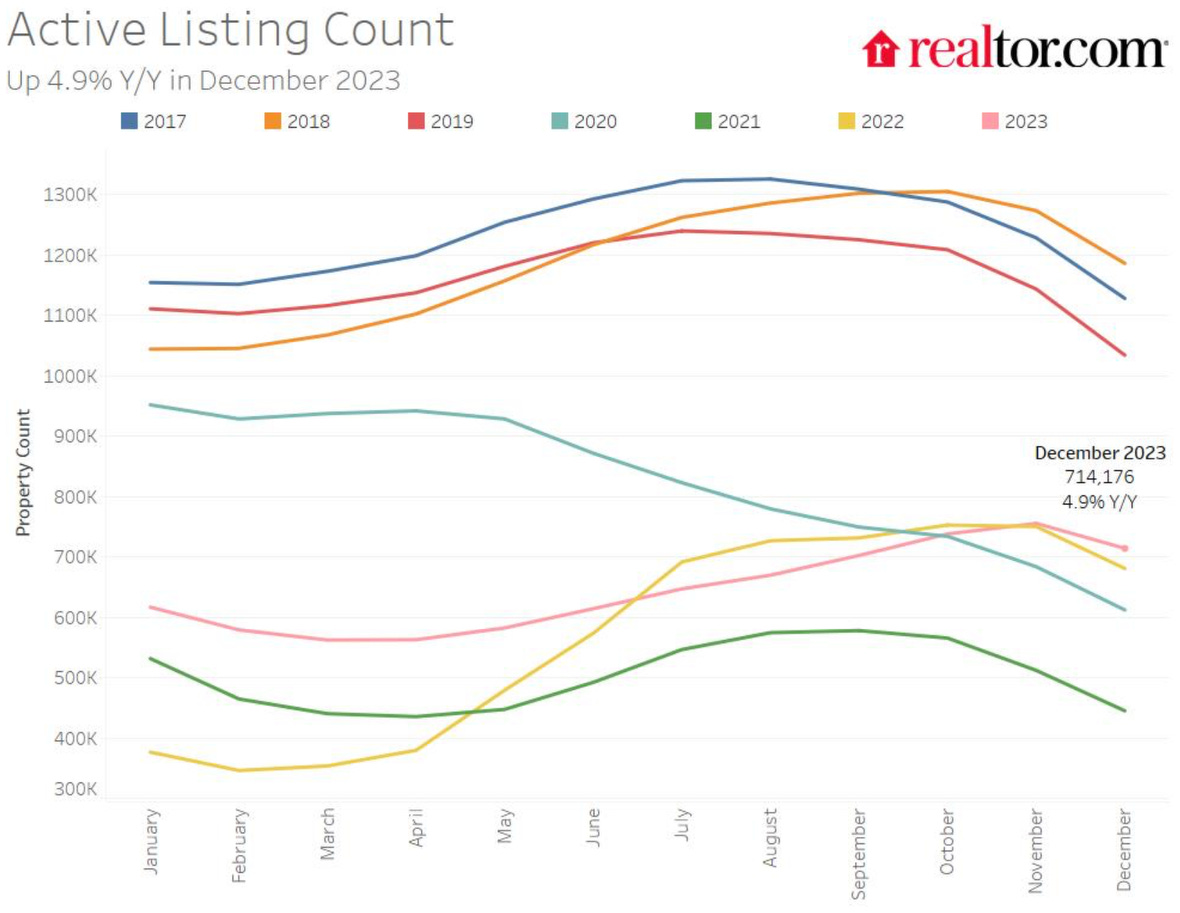

Realtor.com reports that, compared to last year, the number of homes for sale in December was 4.9% higher, new listings were 9.1% higher, yet the median listing price stayed fairly stable, up just 1.2%.

Existing Home Sales dipped 1.0% in December, but the National Association of Realtors is optimistic: “The latest month's sales look to be the bottom before inevitably turning higher in the new year.”

Existing-home sales waned 1.0% in December to a seasonally adjusted annual rate of 3.78 million. Sales faded 6.2% from the previous year. The median existing-home sales price rose 4.4% from December 2022 to $382,600 – the sixth consecutive month of year-over-year price increases.

On an annual basis, existing-home sales (4.09 million) fell to the lowest level in nearly 30 years, while the median price reached a record high of $389,800 in 2023.

The inventory of unsold existing homes slumped 11.5% from the previous month to 1 million at the end of December, or the equivalent of 3.2 months' supply at the current monthly sales pace.

A national online real estate database found the median mortgage payment in December was nearly $400 lower than its October peak. Buyer demand came in 10% ahead of November, at the highest level since August.

DID YOU KNOW… Zillow found that in Q4 of last year, 21% of homeowners were considering selling their homes in the next three years, up from 15% a year ago—another sign inventories should improve.

CURRENT 30-YEAR FIXED MORTGAGE RATE (CNBC)

Note: Mortgage rates fluctuate frequently and are based on several factors and will vary from borrower-to-borrower.

As of Wed Jan. 24, 2024 10:33 AM PST

☀️ HOW MUCH CAN YOU SAVE WITH SOLAR?

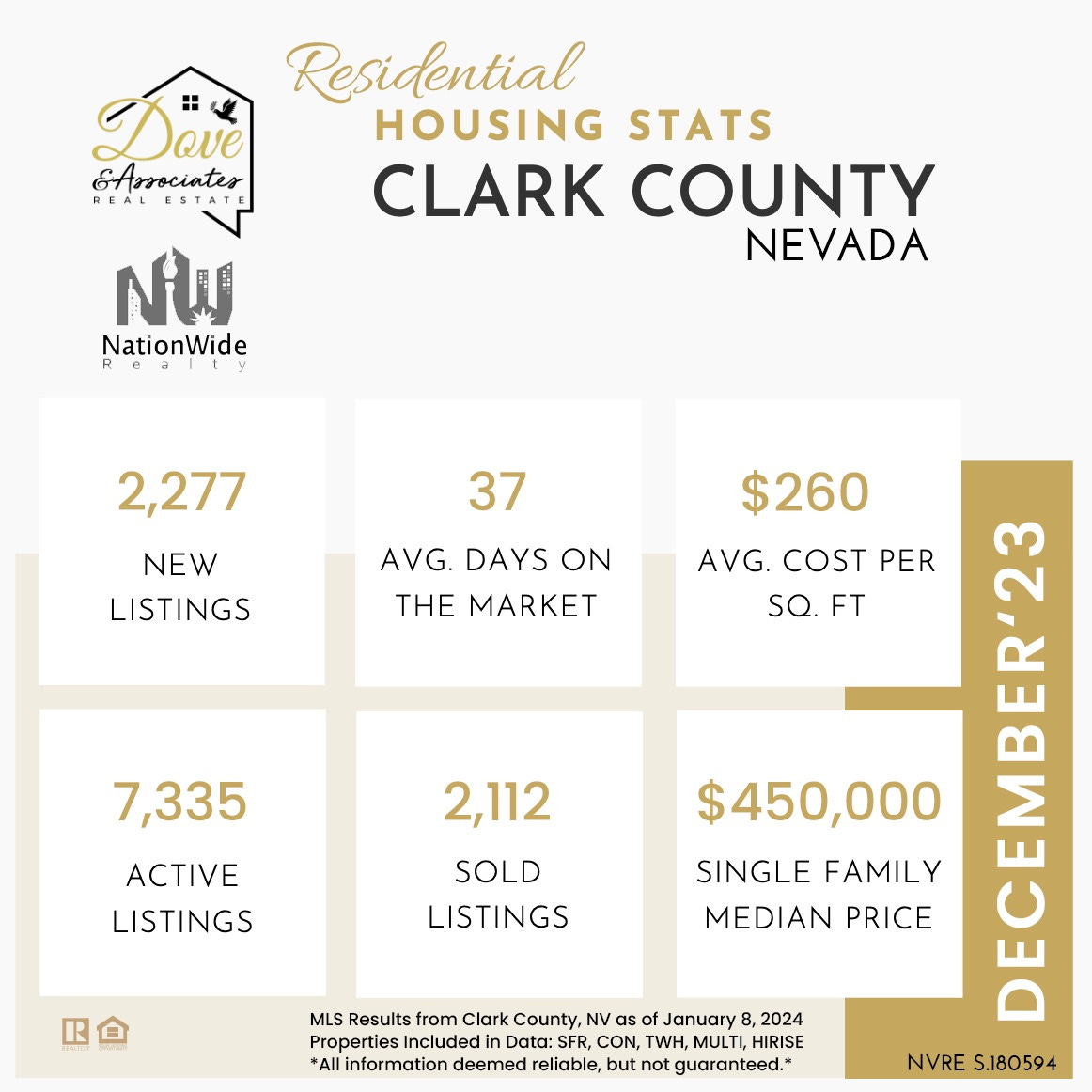

Each week we will update the current median price for the current month. These properties include all of Southern Nevada whereby the above graphic is only Clark County, NV.

Keep in mind the majority of sales occur at the end of the month, so official numbers will be published on the first Monday of each month. These median prices are calculated from 1,264 sold January listings in from the MLS as of January 24, 2024. (All counties in the LVR MLS, not just Clark as referenced above.)

CURRENT JANUARY MEDIAN PRICES

Single Family

$445,000

-$4,925

Down from December of $449,925

Condo

$230,000

-$5,000

Down from December of $235,000

Townhomes

$329,995

-$5,005

Down from December of $335,000

As of January 24, 2024, there are currently active (W/w change):

3,904 Single Family Homes (-170) -4.17%

790 Condos (+22) +2.86%

451 Townhouses (-11) -2.38%

233 Manufactured Homes (+12) +5.43%

308 High Rise Units (-2) -0.64%

65 Multiple Dwellings (+7) +12.06%

2,253 Parcels of Land (+29) +1.30%

3,327 Rentals On Market (-46) -1.36%

Past Seven Days Market Watch (W/w change):

765 New Listings (+37) +5.08%

169 Back on Market (+36) +27.06%

95 Price Increases (-11) -10.37%

514 Price Decreases (+26) +5.3%

918 Accepted an Offer (+181) +24.56%

497 Sold (-45) -8.30% (M/m)

51 Expired (-8) -13.56%

293 Taken Off Market (+45) +18.14%

This week, there are 142 less active residential resale properties on the market compared to last week's reading on Jan. 15, 2024 for a total of 5,751 - a decrease of 2.41%.

Note: Another significant jump in accepted offers this week, mostly into single family homes which decreased supply this week, even with the 5% gain in new active listings.

According to CNBC, 30-year fixed mortgage rates are up 5 basis points today to a 6.92% national average.

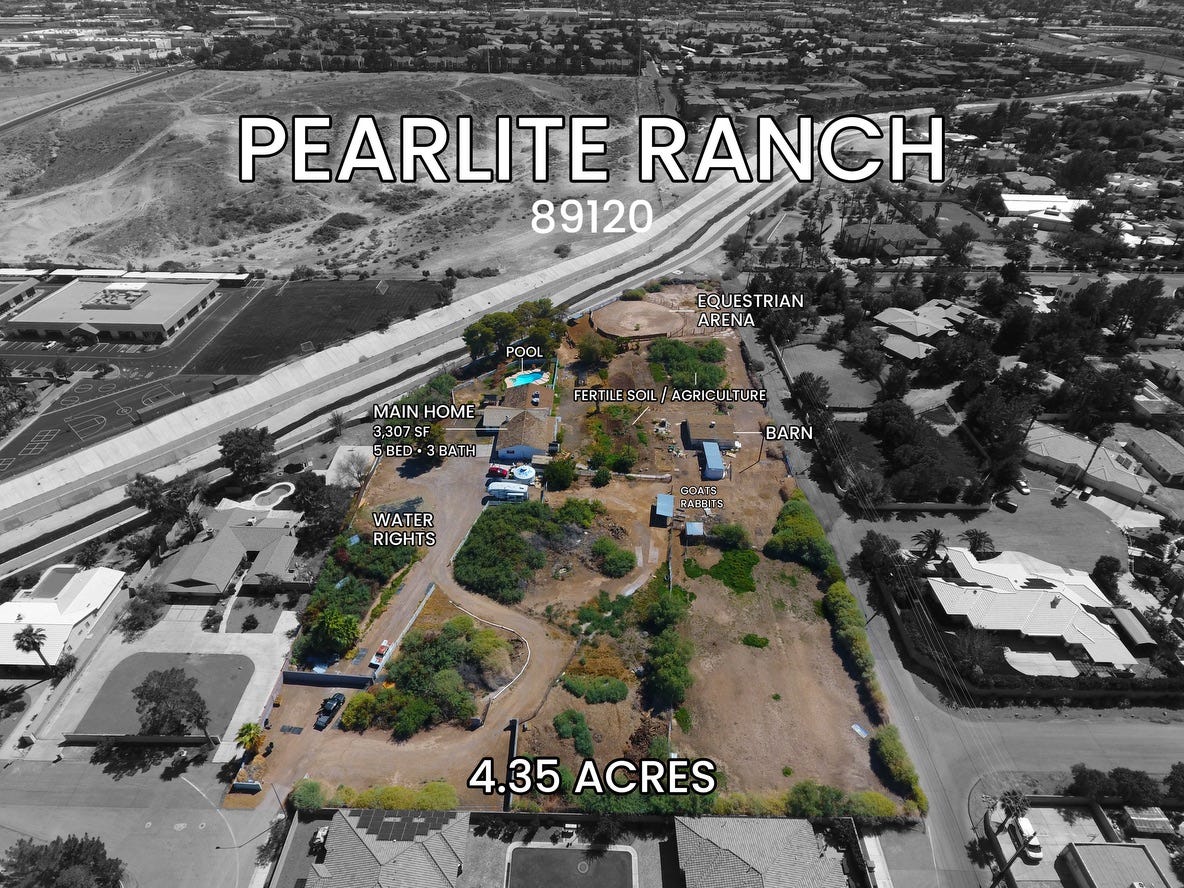

Las Vegas, NV 89120 | MLS 2523540

5855 Pearlite Ave.

5 BED | 3 BATHS | 3,307 SF

4.35 ACRES | POOL & SPA

IRREVOCABLE WATER/IRRIGATION RIGHTS (10 ACRE FEET)

EQUESTRIAN ARENA | BARN | FERTILE SOIL

78 RATTLESNAKE GRASS

PRICE IMPROVED TO $558,880

NEW AND PENDING HOME SALES, GDP, INFLATION... For December, New Home Sales are expected to continue upward, and, promisingly, so is the Pending Home Sales index of signed contracts on existing homes. The forecast is for slower Q4 economic growth, shown by the GDP-Advanced read. This is what the Fed wants to see to start cutting rates. However, the PCE Prices measure of inflation should be up a bit, something the central bankers don't want to see.

Buying a home is a big deal and can feel especially complicated if you don't know the terms used during the process.

If you want to become a homeowner this year, it's a good idea to learn these key housing terms and understand how they relate to the current housing market. That will help you feel confident when you buy a home.

Let’s connect so you can get expert help with any questions you have.

Forecasting Federal Reserve policy changes in coming months. The futures market now expects the Fed to keep the rate where it is through March, then do a cut in May of at least a quarter percent. Note: In the lower chart, a 2.6% probability of change is a 97.4% probability the rate will stay the same. Current rate is 5.25%-5.50%.

With gratitude,

Jordan C. Dove, ABR® SFR®

MANAGING PRINCIPAL | REALTOR®

Dove & Associates Powered by Nationwide Realty

702.767.5557 | Jordan@DoveandAssociates.com

JordanDove.com | DoveandAssociates.com

Subscribe to my YouTube Channel

3960 E. Patrick Ln. Ste. 204

Las Vegas, NV 89120

NV Lic. # S.0180594